INP-WealthPk

Ayesha Mudassar

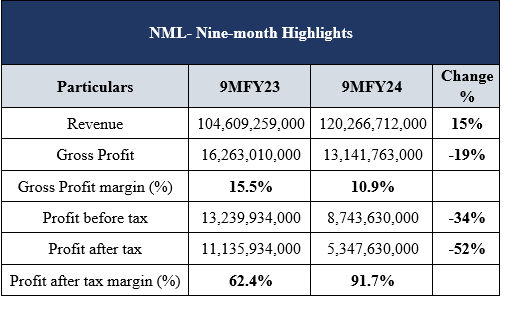

Nishat Mills Limited (NML), the flagship company of Nishat Group, saw its net profit plunge by 52%, clocking in at Rs5.3 billion for the nine months ending March 31, 2024, reports WealthPK.

As per the third quarterly report, the company posted a profit-before-tax of Rs8.7 billion compared to Rs13.2 billion in 9MFY23. The decline in profit was mainly due to an increase in operating expenses and a substantial rise in finance costs during the period.

Furthermore, the unprecedented rise in the cost of production, especially energy expenses due to the withdrawal of various subsidies, led to a considerable decline in gross profit by 19% to Rs13.1 billion. On the positive side, the NML recorded an increase in revenue by 15% from Rs104.6 billion to Rs120.2 billion in 9MFY24. This growth can be attributed to the spinning and home textile division which contributed an additional Rs11.9 billion and Rs6.2 billion during the period under review.

Pattern of Shareholding

As of June 30, 2023, Nishat Mills Limited has 351.5 million outstanding shares distributed among 13,861 shareholders. The local general public holds the majority stake of 32.6% of the shares, followed by directors, the CEO, their spouses, and minor children, who possess 25.2% of the company’s ownership. Around 10.3% of the company’s shares are owned by the Government of Pakistan, while associated companies, undertakings, and related parties hold an 8.7% stake. Joint stock companies account for 7.9% of NML’s shares. Modarabas & Mutual funds hold 4.2% of the shares, whereas Banks, DFIs, and NBFIs have 3.8% of the shares. Foreign companies and the foreign general public have 3% and 1.5% of NML’s shares respectively. The remaining ownership is held by other categories of shareholders.

Operational Performance (2019-23)

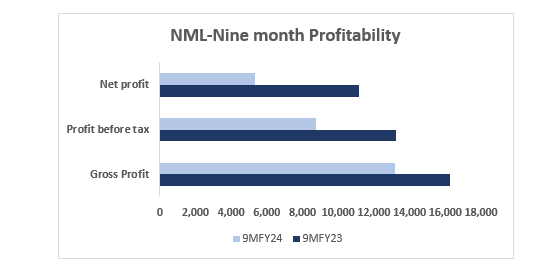

Except for a dip in 2020, the company's topline and bottom line have consistently experienced an upward trajectory over the years. In addition, the gross and net margins grew reasonably in 2019, bounced back in 2020, and continued to recover in the subsequent two years. However, the company's margins again observed a decline in 2023.

The year 2022 stood out with remarkable growth in both the topline and bottom line for Nishat Mills Limited. The company’s topline magnified by 62%, driven significantly by favorable pricing and increased sales volume during the year. Furthermore, enhanced dividend income, net exchange gain, and higher rental income contributed to a 74.1% growth in profit, reaching Rs10.3 billion compared to Rs5.9 billion in 2021.

The Company and its Operations

Nishat Mills Limited is a public limited Company incorporated in Pakistan under the Companies Act, 1913 (Now Companies Act, 2017) and listed on the Pakistan Stock Exchange Limited. The company is engaged in the business of textile manufacturing and spinning, combing, weaving, bleaching, dyeing, printing, stitching, apparel, buying, and selling.

General Market Review and Future Prospects

The textile sector in Pakistan has exhibited a weak performance in the nine months of the ongoing fiscal year 2024. The reason is primarily attributed to a subdued demand for textile products in the USA and European markets. Additionally, the textile sector in Pakistan is facing several challenges such as high raw material costs, expensive energy, costly bank financing, and delayed sales tax refunds. The aforementioned factors have negatively impacted the profitability and overall performance of the sector. Amidst a continuously changing economic landscape, the textile composite is determined to work closely with the relevant departments to overcome these challenges to strengthen its presence and explore new growth opportunities.

Credit: INP-WealthPk