INP-WealthPk

Hifsa Raja

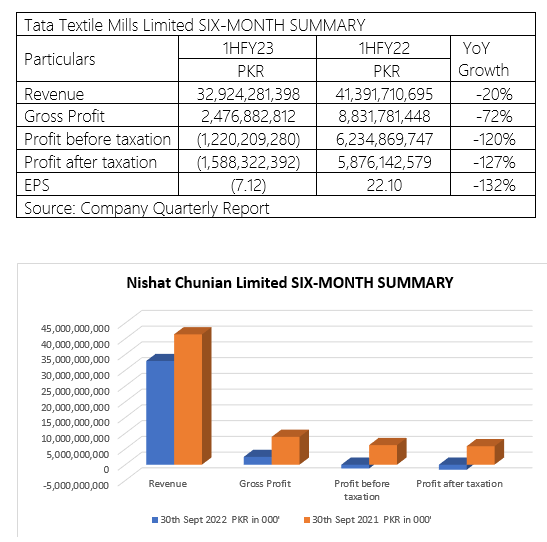

Nishat Chunian Limited’s revenue decreased by 20% to Rs32.92 billion in the six months (July-Dec) of the Financial Year 2022-23 compared with Rs41.39 billion in the corresponding period of the previous year. The gross profit during the six months of FY23 reached Rs2.47 billion from a profit of Rs8.83 billion in the corresponding period of FY22.

The profit before taxation during the six months of FY23 reached Rs1.22 billion from a profit of Rs6.23 billion in the corresponding period of FY22. The profit after taxation shows a decrease of 127% from Rs1.58 billion in six months of FY23 compared with a profit of Rs5.87 billion over the corresponding period of FY22, reports WealthPK.

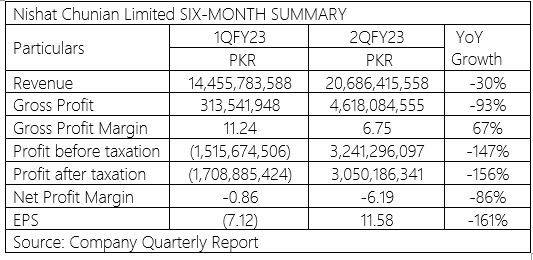

It can be seen that profitability which is indicated by gross profit margin was significantly higher in the first quarter of Fiscal Year 2023. The second quarter of the Fiscal Year 2023 is comparable to the first quarter of the previous fiscal year in this regard. The value gross profit margin for 1QFY23 is 11.24 whereas in 2QFY22 it is 6.75. The net profit margin is negative in both quarters.

Earnings Growth Analysis:

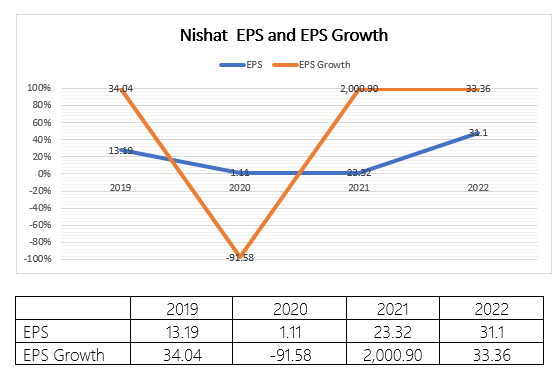

The EPS was quite high from the previous years. It was Rs31.1 in 2022, Rs23.32 in 2021, and very low and close to Rs1.1 in 2020.

As of 2022, the company pays a dividend of Rs7.08, which is an improvement over the previous year when there was a low payout. For investors, the rising dividend and dividend yield are fairly positive signs.

Industry Comparison:

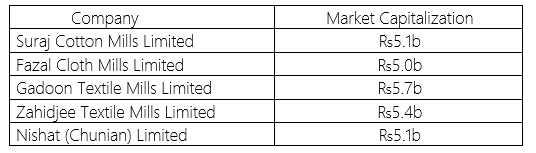

Fazal Cloth Mills Limited, Gadoon Textile Mills Limited, Zahidjee Textile Mills Limited, and Suraj Cotton Mills Limited are some of Nishat (Chunian) Ltd’s rivals. Gadoon Textile Mills Limited has a value of Rs5.7 billion. Fazal Textile Mills Ltd, on the other hand, has the lowest market capitalization of Rs5 billion. The market value of Nishat Chunian Ltd is Rs5.1 billion.

Company profile:

Nishat (Chunian) Limited is a Pakistan-based independent power producer (IPP). The company’s principal activity is to build, own, operate and maintain a fuel-fired power station having gross capacity of 200 megawatts. The company is also principally engaged in the business of spinning, weaving, dyeing, printing, stitching, processing, doubling, sizing, buying and selling. It also deals in yarn, fabrics and made-ups from raw cotton, synthetic fiber and cloth. Additionally, it generates, accumulates, distributes, supplies, and sells electricity.

Credit: Independent News Pakistan-WealthPk