INP-WealthPk

Hifsa Raja

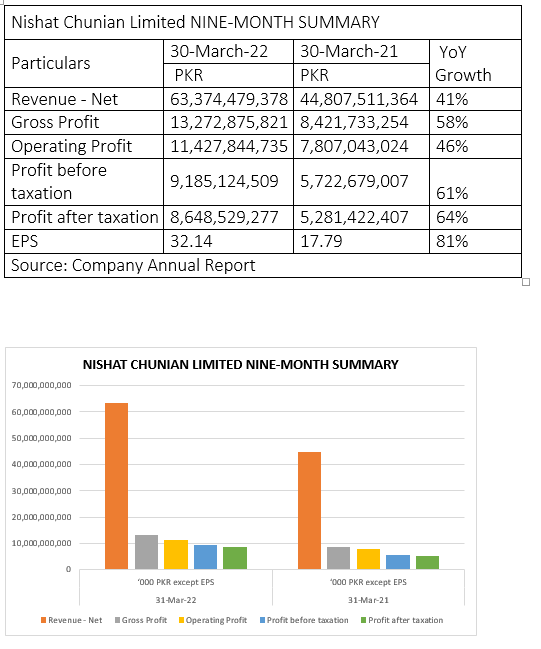

Nishat Chunian Limited (NCL) revenue climbed 41% to Rs63.37 billion in the first nine months of the fiscal year 2021-22 (9MFY22) from Rs44.80 billion over the corresponding period of FY21.

The gross profit, showing a 58% growth, stood at Rs13.27 billion in 9MFY22, as compared to Rs8.42 billion over the same period of FY21.

The operating profit stood at Rs11.42 billion, 46% higher than Rs7.80 billion in 9MFY21.

Similarly, the profit-before-taxation in 9MFY22 stood at Rs9.18 billion, up 61% from Rs5.72 billion in 9MFY21.

The after-tax profit grew by 64% to Rs8.64 billion in 9MFY22 from Rs5.28 billion in 9MFY21.

The earnings per share (EPS) stood at Rs32.14 in 9MFY22 compared to Rs17.79 over the same period in FY21, showing a growth of 81%, reports WealthPK.

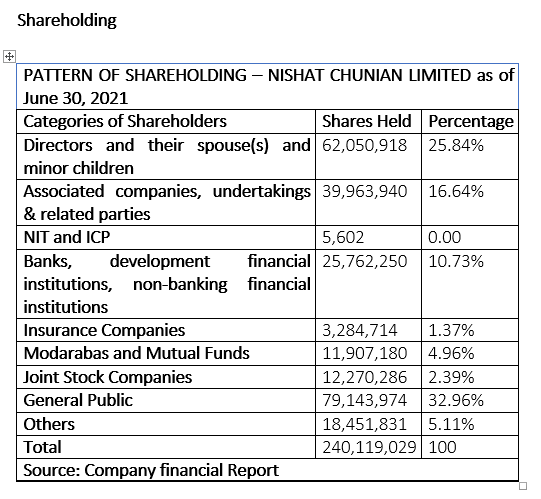

As of June 30, 2021, directors, their spouse(s) and minor children owned 25.84% of the total shares of the company. Associated companies, undertakings & related parties owned 16.64% of the shares, banks, development financial institutions, non-banking financial institutions 10.73%, insurance companies 1.37%, modarabas and mutual funds 4.96%, joint stock companies 2.39%, general public 32.96%, and ‘others’ owned 5.11% of the shares, respectively.

Financial Performance

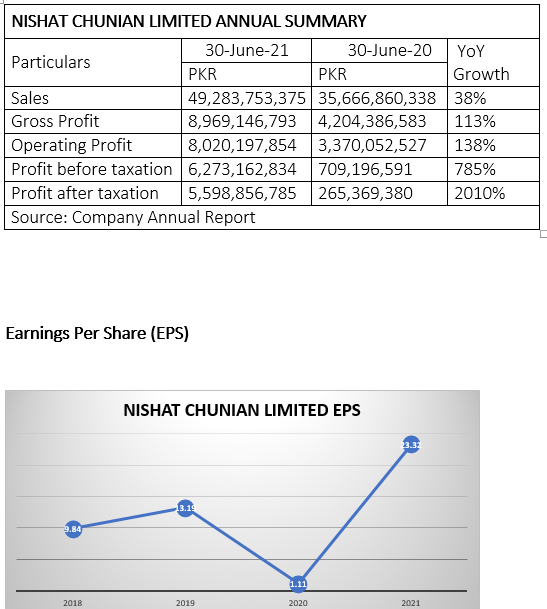

During the fiscal year 2020-21, the company generated sales of Rs49.28 billion against Rs35.66 billion in 2019-20, registering an increase of 38%. The gross profit for FY21 was Rs8.96 billion, registering a growth of 113% over Rs4.20 billion in FY20. The operating profit for FY21, showing a growth of 138%, settled at Rs8.02 billion, as against Rs3.37 billion in FY20. The profit-before-tax for FY22 was Rs6.27 billion compared to Rs709 million in FY20, showing a steep increase of 785%. Similarly, the profit-after-tax for FY22 was Rs5.59 billion as compared to Rs265 million in FY21, showing a mammoth increase of 2010%.

The earnings per share (EPS) jumped from Rs9.84 in 2018 to Rs13.19 in 2019. However, EPS declined to Rs1.11 in 2020 before shooting up to Rs23.32 in 2021.

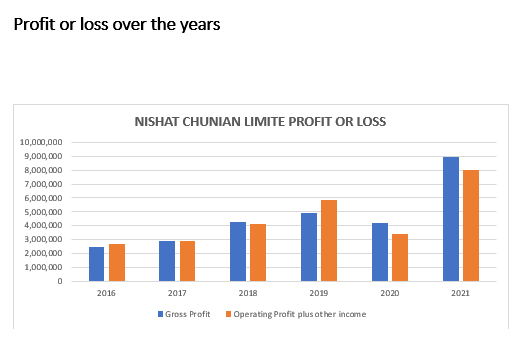

Profit or loss over the years

The company’s profitability – gross and operating profits – steadily increased since 2016, before slightly dipping in 2020. However, both the gross and operating profits improved significantly in 2021. Nishat (Chunian) Limited deals in yarn, fabric and made-up articles. It also generates and sells electricity.

Credit: Independent News Pakistan-WealthPk