INP-WealthPk

Hifsa Raja

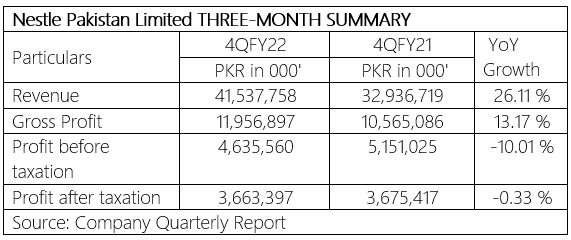

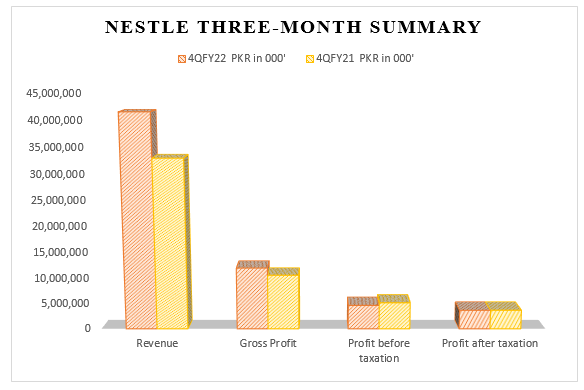

Nestle Pakistan Limited’s revenue cranked up to Rs41 billion in the fourth quarter of the Fiscal Year 2022 compared with Rs32 billion in the corresponding period of the previous year. The gross profit, likewise, registering a 13.17% increase during the 4QFY22, reached Rs11 billion from Rs10 billion in the corresponding period of 4QFY21. The profit before tax shot down by 10.01% to Rs4 billion in 4QFY22 from Rs5 billion in 4QFY21. The after-tax profit decreased to Rs3.66 billion in 4QFY22 from Rs3.67 billion in 4QFY21, reports WealthPK.

The business will also continue to invest in infrastructure, distribution, and brand equity to ensure its products remain accessible to customers across Pakistan.Despite the challenging situations, the company continues to retain its credibility as a consistent supplier to the Pakistani market.

International palm oil prices dropped by over 34% during the 1st quarter. This price drop resulted in a fall in local oil prices. In addition, the delivery of finished products also slowed down due to logistics issues resulting from the heavy monsoon. These things have impacted the gross profit margins.

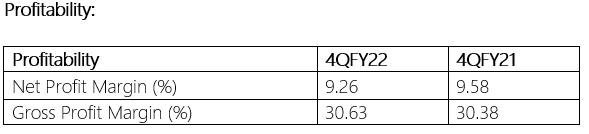

The profitability of the prior year (2021) was significantly higher than that of the fourth quarter of the fiscal year 2022. Net profit margin and gross profit margin are used here as profitability indicators.

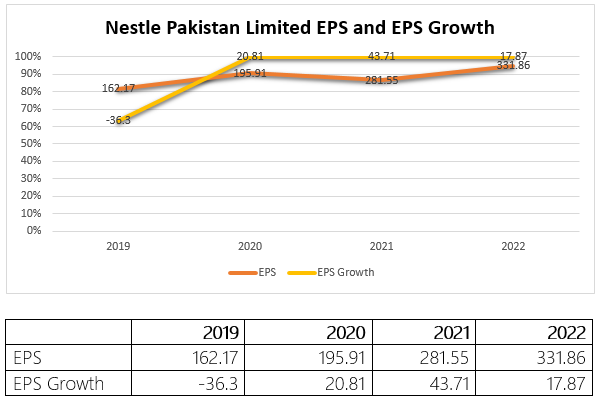

Earnings growth analysis:

The EPS increased steadily for the past four years in a row, which is a highly positive indicator for investors. The EPS was Rs162.17 in 2019, Rs195.91 in 2020, Rs281.55 in 2021, and Rs 331.86 in 2022, respectively.

In 2019, the company paid a dividend of Rs152; in 2020, it rose to Rs194; and in 2021, it grew to Rs285. Growing dividends are a very positive sign for investors.

Industry comparison:

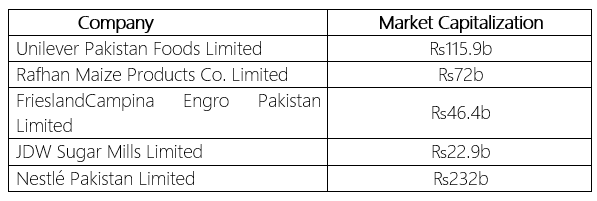

Nestlé Pakistan Limited’s competitors include Unilever Pakistan Foods Limited, Rafhan Maize Products Co. Limited, Friesland Campina Engro Pakistan Limited, and JDW Sugar Mills Limited. The company has the largest market capitalization of Rs232 billion among its competitors, while Unilever Pakistan Food Limited stands second with a market capitalization of Rs115.9 billion.

Company profile:

Nestlé S.A., together with its subsidiaries, operates as a food and beverage company. The company operates through Zone North America; Zone Europe; Zone Asia, Oceania, and Africa; Zone Latin America; Zone Greater China; Nespresso; and Nestlé Health Science segments. It offers baby foods under the Cerelac, Gerber, Nido, and NaturNes brands; bottled water under the Nestlé Pure Life, Perrier, Vittel, Buxton, Erikli, and S. Pellegrino brands; cereals under the Fitness, Nesquik, Cheerios, and Lion Cereals brands; and chocolate and confectionery products under the KitKat, Smarties, Aero, Nestle L’atelier, Milkybar, Baci Perugina, Quality Street, and Fitness brands. The company is principally engaged in manufacturing, processing, and selling dairy, nutritional, beverages and food products, including imported items.

Credit: Independent News Pakistan-WealthPk