INP-WealthPk

Ayesha Mudassar

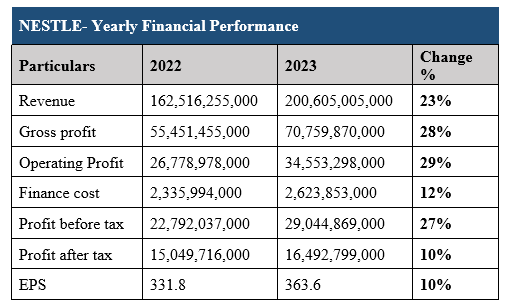

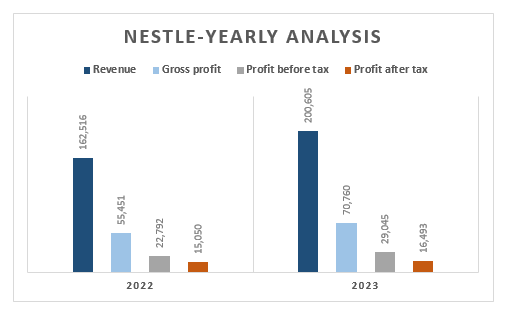

Nestle Pakistan Limited (NESTLE) witnessed an increase of 27% and 10% in before and after-tax profit, respectively, in the calendar year 2023, compared with the CY22, reports WealthPK. As per the company's annual report, NESTLE posted a profit-before-tax (PBT) of Rs 29 billion and a profit-after-tax (PAT) of Rs 16.4 billion in CY23. Moreover, the gross profit stood at Rs 70.7 billion, demonstrating an increase of 28%. The operating profit also improved because of the localization of raw and packaging materials, a favourable product mix, strict control on fixed costs, and increased exports.

The company observed an increase in revenue, amounting to Rs 200.6 billion, demonstrating an increase of 23% over the calendar year 2022. The rise in revenue can be attributed to favourable portfolio mix, demand-generating activities, and pricing management initiatives. Furthermore, the relentless focus on ensuring product availability and renovation initiatives have helped to attain higher revenue. Furthermore, the earnings per share (EPS) for the year was recorded at Rs 363.6, reflecting a growth rate of 10% compared to Rs 331.8 in CY22. This rise reflects the effective utilization of profits to benefit shareholders. In 2023, Nestle Pakistan allocated Rs 3.3 billion in investments, with a strong focus on sustainability initiatives.

Pattern of Shareholding

As of December 31, 2023, NESTLE has a total of 45.3 million shares outstanding, which are held by 1097 shareholders. Associated companies, undertakings, and related parties, with a stake of 81.5% share, form the largest shareholding category of NESTLE. This is followed by the local public which accounts for 13.5% of shares of the company. Directors, CEO, and their spouses, and minor children hold 3.2% shares, while the institutions and public sector companies have 1.14% shares of NESTLE. Insurance companies have a representation of 0.01% in the outstanding share volume of the company. The remaining shares are held by other shareholders, including insurance and foreign companies, each with less than a 1% stake in the company.

Historical Operational Performance (2019-2023)

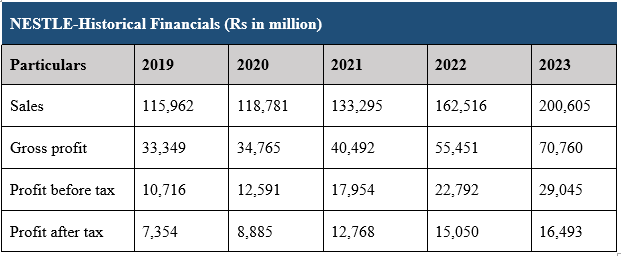

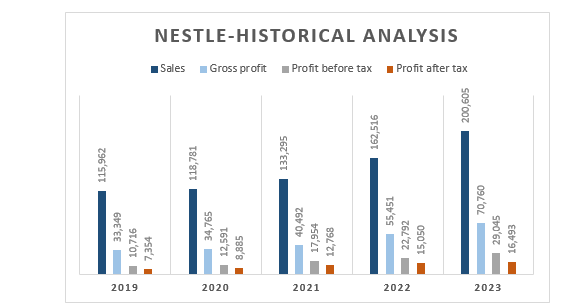

Nestle Pakistan has consistently observed a growing topline and bottom line since 2019. Furthermore, gross profit and profit before tax have increased over six years.

In 2020, NESTLE's sales posted a moderate year-on-year (YoY) growth of 2.4% to clock in at Rs 118.7 billion. The undisrupted supply and availability of products, innovation and renovation initiatives, and numeric distribution expansion have contributed to the company's sales. Improvement in gross and net profit has been achieved through numerous cost-saving initiatives, optimization projects, and prudent pricing management. In subsequent years (2021,2022 and 2023), the company continued its journey towards growth, registering a rise in revenue and improved profitability.

Historical Ratios (2019-2023)

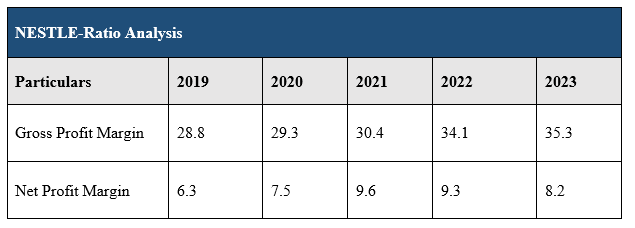

The ratio analysis provides valuable insights regarding Nestle Pakistan's financial performance over the years, highlighting key indicators such as gross profit margin, net profit margin, and EPS growth ratio.

The gross profit margin, a crucial indicator of how efficiently a company manages its production costs, has shown a consistent trend over the years. In CY 2023, the gross profit margin stood at 35.3%, a slight increase from 34.1% in CY22, 30.4 in CY21, 29.3% in CY20, and 28.8% in CY19. The net profit margin has shown slight fluctuations during the period under consideration. In CY23, the net profit margin was 8.2%, down from 9.3% in CY22, and 9.6% in CY21, but higher than 7.5% in CY20.

About the company

Nestle Pakistan Limited is a public limited company incorporated in Pakistan under the repealed Companies Ordinance 1984 (now Companies Act 2017). The company is a subsidiary of Nestle S.A, a Swiss-based public limited company. The firm is principally engaged in the manufacturing, processing, and sale of dairy, nutrition, beverages, and food products, including imported products.

Future Outlook

Despite the challenges, the company is cautiously optimistic to continue the growth trend in the upcoming year through using its strong brand equity and highly committed workforce.

Credit: INP-WealthPk