INP-WealthPk

Ayesha Mudassar

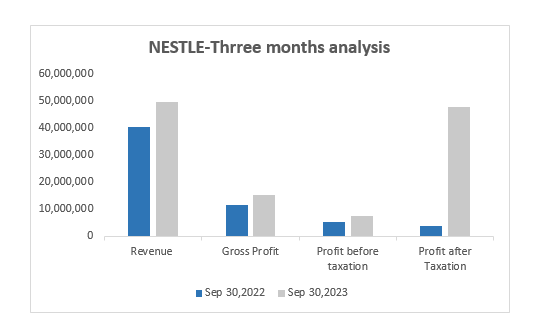

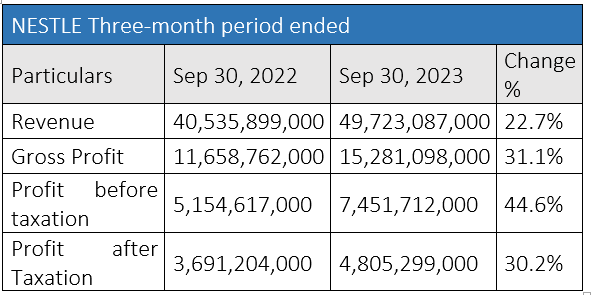

Nestle Pakistan Limited’s revenue cranked up to Rs49.7 billion in the third quarter of the ongoing calendar year 2023 (3QCY23) compared with Rs40.5 billion over the corresponding period of last year, reports WealthPK. The gross profit, likewise, registering a 31.1% increase in 3QCY23, reached Rs15.2 billion from Rs11.6 billion in 3QCY22. This rise indicates the company's effective cost management and improved pricing strategy. The operating profit for the three months also witnessed substantial growth, increasing by 37.6% from Rs5.9 billion in 3QCY22 to Rs8.2 billion in 3QCY23. The improvement suggests that Nestle Pakistan has successfully controlled its operating expenses and enhanced its operational efficiency.

Despite an increase in finance cost, the profit-before-tax also increased by 44.6% to Rs7.4 billion in 3QCY23 from Rs5.1 billion in 3QCY22. The company’s ability to generate additional income from other sources, such as investments or non-operating activities, significantly improved, with other income increasing by an impressive 380% to Rs354 million in 3QCY23 from Rs73 million in 3QCY22. Furthermore, the company reported a profit-after-tax of Rs4.8 billion, showing a 31% increase from Rs3.6 billion in 3QCY22. The earnings per share (EPS) for the three months were recorded at Rs105.9, reflecting a growth rate of 30.1% compared to Rs81.3 in 3QCY22. This increase reflects the effective utilisation of profits to benefit shareholders.

Nine-month summary

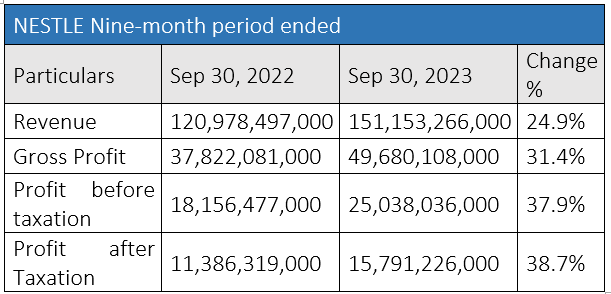

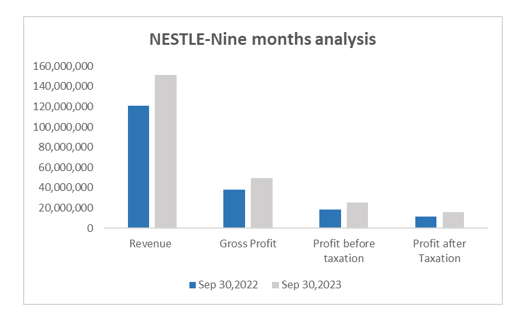

Nestle Pakistan's financial performance for the nine months ending on September 30, 2023, also reflects robust growth across various key financial metrics. The company’s revenue grew by 24.9%, whereas the gross and after-tax profits rose 31.4% and 38.7%, respectively, in 9MCY23 as compared to the corresponding period of the earlier calendar year.

The company posted Rs151.1 billion in revenue and a gross profit of Rs49.6 billion in 9MFY23. Furthermore, the firm earned Rs15.7 billion in after-tax profit during the period under review. Nestle posted earnings per share (EPS) of Rs348.2.

Nestle-ratio analysis

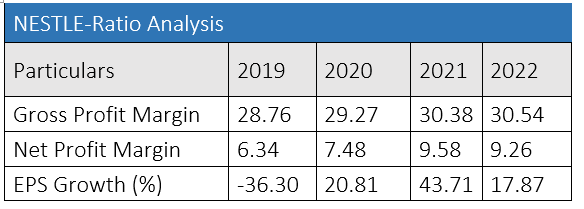

The ratio analysis provides valuable insights regarding Nestle Pakistan’s financial performance over the years, highlighting key indicators such as gross profit margin, net profit margin, and EPS growth ratio.

![]()

The gross profit margin, a crucial indicator of how efficiently a company manages its production costs, has shown a consistent trend over the years. In 2022, the gross profit margin stood at 30.54%, a slight increase from 30.38% in CY21, 29.27% in CY20, and 28.76% in CY19. The net profit margin has shown slight fluctuations during the period analysed. In CY22, the net profit margin was 9.26%, down from 9.58% in CY21, but higher than 7.48% in CY20. Nestle Pakistan demonstrated exceptional growth in EPS over the three years (2019-2021), indicating enhanced profitability and efficient utilisation of resources. The negative growth in CY19 reflects a challenging period, but the subsequent years witnessed substantial improvements.

About the company

Nestle Pakistan is a public limited company incorporated in Pakistan under the now repealed Companies Ordinance, 1984 (now Companies Act, 2017). The company is a subsidiary of Nestle S.A, a Swiss-based public limited company. The firm is principally engaged in the manufacturing, processing and sale of dairy, nutritious, beverages, and food products, including imported products.

Credit: INP-WealthPk