INP-WealthPk

Qudsia Bano

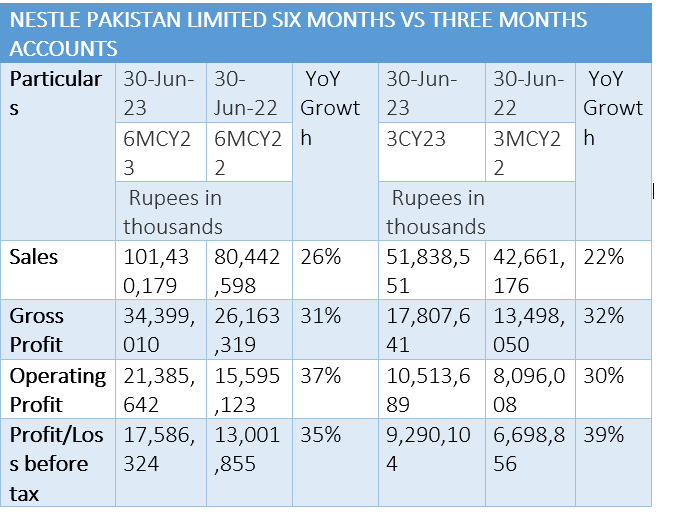

Nestlé Pakistan Limited has reported its financial performance for the six-month period ending on June 30, 2023, showcasing impressive growth across various key financial metrics. The company's sales during this period reached Rs101.43 billion, reflecting a robust year-on-year growth of 26%. This growth can be attributed to sustained consumer demand, effective market strategies, and successful product offerings. The company's gross profit for the six months amounted to Rs34.40 billion, representing a solid growth rate of 31% compared to the same period in the previous year. This increase in gross profit underscores the company's ability to effectively manage its production costs and optimise its operations. Nestlé Pakistan Limited's operating profit during the six months reached Rs21.39 billion, showcasing a notable year-on-year growth of 37%.

This growth in operating profit highlights the company's ability to generate strong profits from its core operations. The profit-before-tax for the six months amounted to Rs17.59 billion, demonstrating a substantial year-on-year growth of 35%. The increase in pre-tax profit indicates the company's successful financial management strategies and efficient utilisation of resources. The profit-after-tax for the six months stood at Rs10.99 billion, representing a remarkable year-on-year growth of 43%. The increase in the after-tax profit reflects the company's ability to sustain profitability and generate positive results on its bottom line. The earnings per share (EPS) for the six months stood at Rs242.25, reflecting a strong 43% growth compared to the same period last year. This growth in EPS indicates that the company's earnings available to shareholders have increased significantly on a per-share basis.

Three months analysis

Nestlé Pakistan Limited's financial performance for the three-month period ending on June 30, 2023, also reflects robust growth in various key financial metrics. The company reported sales of Rs51.84 billion during this quarter, marking a substantial 22% year-on-year increase compared to the same period last year. The company's gross profit for the three months amounted to Rs17.81 billion, representing an impressive growth rate of 32% compared to the corresponding period in the previous year. This growth underscores the company's ability to manage production costs effectively. Nestlé Pakistan Limited's operating profit during the three months reached Rs10.51 billion, showcasing a notable year-on-year growth of 30%.

This growth in operating profit reflects the company's strong operational efficiency. The profit-before-tax for the three months amounted to Rs9.29 billion, demonstrating a significant year-on-year growth of 39%. The increase in pre-tax profit indicates the company's effective financial management and ability to capitalise on market opportunities. The profit-after-tax for the three months stood at Rs5.32 billion, representing an impressive year-on-year growth of 64%. The growth in after-tax profit highlights the company's consistent profitability and financial stability. The EPS for the three months stood at Rs117.40, reflecting a substantial 64% growth compared to the same period last year. This growth in EPS indicates that the company's earnings available to shareholders have increased significantly on a per-share basis.

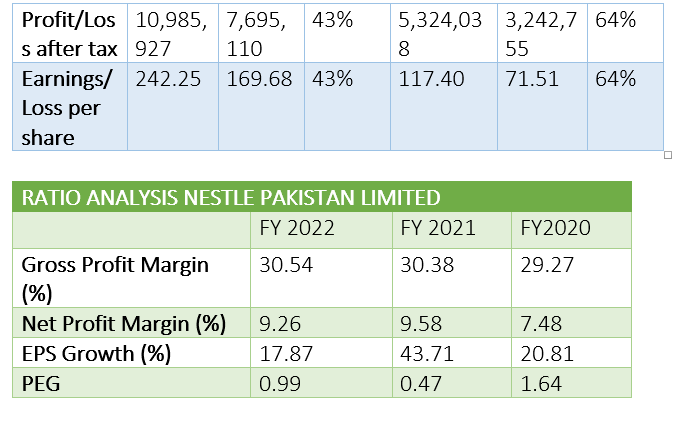

The gross profit margin, a crucial indicator of how efficiently a company manages its production costs, has shown a consistent trend over the years. In FY22, the gross profit margin stood at 30.54%, a slight increase from 30.38% in FY21 and 29.27% in FY20. This indicates the company's ability to effectively maintain its profitability while managing its production expenses. The net profit margin, which indicates the portion of revenue retained as net profit after all costs, has shown slight fluctuations. In FY22, the net profit margin was 9.26%, down from 9.58% in FY21 but higher than 7.48% in FY20. Despite these variations, Nestlé Pakistan has been able to sustain a healthy level of profitability relative to its revenue.

The earnings per share growth, which measures the percentage change in EPS from one fiscal year to another, has displayed varying rates of growth. In FY22, the EPS growth was 17.87%, reflecting a moderate increase. In FY21, the EPS growth was 43.71%, demonstrating robust growth in earnings. Similarly, in FY20, the EPS growth was 20.81%, indicating steady progress in generating earnings available to shareholders. The PEG (Price/Earnings to Growth) ratio considers a company's P/E ratio in relation to its EPS growth rate, offering insight into its valuation concerning growth prospects. In FY22, Nestlé Pakistan’s PEG ratio was 0.99, suggesting a relatively balanced alignment between its price, earnings, and growth potential. In FY21, the PEG ratio was 0.47, reflecting a favourable valuation considering the high EPS growth. However, in FY20, the PEG ratio increased to 1.64, indicating a less optimal valuation relative to EPS growth.

About the company

Nestlé Pakistan is a public limited company incorporated in Pakistan under the Companies Ordinance, 1984 (now Companies Act, 2017). The company is a subsidiary of Nestlé S.A, a Swiss-based public limited company. The company is principally engaged in the manufacturing, processing and sale of dairy, nutritional, beverage and food products, including imported ones.

Credit: INP-WealthPk