INP-WealthPk

Ayesha Mudassar

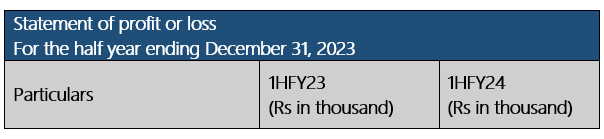

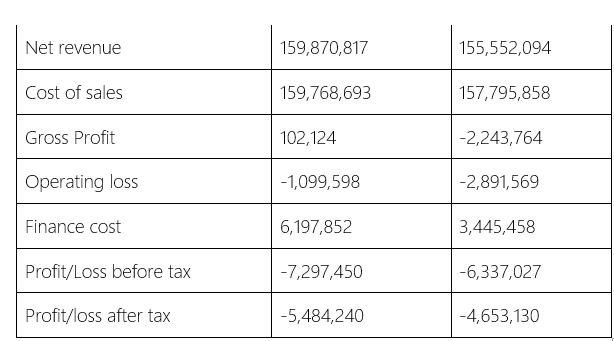

The net loss and loss-before-tax (LBT) of the National Refinery Limited (NRL) declined 13.2% and 15.2%, respectively, in the first half of the ongoing fiscal year (1HFY24), compared to the corresponding period of the last year, reports WealthPK. Quoting the half-yearly report, the NRL recorded a net loss of Rs4.6 billion, resulting in a loss per share of Rs59.19, as compared to a net loss of Rs5.4 billion, which resulted in a loss per share of Rs68.58, in the corresponding period.

The company's net sales declined by 2.7% to Rs155.5 billion during 1HFY24, compared to Rs159.8 recorded in IHFY23. The reduction in revenue is attributable to a continuous drop in international oil prices which caused the company to incur significant inventory losses. The global downturn triggered by geopolitical instability and concerns about a looming recession has retarded the growth of both the fuel and lube segment.

Furthermore, the financial constraints and lower product upliftment prevented the company from increasing its throughput, which remained low at the level of 50% as compared to 56% in the same period last year.

Six years at a glance

- Operational performance

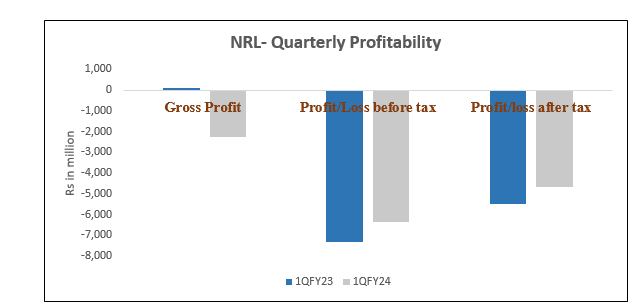

The financial performance of the National Refinery has fluctuated over the years. Its revenue increased at an impressive rate from FY20-FY23, before which growth eroded due to falling prices of petroleum products amid the supply glut. In 2019, the NRL incurred a loss of Rs8.6 billion primarily due to volatility in the oil prices, increase in the product prices, and sharp devaluation of currency. As per the company's annual report, the margins in both the fuel and lube segment declined during the year. The company’s performance in year 2020 was not only affected by the lower refining margins but also by the Covid-19 pandemic.

During the year, NRL witnessed a decline of 21.9% and 34.8% in net sales and profit-before-tax. Furthermore, the company recorded a net loss of Rs 4.06 billion. The year 2021 was a recovery year. The gradual increase in oil prices and petroleum products helped the NRL turn losses into profits. The NRL posted a net profit of Rs1.7 billion compared to a net loss of Rs4.06 billion in 2020.

![]()

In 2022, the company earned a net profit of Rs9.07 billion as compared to a profit of Rs1.7 billion last year. The improved margins were mainly due to higher demand for petroleum products after the easing of Covid-19 restrictions. Furthermore, the Ukraine crisis resulted in higher product prices, leading to better refinery margins, especially in the last quarter of the year. The fiscal year 2023 proved to be a challenging year for the refinery. Owing to political and economic uncertainty, the company took a notable hit and posted a net loss of Rs4.4 billion for the year against a net profit of Rs 9.08 billion recorded in the previous year.

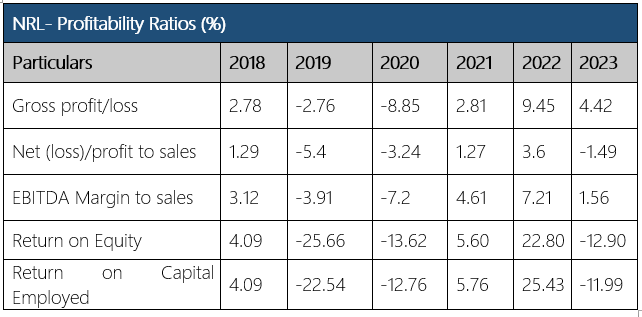

Ratios analysis

Profitability ratios provide insights into a company’s ability to generate profits relative to its revenue, assets, equity, or other financial metrics. During the years under consideration, the gross profit and net profit margin fluctuated over the years, ranging from negative to positive values. The company experienced losses in 2019 and 2020 but returned to profitability in subsequent years.

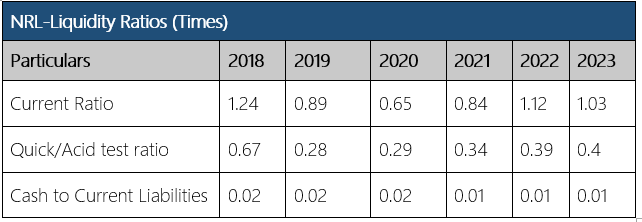

The ROE and ROCE fluctuate widely over the years, with negative values in 2019, 2020, and 2023. However, both rebound strongly in 2021 and 2022, indicating improved profitability relative to the shareholders' equity and better utilization of capital. Liquidity ratios provide insights into a company's ability to meet its short-term obligations using its current assets. The current ratio fluctuated over the years but experienced a tighter liquidity position in 2020.

The quick ratio is considerably lower compared to the current ratio in all years. However, the ratio generally improves over the period, suggesting better liquidity management. The cash to current-liabilities ratio has remained quite low throughout the years, indicating that NRL relies on other current assets besides cash to cover its current liabilities.

Company profile and future outlook

National Refinery Limited was incorporated in Pakistan on August 19, 1963, as a public limited company. The company is engaged in the manufacturing, production, and sale of a large range of petroleum products. Amidst a continuously changing economic landscape, the refinery is striving to be a leading organization that continuously produces high-quality, diversified, environment-friendly energy resources and petrochemicals.

INPCredit: INP-WealthPk