INP-WealthPk

Jawad Ahmed

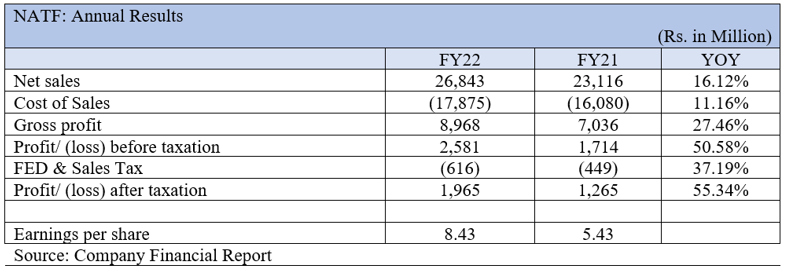

National Foods Limited's net sales increased 16% to Rs26.84 billion in the financial year that ended on June 30, 2022 from Rs23.11 billion in fiscal 2020-21. The company was established in Pakistan on February 19, 1970, as a private limited company, and it later changed its status under the Companies Ordinance, 1984, to become a public limited company. The company primarily produces and sells food products. Its parent company is Associated Textile Consultants (Private) Limited.

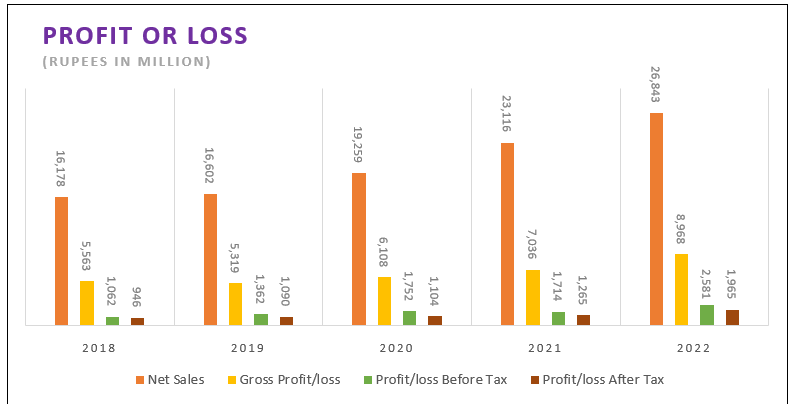

Due to a rise in income, the gross profit for FY22 increased 27.46% to Rs8.98 billion from Rs7 billion in FY21. The before-tax profit increased from Rs1.71 billion in FY21 to Rs2.58 billion in FY22. The company's net profitability increased by 55.3% to Rs1.96 billion in FY22 from Rs1.26 billion in FY21. The earnings per share (EPS) jumped from Rs5.43 the previous year to Rs8.43 in the year under review, WealthPK reported citing financial data of the company.

Historical financial performance

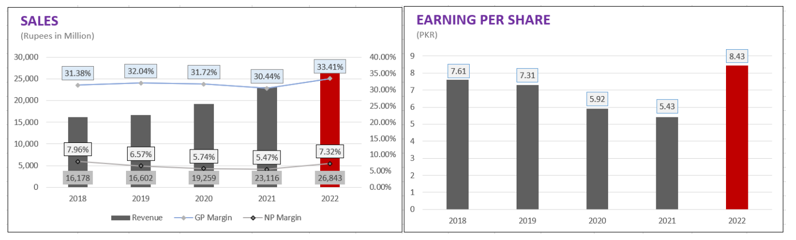

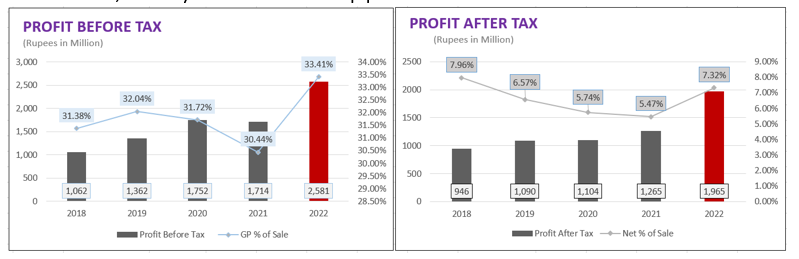

The company's revenues in 2019 were Rs16.60 billion, up 2.5% from Rs16.17 billion the year before. The company's gross profit decreased slightly in 2019 to Rs5.32 billion from Rs5.56 billion in 2018. The profit-after-tax rose 15.2% from Rs946 million in 2018 to Rs1 billion in 2019.

The earnings per share (EPS) decreased slightly from Rs7.61 in 2018 to Rs7.31 in 2019. Despite the challenging economic environment caused by Covid-19 pandemic in 2020, the company's sales rose 16% to Rs19.25 billion from Rs16.60 billion in 2019. As a result, the company's gross profit grew this year to Rs6.11 billion from Rs5.31 billion previously.

The earnings per share (EPS) decreased slightly from Rs7.61 in 2018 to Rs7.31 in 2019. Despite the challenging economic environment caused by Covid-19 pandemic in 2020, the company's sales rose 16% to Rs19.25 billion from Rs16.60 billion in 2019. As a result, the company's gross profit grew this year to Rs6.11 billion from Rs5.31 billion previously.

Following tax deductions, the corporation declared a net profit of Rs1.1 billion for 2020, slightly higher than the profit of the previous year. However, this year's EPS dropped to Rs5.92.

The company' top-line rose from Rs19.25 billion in 2020 to Rs23.11 billion in 2021. The gross profit grew to Rs7 billion from the previous year's Rs6.1 billion. The EPS further dropped to Rs5.43 from the previous year’s Rs5.92.

Recent results and future outlook

The topline increase in FY22 was the outcome of better product mix and price increase despite the effects of inflation and currency devaluation on the cost of production and sale.

According to the financial report, the company may have to deal with issues like rising debt and inflation, devaluation of the Pakistani rupee, and a bullish trend in commodity prices in the coming year.

The company is working hard to improve its revenue-based channels to overcome these obstacles. Future continuous investment in rural and food services will create amazing growth potential for the following year.

Credit : Independent News Pakistan-WealthPk