INP-WealthPk

Ayesha Mudassar

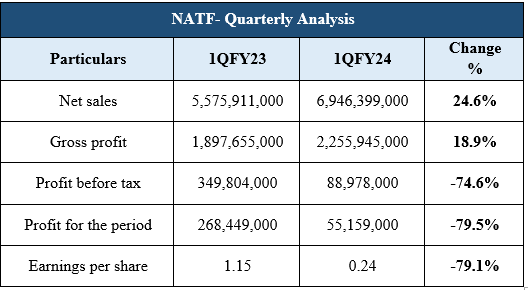

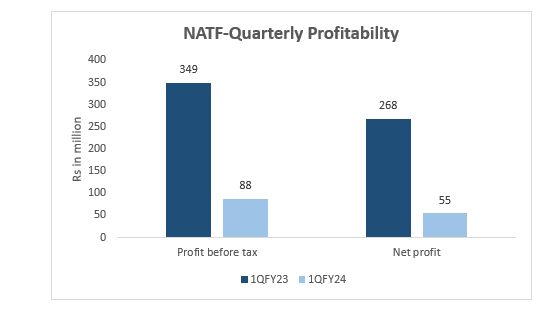

The National Foods Limited (NATF), Pakistan's leading food company, experienced a decline of 75% and 80% in before- and after-tax profits, respectively, during the first quarter of the ongoing fiscal year (1QFY24), as compared to the corresponding period of the last year, reports WealthPK. As per the company's quarterly report, it posted a pre-tax profit of Rs 88.9 million and a post-tax profit of Rs 55.1 million in 1QFY24. The lower profit was mainly due to strained macroeconomic conditions that included a protracted commodity super cycle, current account deficit and high-interest rates.

The company's net sales stood at Rs 6.9 billion in 1QFY24 as compared to Rs 5.5 billion in 1QFY23, showing a 24.6% increase. Furthermore, the cost of sales also surged by 18.9% during the 1QFY24. On the expenses side, distribution and administrative costs escalated by 10% and 45%, respectively, signifying high inflation and soaring freight charges. Furthermore, finance costs posted a huge jump of 176% year-on-year (YoY) in 1QFY24 due to an elevated discount rate.

Six Years at a Glance ((2018-2023)

Financial Performance

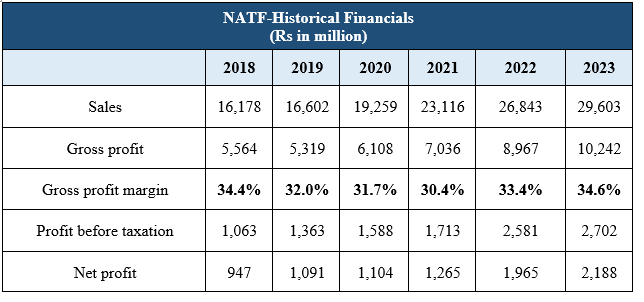

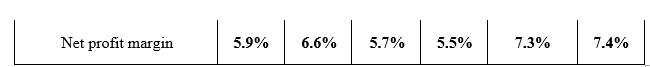

Despite adverse economic conditions, the NATF has consistently improved its financial performance since 2018, as evidenced by the constant rise of its top line and bottom line. Notably, the company's margins have followed a cyclical pattern. After a three-year decline, the gross margin reverberated in 2022, reaching its peak in 2023. Conversely, net profit margins initially increased in 2019, declined in 2020 and 2021, and have since shown signs of recovery. In 2019, the NATF's top line posted a marginal 3% rise. However, a spike in inflation and the depreciation of the rupee resulted in a 4% lower gross profit, with GP margin falling from 34.4% in 2018 to 32.0% in 2019. The net profit stood at Rs 1,091 million in 2019, with an EPS of Rs 7.31.

In 2020, the company continued to sustain and posted a moderate 16% YoY growth in its net sales. Gross profit grew by 15% YoY in 2020, however, GP margin posted a down stick to clock in at 31.7%. The NATF's net profit for the year stood at Rs 1,104 million with an NP margin of 5.7 %. The year 2021 fetched a 20% YoY improvement in the top line of NATF. The growth is mainly attributed to the resumption of business activities after COVID-19. This translated into a 15% YoY progress in gross profit, which stood at Rs 7,036 million in 2021 with a GP margin of 30.4%.

Despite myriad economic challenges, the NATF's top line continued to post a 16% YoY escalation in 2022. The growth was primarily driven by portfolio rationalization, price revisions, and exchange gains on export sales. The company's cost transformation measures along with strategic buying decisions, led to a 27% rise in gross profit. The bottom line posted a 55% YoY growth to clock in at Rs 1,965 million with an NP margin of 7.3%. The NATF registered a 10% YoY growth in its net sales in 2023.

The growth was mainly led by price revisions to counter high inflation, the elevated cost of borrowings, the rupee depreciation, and a steep hike in electricity prices. Furthermore, the company's gross profit rose by 14% in the year, with GP margin touching its peak level of 34.6%. Net profit looked up by 11% YoY to clock in at Rs 2,188 million in 2023 with an NP margin of 7.4%

Six Years' Ratio Analysis

Profitability Ratios

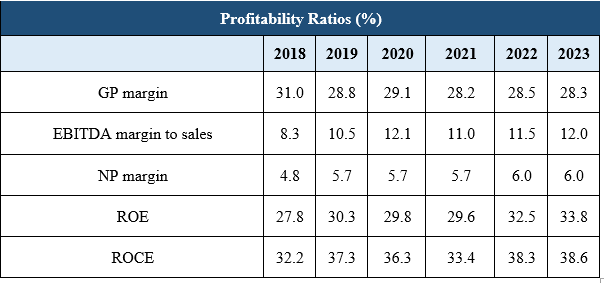

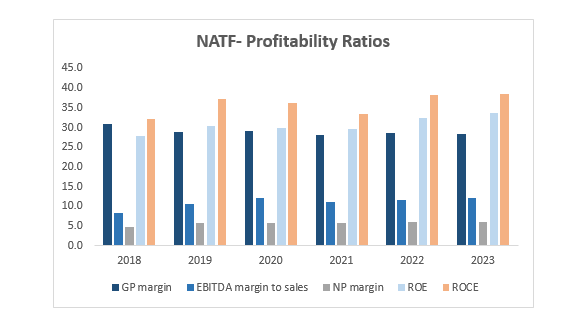

Profitability ratios provide insights into a company's ability to generate profits relative to its revenue, assets, equity, or other financial metrics. During the years under review, the gross profit margin remained relatively stable, hovering around the high 20s, suggesting a consistent efficiency in production and pricing strategies. Moreover, a generally increasing trend in the EBITDA margin-to-sales ratio was seen, indicating improved operating profitability over the years.

Regarding the net profit ratio, the margin showed a slight increase over the years, demonstrating enhanced efficiency in managing expenses and generating profits. The ROE and ROCE showed a consistent increase over the years, indicating improved profitability relative to shareholders' equity. Overall, the trends in these profitability ratios suggest that the company has been effectively managing its operations, improving its profitability, and generating higher returns for its shareholders and capital providers over the years.

Liquidity Ratios

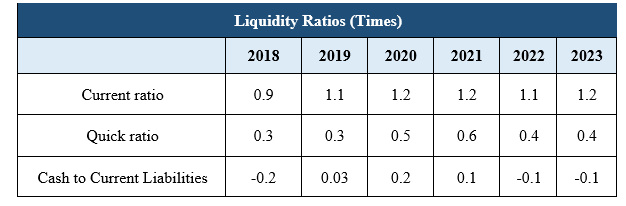

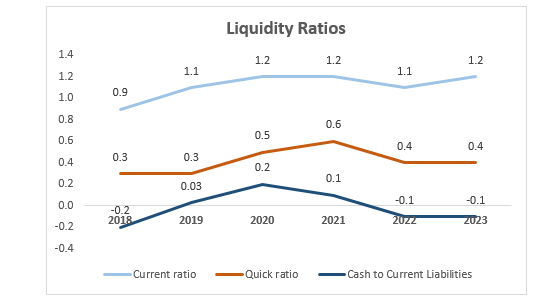

Liquidity ratios provide insights into a company's ability to meet its short-term obligations using its current assets. The current ratio has generally improved over the years, with values increasing from 0.9 in 2018 to 1.2 in 2020, before fluctuating slightly in subsequent years. Overall, a current ratio above 1 indicates that the company has sufficient current assets to cover its current liabilities.

Similar to the current ratio, the quick ratio has been increasing over the years, illustrating a potential rise in the company's ability to meet its short-term obligations with its most liquid assets. Furthermore, the cash-to-current liabilities ratio provides a specific insight into the company's ability to pay off its short-term liabilities using only its cash reserves. The trend shows fluctuations, demonstrating challenges in maintaining sufficient cash reserves to cover short-term obligations.

About Company

The National Foods was incorporated in Pakistan on February 19, 1970, as a private limited company under the Companies Act 1913. It was subsequently converted into a public limited company under the Companies Ordinance, 1984 (now Companies Act 2017). The company is principally engaged in the manufacture and sale of convenience-based food products. The ultimate parent entity of the company is ATC Holdings (Private) Limited.

inpCredit: INP-WealthPk