INP-WealthPk

Ayesha Mudassar

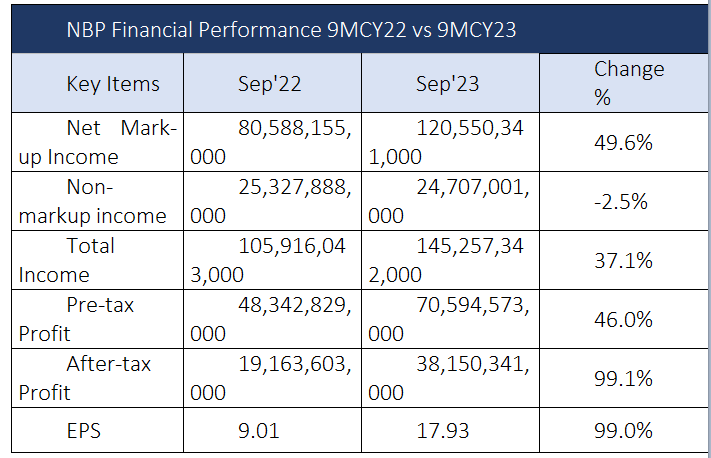

National Bank of Pakistan (NBP), the country's leading commercial bank, has posted profit-after-tax (PAT) of Rs38.1 billion for the nine months ended September 30, 2023 with an inspiring growth of 99% over the corresponding period of the earlier calendar year, reports WealthPK. As per the third quarterly report, the bank recorded a formidable profit-before-tax (PBT) of Rs70.5 billion for 9MCY23 versus a PBT of Rs48.3 billion in 9MCY22. The bank's strong financial results demonstrate its resilient business model, effective management strategies, and the commitment of field personnel. NBP announced earnings per share (EPS) of Rs17.93 for the first nine months of 2023.

For the nine months under review, the bank earned a net markup income of Rs120.5 billion against Rs80.5 billion for the corresponding period of 2022. This increase is achieved through a volumetric growth in average interest-bearing assets coupled with the favourable impact of the policy rate. However, NBP’s non-markup income for 9MCY23 represented a 2.5% year-on-year decrease, mainly due to a decline in dividend and foreign exchange income during the period under review.

Quarterly review

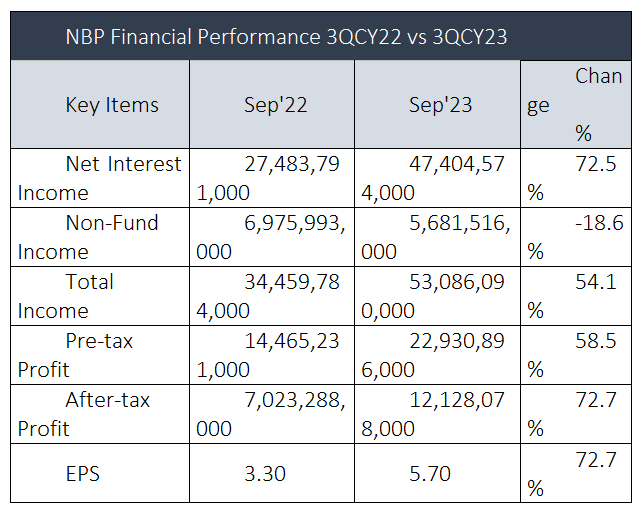

NBP has witnessed a profit growth of 72.7% for the quarter ended September 30, 2023, as it declared a profit-after-tax of Rs12.1 billion for 3QCY23 compared to Rs7.02 billion in the same quarter of the previous year. The bank has attained profit mainly due to the focused efforts of its management in building no-cost deposits. During this quarter, the net markup income increased by 72.5% over the corresponding period of the previous year, indicating the bank’s proficiency in optimising its interest-related revenue streams.

However, the bank’s non-markup income represented an 18.6% year-on-year decline. The EPS for the quarter stood at Rs5.7, reflecting a 72.7% growth compared to the same period last year. This significant growth in EPS indicates that the bank’s earnings available to shareholders have increased considerably on a per-share basis.

Future outlook

The bank will continue to play its vital role in creating sustainable value for stakeholders and supporting a robust economic momentum in the country. In the foreseeable future, the bank's business strategy will remain focused on digitising and extending financial solutions across all segments, with a particular focus on the financial inclusion of the underserved sectors.

Review of the banking sector

The banking sector remained resilient against a challenging operating environment and relatively subdued economic activity throughout the first nine months of 2023. As of September 30, 2023, the total assets of the industry amounted to Rs41,823 billion, reflecting a 21% increase compared to Rs34,530 billion as of December 31, 2022. This growth was primarily driven by a 26% improvement in investments and a significant 64% increase in cash and balances. In contrast, advances experienced a decline of 0.5%. On the liability side, deposits improved by 17% to Rs26,318 billion as of September 30, 2023 from Rs22,467 billion as of December 31, 2022.

Credit: INP-WealthPk