INP-WealthPk

Ayesha Mudassar

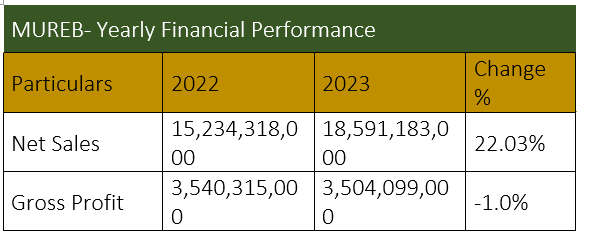

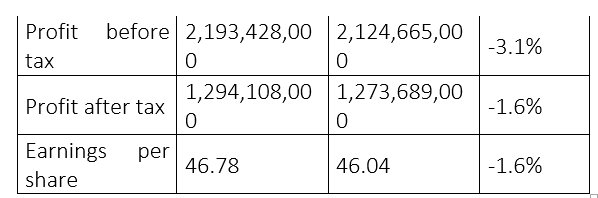

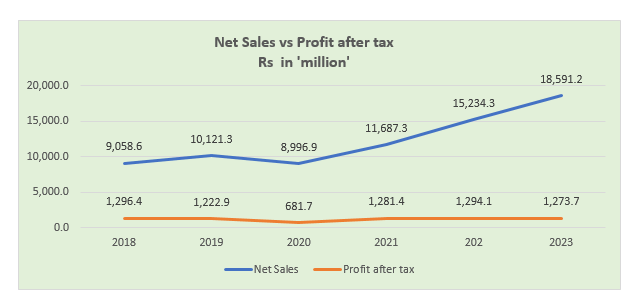

Murree Brewery Company Limited (MUREB) profit-after-tax (PAT) fell slightly to Rs1.27 billion in the fiscal year 2022-23 from Rs1.29 billion in FY22. As the cost of sales surged by 29%, the gross profit fell fractionally to Rs3.50 billion year-on-year in FY23. Similarly, the profit-before-tax (PBT) also declined 3% during the year, clocking in at Rs2.12 billion.

The lower profit was mainly due to challenging and adverse economic conditions fuelled by depletion of the country’s foreign exchange reserves, depreciation of local currency, a steep increase in the interest rate, and the highest-ever inflation. However, the company’s net revenue posted a reasonable year-on-year growth of 22.3% to clock in at Rs18.5 billion. The ‘impressive’ growth in sales can be attributed to increased consumer demand and the company’s strategic marketing initiatives.

The earnings per share (EPS) for the year stood at Rs46.04, representing a 1.6% decline compared to the previous year. The declining EPS suggests a decrease in the company’s earnings available to shareholders per share. Moreover, the company made finance income from its investments, which offset the finance cost by a huge margin in net finance income in FY23. During the year under review, the company contributed a sum of Rs6.6 billion to the government exchequer on account of duties and taxes.

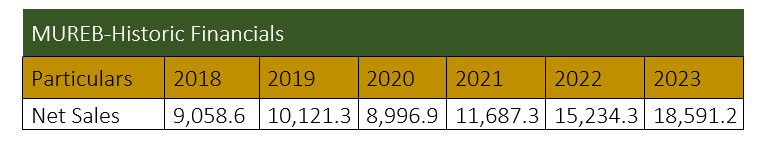

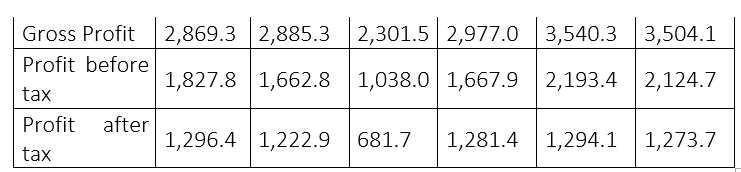

Performance from 2018-23

From 2018 to 2023, MUREB showed steady growth in net sales except in 2020. The company posted the highest-ever net sales of Rs18.5 billion in 2023. However, the PAT kept declining until 2020, but posted a rebound in 2021 and then fluctuated in the subsequent years. The gross profit and PBT also fluctuated over these six years. MUREB posted the highest gross profit and PBT in FY22.

The company and its operations

Murree Brewery was incorporated as a public limited company in February 1861. The principal activity of the company is the manufacturing and sale of alcoholic beer, non-alcoholic beer, Pakistan-Made Foreign Liquor (PMFL), aerated water, mineral water, food products as well as glass bottles and jars. The company presently operates three divisions, namely Liquor, Tops and Glass as its principal activities.

Future outlook

The coming months present unprecedented challenges and uncertainties with continuing political instability, exchange rate volatility, and high inflation. Given the unpredictable economic environment, the company's management remains committed to bringing the best possible value to its shareholders.

Credit: INP-WealthPk