INP-WealthPk

Qudsia Bano

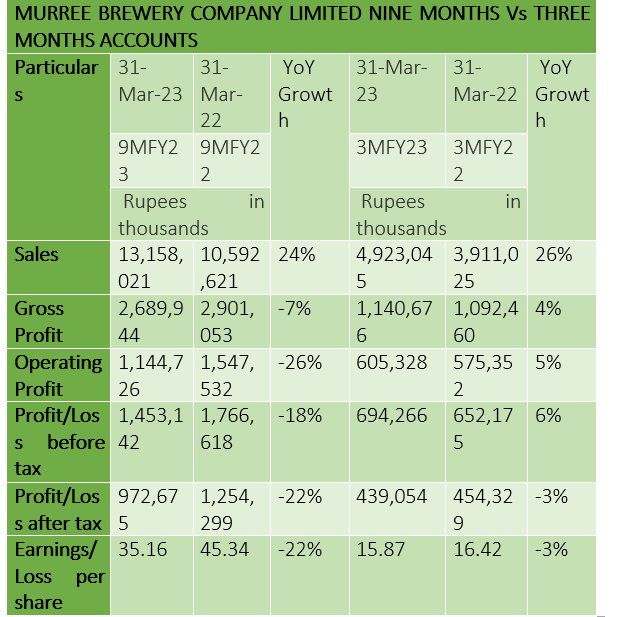

Murree Brewery Company Limited has released its financial results for the nine months ending on March 31, 2023, showcasing a mixed performance amid challenging economic conditions. The company reported a total sales revenue of Rs13.16 billion during the nine-month period, reflecting a 24% year-on-year growth compared to the corresponding period in the previous fiscal year. The impressive growth in sales can be attributed to increased consumer demand and the company's strategic marketing initiatives. However, despite the growth in sales, Murree Brewery faced certain challenges that affected its profitability. The company's gross profit declined by 7% during the nine months, amounting to Rs2.69 billion. Similarly, the operating profit of Murree Brewery also experienced a decline of 26% during the nine months, reaching Rs1.14 billion.

The decrease in operating profit reflects the impact of rising costs on the company's overall operational efficiency. The profit-before-tax for the nine months stood at Rs1.45 billion, reflecting an 18% decline compared to the same period last year. Consequently, the profit-after-tax for the nine months amounted to Rs972.68 million, showcasing a significant 22% decline compared to the corresponding period in the previous fiscal year. The decrease in after-tax profit indicates the company's struggles in managing its tax obligations and mitigating the impact of cost pressures on its bottom line. The earnings per share (EPS) for the nine months stood at Rs35.16, representing a 22% decrease compared to the same period last year. The declining EPS suggests a decrease in the company's earnings available to shareholders per share.

Three months analysis

In the three-month period ending on March 31, 2023, Murree Brewery's performance continued to face challenges, impacting its financial results. The company reported sales of Rs4.92 billion, reflecting a 26% year-on-year growth. Despite the growth in sales, the company's gross profit increased only marginally by 4% to Rs1.14 billion, indicating cost pressures that impacted its profitability. The operating profit for the three months reached Rs605.33 million, showing a modest 5% increase compared to the same period last year. This increase in operating profit may be attributed to the company's efforts in streamlining its operations and managing costs.

Similarly, the profit-before-tax for the three months stood at Rs694.27 million, reflecting a 6% year-on-year growth. The growth in pre-tax profit indicates the company's ability to navigate challenging economic conditions and maintain a reasonable level of profitability. However, the profit-after-tax for the three months amounted to Rs439.05 million, showing a slight decline of 3% compared to the corresponding period in the previous fiscal year. The marginal decrease in after-tax profit indicates the company's ongoing struggle to improve its net earnings despite its efforts to control costs. The EPS for the three months stood at Rs15.87, representing a 3% decrease compared to the same period last year. The declining EPS suggests a slight decrease in the company's earnings available to shareholders per share.

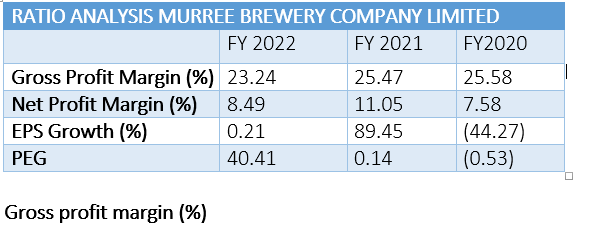

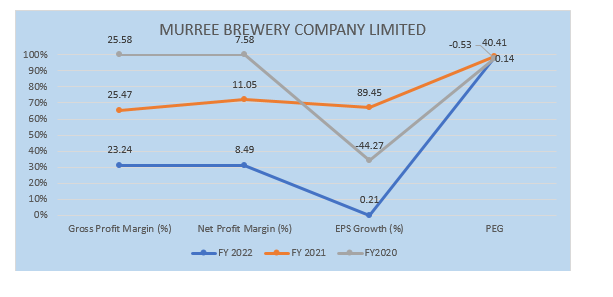

Murree Brewery's gross profit margin has shown a declining trend over the past three fiscal years. In FY22, the gross profit margin was 23.24%, indicating a decrease from 25.47% in FY21 and 25.58% in FY20. The declining gross profit margin suggests that the company's cost of goods sold has been increasing at a faster rate than its sales revenue. This could be due to rising raw material costs, production expenses, or other factors impacting the company's profitability at the gross level.

Net profit margin (%)

The net profit margin, representing the percentage of revenue converted into net profit after all expenses, has also shown a decreasing trend for Murree Brewery over the past three fiscal years. In FY22, the net profit margin was 8.49%, down from 11.05% in FY21 and 7.58% in FY20. The declining net profit margin indicates that the company's overall profitability has been impacted by increasing operating expenses, taxes, or other costs unrelated to production.

EPS growth (%)

Murree Brewery's EPS growth has been fluctuating over the past three years. In FY22, the EPS growth was a meager 0.21%, showing a minimal increase compared to the previous fiscal year. However, in FY21, the EPS growth was 89.45%, indicating a substantial improvement in earnings per share. In contrast, in FY20, the EPS growth was negative at 44.27%, indicating a significant decrease in earnings per share during that year.

PEG (price/earnings to growth) ratio

The PEG ratio compares a company's price-to-earnings (P/E) ratio to its EPS growth rate, providing insights into the stock's valuation relative to its expected earnings growth. A PEG ratio above 1 typically suggests an overvalued stock relative to its growth prospects, while a PEG ratio below 1 might indicate an undervalued stock. In FY22, Murree Brewery's PEG ratio was relatively high at 40.41, suggesting that the stock's price might have been overvalued compared to its minimal EPS growth. Conversely, in FY21, the PEG ratio was low at 0.14, indicating potential undervaluation due to the significant EPS growth. However, in FY20, the PEG ratio was negative at (0.53), suggesting that the stock might have been undervalued, but the negative EPS growth might have impacted the ratio.

About the company

Murree Brewery Company was incorporated under the repealed Indian Companies Act (now the Companies Act, 2017) in February 1861 as a public limited company. The company is principally engaged in manufacturing alcoholic beer, Pakistan Made Foreign Liquor (PMFL), nonalcoholic beer, aerated water (nonalcoholic products), juices and food products, mineral water, glass bottles, and jars. The company presently operates three divisions, namely Liquor, Tops and Glass, to carry out its principal activities.

Credit: INP-WealthPk