INP-WealthPk

Ayesha Mudassar

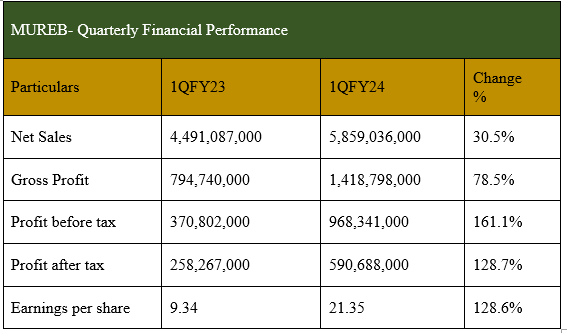

Murree Brewery Company Limited (MUREB) saw its profitability surge by 129% to Rs591 million in the first quarter (July-September) of the current fiscal year 2023-24 (1QFY24), up from Rs258.2 million in 1QFY23. The gross profit also surged by 78.5% to Rs1.41 billion in 1QFY24. Similarly, the profit-before-tax also experienced a gigantic increase of 161% during the period under review. Net revenue posted a reasonable growth of 30.5% to clock in at Rs5.85 billion. The impressive growth in sales can be attributed to increased consumer demand and the company’s strategic marketing initiatives.

The earnings per share (EPS) for the first quarter of FY24 stood at Rs21.35, representing a fabulous 129% rise compared to the same period last year. The rising EPS suggests an increase in the company’s earnings available to its shareholders per share. Moreover, the company generated finance income from its investment, which helped offset the finance cost by a huge margin in the net finance income in 1QFY24. During the year under review, the company contributed a sum of Rs2.46 billion to the government exchequer on account of duties and taxes.

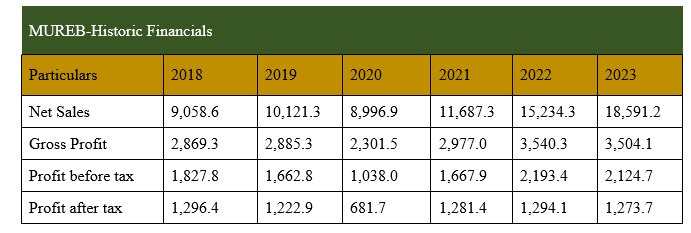

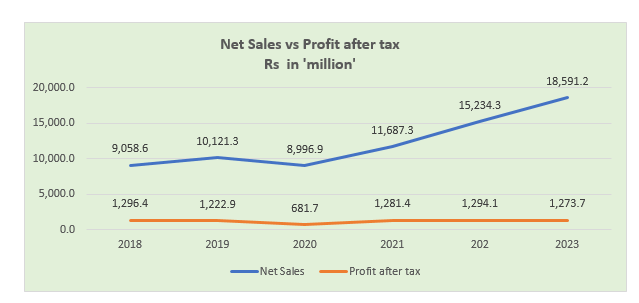

Financial performance (2018-23)

Except in 2020, the company showed steady growth in sales from 2018 to 2023. The company posted the highest-ever net sales of Rs18.59 billion in 2023. The profit-after-tax of the company kept declining until 2020, but rebounded in 2021 and then marginally fluctuated in the subsequent years. Furthermore, the gross profit and before-tax profit fluctuated over the past six years. MUREB posted the highest gross profit and pre-tax profit in FY22.

The company and its operations

Murree Brewery Company was incorporated as a public limited firm in February 1861. The company manufactures and sells alcoholic and non-alcoholic beer, Pakistan-made Foreign Liquor (PMFL), aerated and mineral water, food products as well as glass bottles and jars. The company presently operates three divisions, namely Liquor, Tops and Glass.

Future outlook

The coming months present unprecedented challenges and uncertainties because of exchange rate volatility and high inflation. Given the unpredictable economic environment, the company's management remains alert in its endeavour to continue to bring the best possible value to its shareholders.

Credit: INP-WealthPk