INP-WealthPk

Ayesha Mudassar

The Ukraine crisis, worsened global market conditions, reversal of energy subsidies, massive currency depreciation, and most

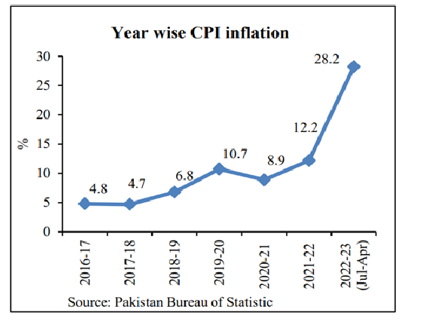

importantly, the 2022 flood devastation contributed to the inflation measured by the Consumer Price Index (CPI) in Pakistan during the just-concluded fiscal year, said World Bank Senior Economist Adnan Ashraf Ghumman. The CPI stood at 36.4% year-on-year (YoY) in April 2023 compared to 35.4% the previous month, according to the Economic Survey of Pakistan 2022-23. According to the survey, the CPI averaged 28.2% during the July-April period of fiscal year 2022-23 against 11% in the comparable period of FY22. The senior economist stated that the torrential rainfall in 2022 caused colossal supply disruption and resulted in price hikes. Multi-decade high inflation was primarily driven by hikes in food and energy prices, he added.

As per the economic survey, inflation for transportation registered a sharp increase of 52.8% as against 19.4% during July-April FY22. Similarly, housing, water, electricity, gas, and other fuels recorded an increase of 13.6% compared to 11% during the same period of FY22. The increase in domestic energy prices is mainly due to rising global oil prices, a weaker exchange rate, and high energy tariffs associated with the reversal of energy subsidies. Moreover, food inflation sharply grew during the period under review. Prices of perishable food items increased by 47% compared to 4.1% during the same period of FY22. A major increase was witnessed in the prices of potatoes, onions and fresh vegetables.

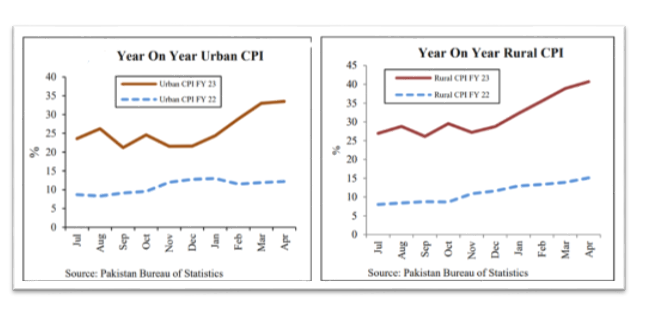

Non-perishable food items recorded a 36.4% increase during July-April FY23 against an increase of 13.1% during the same period of FY22. Item-wise data shows that upward pressure came from wheat flour, rice, chicken, eggs, edible oil/ghee, and pulses. The economic survey also illustrates that rise in CPI urban inflation increased by 33.5% YoY in April 2023 compared to an increase of 33% in the previous month and 12.2 % in April 2022. CPI inflation rural grew by 40.7% YoY in April 2023 compared to 38.9% in the previous month and 15.1% in April 2022.

Credit: INP-WealthPk