INP-WealthPk

Shams ul Nisa

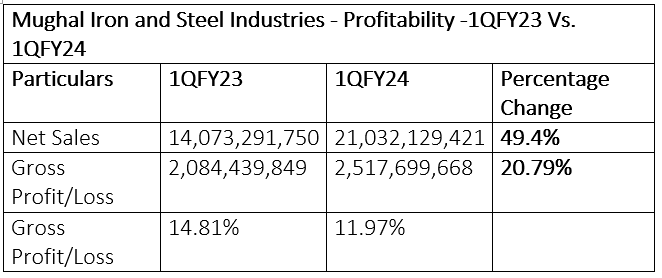

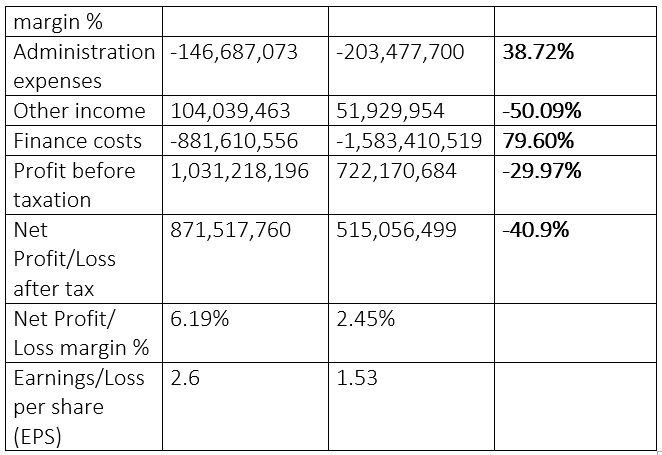

Mughal Iron and Steel Industries posted a net profit of Rs515.056 million in the first quarter of the ongoing fiscal year 2023-24 (1QFY24), registering a significant reduction of 40.9% from Rs871.5 million in the same period last year. The company's sales, however, hiked by 49.4% to Rs21.033 billion in 1QFY24 from Rs14.07 billion in 1QFY23. The company attributed this increase to a rise in selling prices both in ferrous and non-ferrous segments and an increase in volumes in ferrous segments. Gross profit improved 20.79% in 1QFY24 to Rs2.517 billion from Rs2.08 billion in 1QFY23. The net profit margin reduced to 2.45% from 6.19% in 1QFY23. The gross profit margin stood at 11.97% in 1QFY24 compared to 14.81% in 1QFY23.

Administrative expenses widened 38.72% to Rs203.47 million in 1QFY24 from Rs146.68 million in 1QFY23 because of the rise in salary expenses. This indicates the company's interest in enlarging its core operations during the period. However, the company saw a 50.09% decline in the other income generation compared to the previous year as a result of the reduction in exchange gains. Similarly, finance costs climbed significantly to Rs1.58 billion in 1QFY24 from Rs881.6 million in 1QFY23, indicating a hike of 79.60%. The factor behind this hike was the significant increase in the base discount rate. At the end of the first quarter of FY24, the profit-before-tax stood at Rs722.17 million, 29.97% lower than Rs1.03 billion in 1QFY23. The company announced the earnings per share (EPS) of Rs1.53 in 1QFY24 compared to Rs2.6 in 1QFY23.

Historical trend

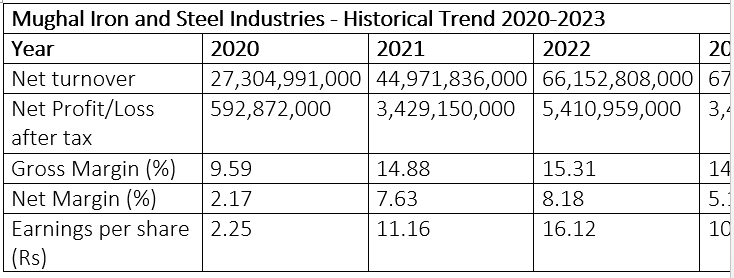

The net turnover of Mughal Iron and Steel Industries increased gradually over time, reaching a peak of Rs67.39 billion in 2023 from Rs27.3 billion in 2020. The net profit also climbed, peaking at Rs5.4 billion in 2022 before reducing to Rs3.48 billion in 2023. This suggests that in FY23, the company was not able to keep costs under control to generate a reasonable profit. The company had the highest gross profit margin of 15.31% in 2022 and the lowest of 9.59% in 2020. It stood at 14.35% in 2023. A similar pattern was followed by net profit margin and earnings per share of the company. The net margin ranged between 2.17% in 2020 and 8.18% in 2022. The company reported the highest EPS of Rs16.12 in 2022.

Cash flows analysis

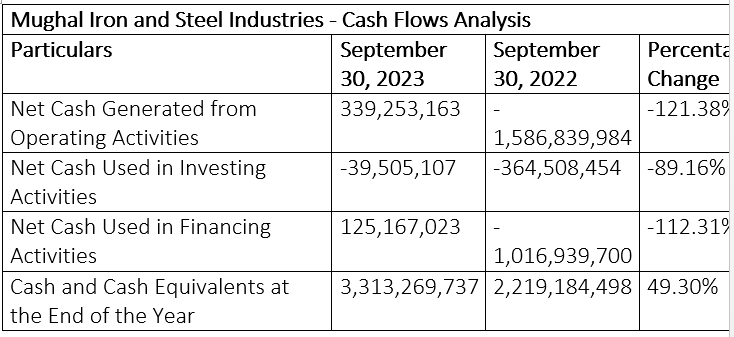

In September 2022, Mughal Iron and Steel Industries utilised Rs1.58 billion in net cash for operations compared to Rs339.25 million cash generated in September 2023, indicating an increase of 121.38%. The company used Rs39.5 million cash for investing activities in September 2023 compared to Rs364.5 million in September 2022, posting an 89.16% decline. In September 2022, the company utilised Rs1.016 billion for financing activities, while in September 2023, it generated Rs125.16 million. As a result, the company's cash and cash equivalent at the end of the year stood at Rs3.31 billion in September 2023 against Rs2.219 billion generated during the same period last year.

Credit: INP-WealthPk