INP-WealthPk

Mughal Industries market value declines in 2QFY23

January 09, 2023

Fakiha Tariq

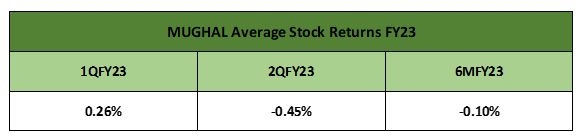

The market value of Mughal Iron and Steel Industries Limited (MUGHAL) declined by 0.45% in the second quarter (Oct-Dec) of the ongoing fiscal year 2022-23 as compared to the first quarter (July-Sept) of the same year when the company had earned positive returns of 0.26% on its stocks, reports WealthPK.

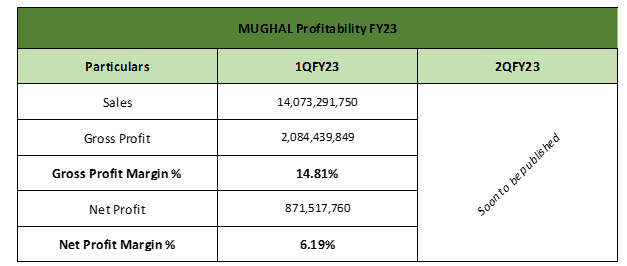

On average, MUGHAL produced negative stock returns of 0.10% over the cumulative period of the first six months (July-Dec) of the ongoing fiscal (6MFY23). In terms of profitability, in the first quarter of FY23, the company’s gross sales stood at Rs14 billion. The company made a gross profit of Rs2 billion and a net profit of Rs871 million from its sales. The financial results for the second quarter of FY23 are soon to be published by the company.

Mughal Iron and Steel Industries Limited with the market symbol of MUGHAL is a public limited company listed in the engineering sector on the Pakistan Stock Exchange. MUGHAL is the second largest enterprise among its peer companies on the basis of market capitalisation worth Rs15.7 billion. Primarily engaged in the business of iron and steel-based products, MUGHAL is one of the pioneer servers in its sector in Pakistan.

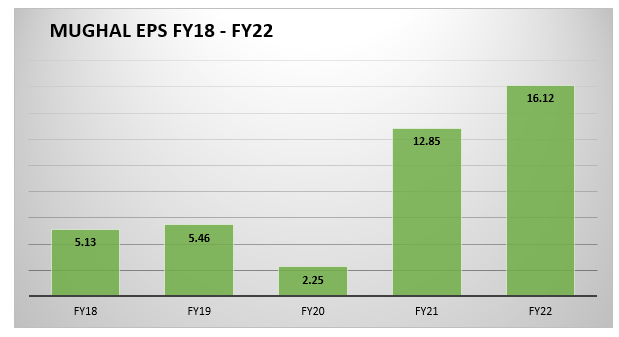

MUGHAL financial performance – FY18 till now

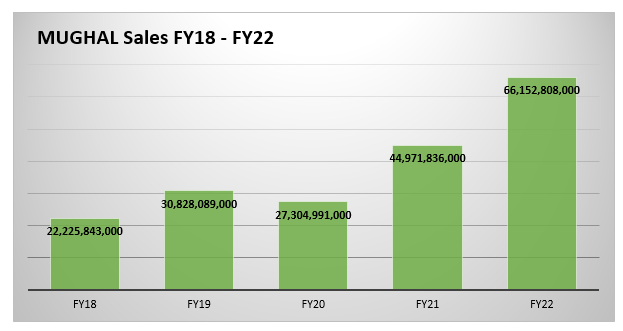

Of the last five financial years, FY22 remained the most profitable year for Mughal Industries. Looking into the sales values of the previous five years, MUGHAL netted the gross highest sales of Rs66 billion in FY22 followed by a sales value of Rs44 billion in FY21.

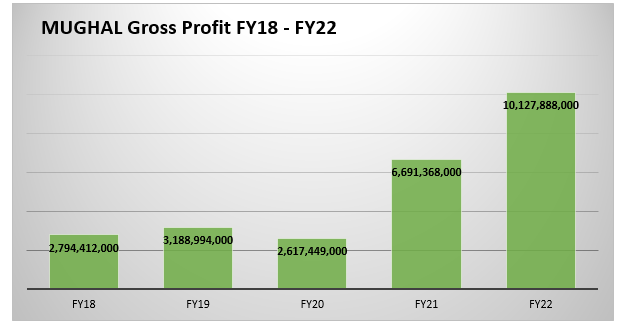

Likewise, the highest gross profit ratio of 15.31% was also achieved in FY22 followed by 14.88% in FY21.

With a net profit value of Rs5.4 billion, the highest during the last five years, MUGHAL reported the highest EPS value of Rs16.12 per share in FY22.

Credit : Independent News Pakistan-WealthPk