INP-WealthPk

Mitchell’s posts 79% increase in operating profit YoY

January 10, 2023

Qudsia Bano

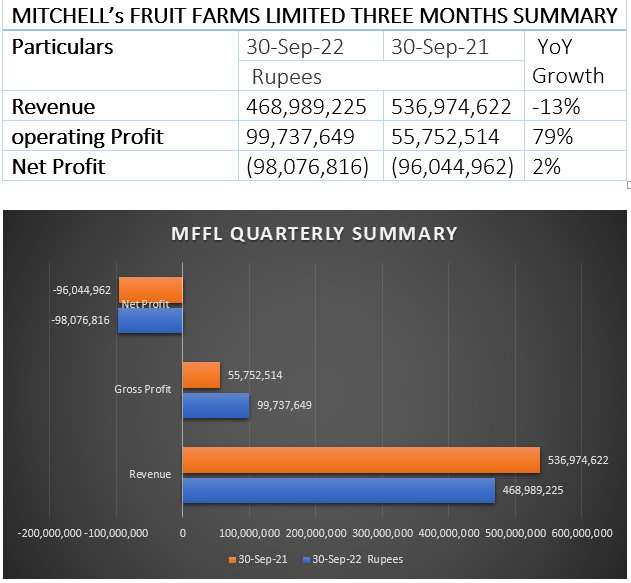

The sales revenue of Mitchell’s Fruit Farms Limited decreased 13% to Rs468.9 million in the first quarter of the ongoing financial year (1QFY23) compared to Rs536.9 million in the corresponding period of the previous fiscal. However, the operating profit of the company increased 79% to Rs99.7 million in 1QFY23 from Rs55.7 million recorded in 1QFY22. The company posted a net loss of Rs98 million in 1QFY23, which was up 2% from a loss of Rs96 million over the corresponding period of FY22, reports WealthPK.

Performance in 2021-22

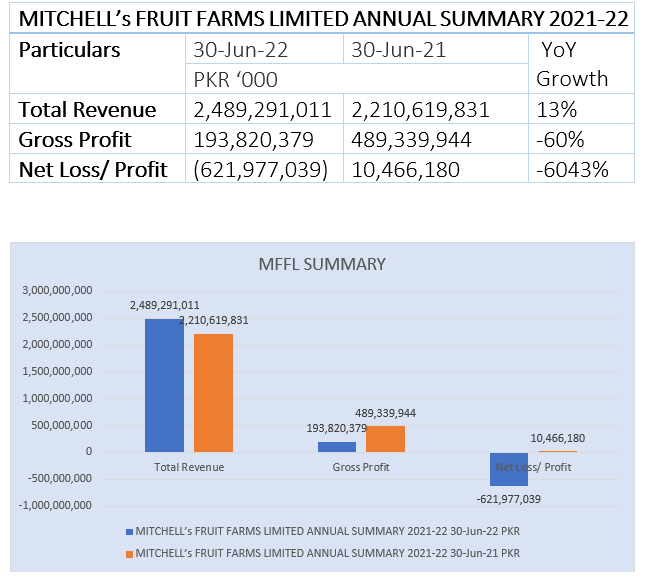

During the fiscal year 2021-22, the company’s gross sales went up to Rs2.48 billion from Rs2.2 billion in FY21, posting an increase of 13% year-on-year. However, the gross profit for FY22 stood at Rs193.8 million, down 60% from Rs489 million in FY21. The loss-after-tax for the year also went up by a mammoth 6043% to Rs621.9 million from a profit of Rs10.46 million in FY21.

Unprecedented growth in the costs of raw materials and packaging supplies, an increase in the price of other inputs such as gasoline and electricity, salaries and wages, etc, rise in selling and distribution costs, lack of access to export financing, a rise in bank interest rates, and a deficiency of goods due to problems in the global supply chain have contributed to massive losses.

Earnings per share and profitability

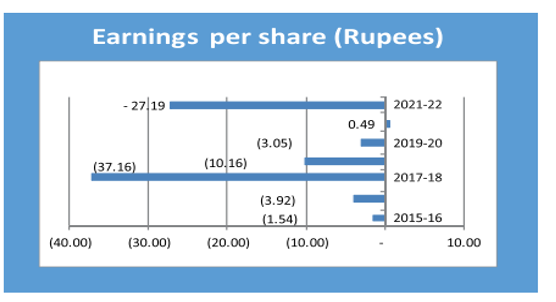

The EPS of the company stood at Rs-3.05 in 2018-19, but jumped to Rs0.49 in 2021. The EPS massively decreased to Rs-27.19 in 2022.

About the company

Mitchell’s Fruit Farms Limited is principally engaged in the manufacture and sale of various farm and confectionery products.

Credit : Independent News Pakistan-WealthPk