آئی این پی ویلتھ پی کے

Ayesha Mudassar

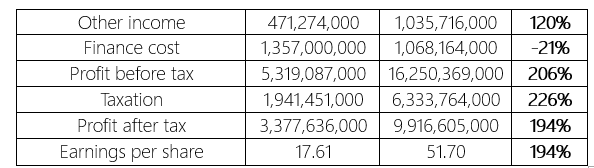

Millat Tractors Limited (MTL) has reported a substantial year-on-year (YoY) profit increase of 194%, reaching Rs9.9 billion for the fiscal year 2024. This marks a significant rise from Rs3.3 billion profit recorded in the earlier fiscal year, reports WealthPK.

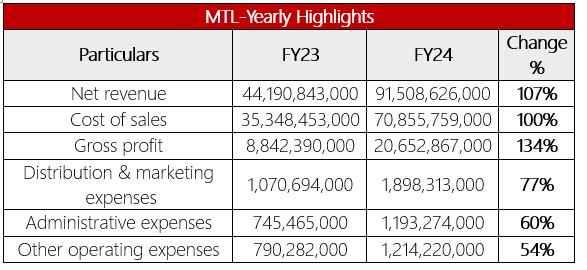

The company's revenue rose 107% YoY to Rs91.5 billion, up from Rs44.1 billion in FY23. Similarly, the cost of sales grew by 100% YoY, totaling Rs70.8 billion compared to Rs35.3 billion in FY23. As a result of a greater increase in sales relative to the cost of sales, the gross profit magnified by 134% YoY to Rs20.6 billion in FY24.

On the expense side, the company experienced increased distribution and marketing expenses, which rose by 77% YoY to Rs1.8 billion. The administrative costs increased by 60% YoY, reaching Rs1.1 billion during the year. Additionally, the other operating expenses inflated by 54% YoY to Rs1.2 billion compared to Rs790.2 million in FY23. However, the company’s finance costs dipped by 21% YoY and stood at Rs1.06 billion, down from Rs1.3 billion in FY23. On the tax front, the company paid a higher tax of Rs6.3 billion against Rs1.9 billion in FY23, depicting a rise of 226% YoY.

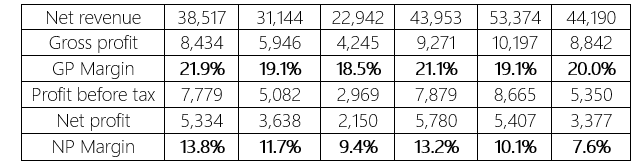

Historical Performance (2018-2023)

The top line of MTL has exhibited a fluctuating trend over the years. Following a decline in FY19 and FY20, the net revenue rebounded in the next two years and then experienced another downturn in 2023. The company's net profit showed growth only in 2021 among all the reviewed years. While margins had been declining until 2020, they greatly revived in 2021 and then slipped again in 2022. In 2023, the gross profit (GP) margin saw a slight increase, whereas the net profit margin continued its downhill trajectory.

In 2019, the company’s net sales dropped by 19% YoY to Rs31.1 billion. This decrease in sales was primarily attributed to reduced agricultural growth due to water shortages and diminished demand for sugarcane crops. Owing to low sales volume, MTL's gross profit margin fell from 21.9% in FY18 to 19.1% in FY19. Furthermore, the bottom line experienced a 32% YoY decline, amounting to Rs3.6 billion with a net profit margin of 11.7%. The year 2020 was marked by strict lockdowns and suspension of routine business activities due to the Covid-19 epidemic. Consequently, the company's topline plummeted by 26% YoY in FY20, leading to a 29% decrease in gross profit and a reduction in the gross profit margin to 18.5%. Furthermore, the company's net profit narrowed down by 41% YoY to Rs 2.1 billion with a net profit margin of 9.4%. Following two challenging years, MTL's topline posted an impressive 92% YoY growth in FY21.

The gross profit increased by 118% with the GP margin increasing to 21.1%. This impressive performance was bolstered by substantial growth in other income and a reduction in finance costs, resulting in a 169% rise in net profit. In FY22, the company's top line continued to grow due to increased tractor prices. However, escalating raw material costs, high interest rates, and sharp currency depreciation adversely affected profitability. As a result, the net profit posted a 6% decline to Rs 5.4 billion with an NP margin of 10.1%. The FY23 was characterized by challenging socio-economic conditions, including devastating floods, skyrocketing inflation, and massive currency depreciation. The company's topline slid by 17%YoY, driven by a 47% drop in sales volume. The high operating expenses trimmed down the net profit by 38% with the net profit margin slipping to 7.6%.

Company Description

Millat Tractors Limited is a public limited company and was incorporated in Pakistan in 1964 under the Companies Act, 1913 (now the Companies Act, 2017). The company is principally engaged in assembling and manufacturing agricultural tractors, implements, and multiapplication products.

Credit: INP-WealthPk