INP-WealthPk

Muneeb ur Rehman

Improved performance of the microfinance sector signifies a positive outlook for Pakistan in terms of economic growth, employment, and entrepreneurship, says Amir Khan, President HBL Microfinance Bank, while talking to WealthPK. The demand for microloans represents the economy’s progress with regard to filling the untapped growth potential. Given the GDP growth rate of 0.29%, the microfinance industry will contribute to enhanced growth by promoting small businesses and startups, he said.

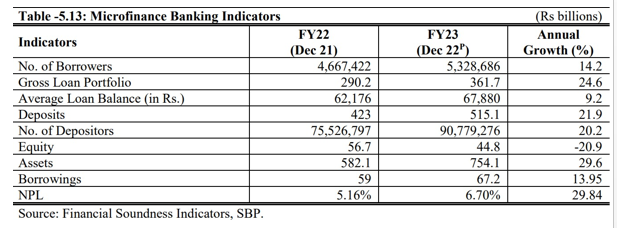

The Microfinance Banks (MFBs) posted a positive growth in terms of number of borrowers, gross loan portfolio, and average loan balance during the Fiscal Year 2023. According to the State Bank of Pakistan, the number of borrowers increased from 4,667,422 in FY 2021-22 to 5,328,686 in FY 2022-23 posting a growth rate of 14.2%. Similarly, deposits in the microfinance banks increased from Rs423 billion to Rs515.1 billion. During the last fiscal year, the average loan balance also showed a positive growth rate of 9.2%.

Amir Khan identified the absence of financial inclusion in the country as the primary cause of its subdued economic output, and he asserted that microfinancing offered a viable solution to address this issue. “Microfinancing in Pakistan is facilitating the provision of financial services to individuals and small enterprises that would otherwise be excluded from mainstream banking channels.” He added that low savings in the country were persistently creating shortage of investable funds, eventually forcing the government to borrow from the international lenders. “This enhanced inclusion is empowering them to save, invest, and engage more actively in economic activities, thereby enabling a broader segment of the population to contribute significantly to overall economic growth,” said the HBL Microfinance Bank president.

Mentioning the shortcomings of microfinancing, Amir Khan said a few borrowers of MFBs were unable to pay their debt obligations, which in turn placed MFBs under considerable financial stress owing to escalated loan loss provisioning and charging off overdue facilities. In order to avert the default on the part of borrowers, the government needs to devise an effective policy of risk sharing for the borrowers, he emphasized. The expansion of microfinance sector serves as a favorable signal for the country's overall economic performance. Nonetheless, there are still prevalent bottlenecks that need the government’s attention.

Credit: INP-WealthPk