INP-WealthPk

Amir Khan

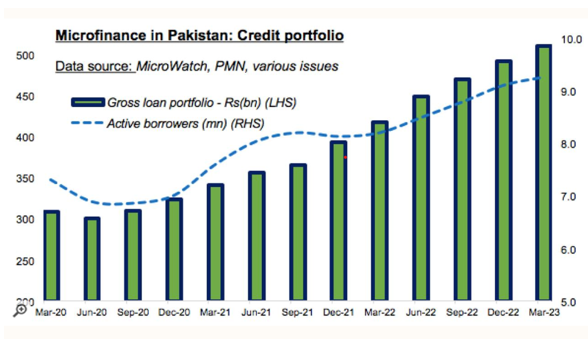

The microfinance institutions have achieved a significant milestone by surpassing PKR500 billion in the gross loan portfolio, making a substantial contribution towards driving financial inclusion in Pakistan, reports WealthPK. According to the Pakistan Microfinance Review 2023, the industry has witnessed a notable increase in active borrowers, reaching 9.3 million, reflecting a growth rate of 1.8% compared to the previous year. “This achievement highlights the growing importance and effectiveness of microfinance in empowering individuals and fostering economic growth,” a senior official from Pakistan Microfinance Network told WealthPK on the condition of anonymity.

The above graph depicts a gradual increase in the number of active borrowers in microfinance banking over time. Additionally, it illustrates the growth of credit portfolio, which has not only impacted various sectors of the economy positively but also created job opportunities for individuals living below the poverty line.

The report further analyses the customer base, distinguishing between microfinance banks and non-banking microfinance companies. Microfinance banks catered to 6.1 million active borrowers, constituting 66% of all clients. Nano loans – a popular product offered by microfinance banks – were utilized by 2.3 million borrowers, highlighting their appeal among the customers.

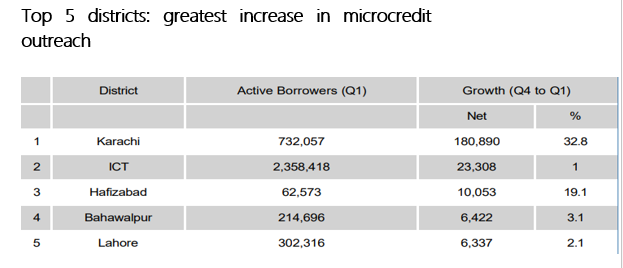

By granting substantial loans, microfinance banks empower individuals to pursue their entrepreneurial ideas, reduce poverty and improve living standards in the process. The above table depicts the microcredit outreach districts in Pakistan. The official also highlighted the prevailing financial exclusion in Pakistan, with approximately 85% of the population lacking access to formal financial services.

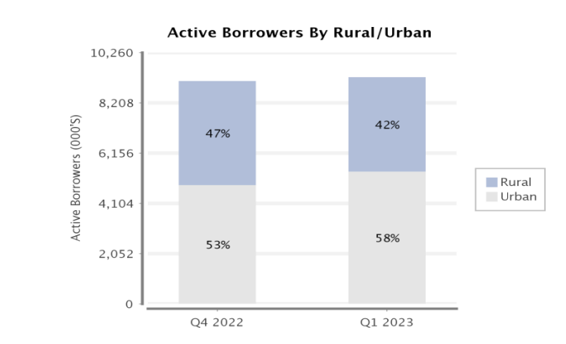

“Access to credit is particularly limited, with only around 5% of the population having such facilities. This creates hurdles for 75% of urban residents engaged in small and micro enterprises, as well as the 80% of rural dwellers involved in small-scale farming,” he added.

The Gross Loan Portfolio of the microfinance industry has reached PKR509 billion, marking a 3.7% increase. The microfinance banks account for PKR394 billion of the portfolio, representing a 4% increase, while non-bank microfinance companies held PKR115 billion, showing a 3.5% increase.

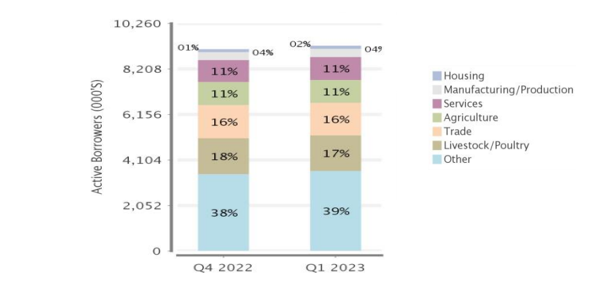

Active borrowers spanned various sectors, including livestock/poultry, trade, agriculture, services, manufacturing/production, and housing. Improving financial inclusion in Pakistan is crucial to fulfilling the specific financial needs of every individual, regardless of their economic background.

In urban areas, where 75% of the population is engaged in small and micro enterprises, and in rural areas, where over 80% of inhabitants rely on small-scale farming, microfinance banks play a pivotal role. By providing loans and support to entrepreneurs and farmers, they create jobs and contribute to economic growth.

The microfinance industry is growing rapidly and is expected to play a critical role in driving financial inclusion, reducing poverty, and fostering sustainable development.

Credit: Independent News Pakistan-WealthPk