INP-WealthPk

Muneeb ur Rehman

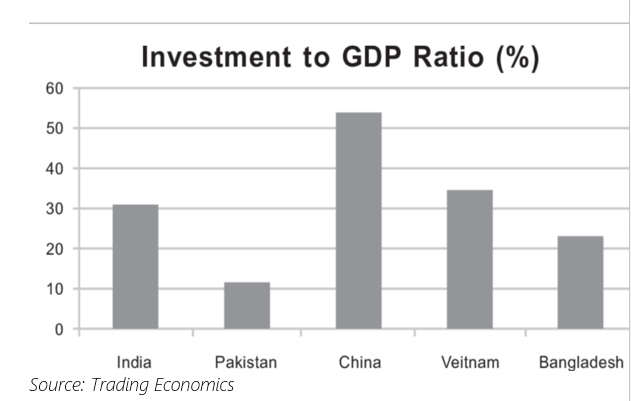

The regulatory framework of countries largely shapes their ability to attract foreign investment. The abolition of "Minimum Equity Requirement" for foreign investors by the Government of Pakistan is likely to attract foreign investment into the country, Zulfiqar Ali, Director of General Reforms at the Pakistan Board of Investment (BOI), told WealthPK. He said with the abolition of the Minimum Equity Requirement (MER), foreign investors would not be subject to any minimum initial capital requirements and would be free to invest in diverse sectors except casinos, consumable alcohol manufacturing, arms and ammunition, atomic energy, high explosives, currency, and mining. It is important to mention that Pakistan lags far behind in the investment-to-GDP ratio compared with the regional countries.

According to the Pakistan Economic Survey 2022-23, the investment-to-GDP ratio was recorded at 13.6%, a decrease from 15.6 % in FY2022. The Gross Fixed Capital Formation (GFCF) estimates amounted to Rs10093.5 billion, indicating an 8.1% increase from FY2022.Top of Form Pakistan's economy, he mentioned, is largely driven by a few sectors like textile and services. Overdependence on limited sectors always makes the economy prone to external shocks. Abolition of the MER will encourage foreign investors to explore a wider array of industries, contributing to economic diversification. This diversification will make the economy more resilient to fluctuations in specific sectors. He expressed optimism regarding its positive impact on the GDP growth rate. "Without a minimum equity requirement, the foreign investors will find it more attractive to invest in the country.

This will lead to an influx of foreign capital into various sectors, fostering economic growth." Underscoring the impact of enhanced foreign investment on technology transfer, he said, "With easier access to various sectors, the foreign investors will bring in new technologies, skills, and expertise, contributing to the transfer of knowledge and advancements within the domestic economy." Zulfiqar Ali asserted that by removing barriers related to equity requirements, the economy will become more competitive in attracting foreign investors compared to other nations that maintain such restrictions. In addition, increased foreign investment will lead to the expansion of businesses, potentially resulting in job creation and reduced unemployment rates that currently stand at more than 8%.

Credit: INP-WealthPk