INP-WealthPk

Ayesha Mudassar

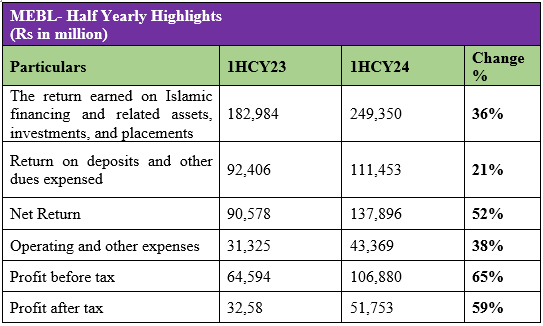

Meezan Bank Limited (MEBL) reported a net return of Rs 137.8 billion for the half year that ended on June 30, 2024, reflecting an impressive 52% growth, compared to the corresponding period the last year, according to WealthPk.

The robust performance was driven by a 36% increase in returns from financing, investments, and placements, fuelled by a higher average policy rate and an expanded portfolio of earning assets. As a result, the bank posted an unconsolidated profit-before-tax (PBT) of Rs 106.8 billion and a profit-after-tax (PAT) of Rs 51.7 billion for 1HCY24. Earnings per share (EPS) rose to Rs 28.89, marking a 59% increase compared to 1HCY23.

![]()

However, the return on deposits and other dues expensed grew to Rs 111.4 billion, up from Rs 92.4 billion in 1HCY23. Operating and other expenses grew by 38% Year-on-Year (YoY). This rise in expenses can be attributed to persistent inflationary pressures, strategic investments in IT projects, and the costs associated with expanding the bank’s branch network.

Financial Position

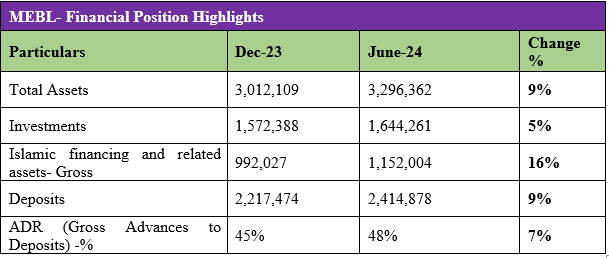

The investment portfolio grew by 5% YoY, reaching Rs 1.6 trillion during the half year. This growth is largely attributed to the Government of Pakistan’s regular Sukuk auctions, which have facilitated effective liquidity management.

Meezan Bank has proactively enhanced its credit lending activities, prioritizing the financing portfolio’s quality. Resultantly, the gross financing portfolio increased by 16% from Rs 992 million to Rs 1.1 billion for the half year, translating into an Advances to Deposit Ratio (ADR) of 48%.

The Year 2023

- Operational Insights

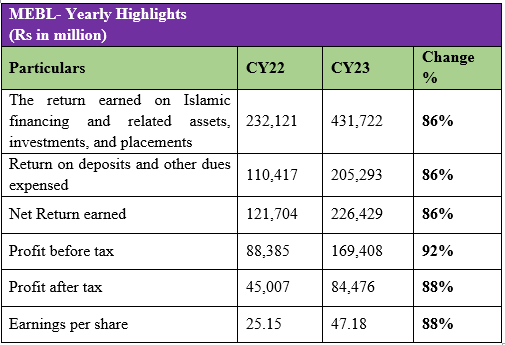

Despite fragile economic conditions, 2023 proved to be a momentous year with significant milestones. Profit-before-tax and profit-after-tax surged by 92% and 88%, respectively, compared to calendar year 2022. Meezan maintains the distinction of being the most profitable bank in Pakistan. Earnings per share rose to Rs 47.13, a considerable increase from Rs 25.12 per share a year ago. The return on financing, investments, and placements surged to Rs 431.7 billion from Rs 232.1 billion in the year 2023, marking an inspiring increase of 86%. This growth was mainly due to augmented average earning assets volume and a remarkably elevated policy rate, averaging 20.6% compared to 13.2% in 2022.

Similarly, the return on deposits and borrowings witnessed a substantial uptick, reaching Rs 205.2 billion from Rs 110.4 billion in 2022, reflecting an 86% increase. The growth in average deposits and borrowings volume, along with an increase in depositors’ profit rates, have contributed to the rise in expenses.

- Balance Sheet Insights

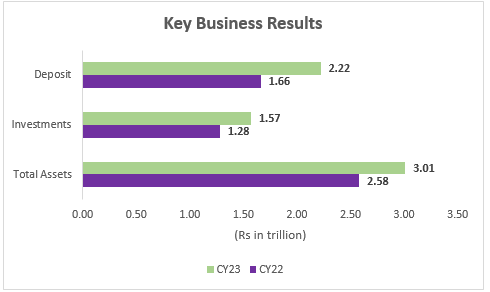

The asset base crossed the Rs 3 trillion mark as compared to Rs 2.6 trillion in 2022 – an increase of 17% or Rs 434 billion. This expansion is funded by a robust growth in deposits.

In addition, the investment portfolio crossed Rs 1.5 trillion, registering a 23% growth compared to Rs 1.28 trillion in the previous year. The regular issuance of Ijarah Sukuk played a pivotal role in intensifying the bank’s investment book.

About the bank

Meezan Bank Limited was incorporated in Pakistan on January 27, 1997, as a public limited

company under the Companies Act, 2017. The bank was granted a ‘Scheduled Islamic

Commercial Bank’s license on January 31, 2002, and formally commenced operations as a

Scheduled Islamic Commercial Bank with effect from March 20, 2002. Currently, the Bank is

engaged in corporate, commercial, consumer, investment, and retail banking activities.

Future Outlook

The bank is committed to driving economic growth and supporting the transition to a fully Shariah-compliant financial system, in line with the Federal Shariat Court’s directives. MEBL prioritizes balanced growth, sectoral diversification, and surpassing regulatory benchmarks. It is expanding its reach, with a strong focus on providing top-tier digital services to maintain industry leadership.

Credit: INP-WealthPk