INP-WealthPk

Qudsia Bano

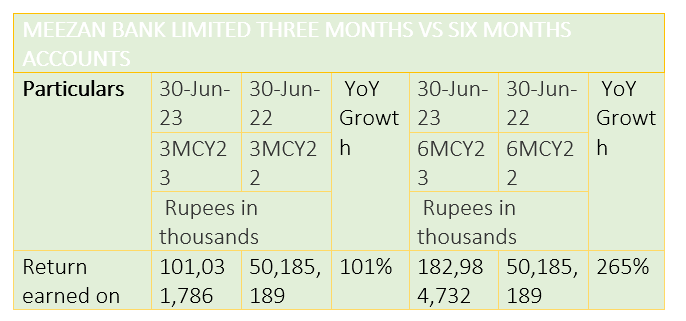

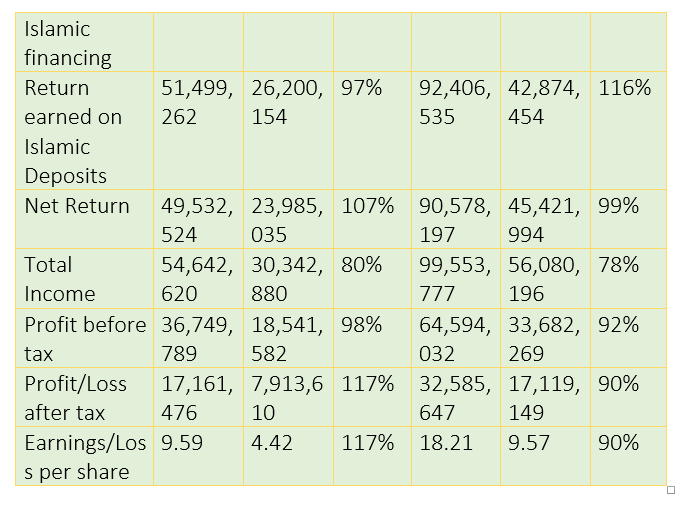

Meezan Bank Limited, a leading Islamic bank in Pakistan, has announced its financial performance for the three-month period ending on June 30, 2023. The bank's results underscore remarkable growth across key financial indicators, reflecting its robust performance and strategic adaptation within a dynamic economic landscape. During this quarter, the return earned on Islamic financing surged to Rs101.03 billion, marking an impressive 101% year-on-year growth. This substantial expansion is attributed to the bank's effective management of its Islamic financing portfolio and a growing demand for Sharia-compliant financial products. The return earned on Islamic deposits witnessed substantial growth as well, reaching Rs51.50 billion, a noteworthy 97% year-on-year increase.

This growth indicates the bank's successful efforts in attracting and retaining Islamic deposits, a key component of its funding base. The net return for the quarter amounted to Rs49.53 billion, reflecting a substantial 107% year-on-year increase. This remarkable growth underscores Meezan Bank's proficiency in managing its Islamic financing and deposit operations, resulting in healthy returns for its stakeholders. Meezan Bank's total income for the quarter stood at Rs54.64 billion, showcasing an impressive 80% growth compared to the same period last year. This comprehensive income figure underscores the bank's capability to generate revenue across various segments, driven by its innovative Islamic financial solutions.

The profit-before-tax surged to Rs36.75 billion, marking an impressive 98% year-on-year increase. This substantial growth in profitability is indicative of the bank's adeptness in optimising its income-generating activities while managing its operational costs effectively. The profit-after-tax for the three months amounted to Rs17.16 billion, demonstrating an exceptional 117% year-on-year growth. This surge in profitability underscores the bank's resilient business model and ability to seize growth opportunities in the Islamic banking sector. Earnings per share (EPS) for the quarter stood at Rs9.59, reflecting a remarkable 117% growth compared to the corresponding period last year. This substantial increase in EPS indicates that Meezan Bank's earnings available to shareholders have substantially expanded on a per-share basis.

Six months analysis

For the first half of the fiscal year ending on June 30, 2023, Meezan Bank Limited's financial performance continues to stand out as a beacon of growth and adaptability within the Islamic banking sector. The return earned on Islamic financing reached a staggering Rs182.98 billion during the six months, marking an impressive 265% year-on-year growth. This remarkable increase signifies the bank's prowess in capturing Islamic financing opportunities and effectively managing its portfolio. The return earned on Islamic deposits amounted to Rs92.41 billion, reflecting a notable 116% year-on-year growth. This growth underscores the bank's ongoing success in attracting and retaining Islamic deposits, vital for its funding needs.

The net return for the first half of the fiscal year reached Rs90.58 billion, showcasing a substantial 99% year-on-year increase. This growth is a testament to Meezan Bank's ability to effectively balance its financing and deposit activities, resulting in robust net returns. The bank's total income for the first half of the fiscal year stood at Rs99.55 billion, reflecting a commendable 78% growth compared to the same period last year. This comprehensive income figure showcases Meezan Bank's capability to generate substantial revenue through its array of Islamic financial products. The profit-before-tax surged to Rs64.59 billion, marking a noteworthy 92% year-on-year increase. This growth reflects the bank's efficient income generation, prudent risk management, and cost control measures.

The profit-after-tax for the six months amounted to Rs32.59 billion, demonstrating a substantial 90% year-on-year growth. This surge in profitability is a testament to the bank's sustained growth trajectory and its ability to translate revenue into robust earnings. The earnings per share (EPS) for the six months stood at Rs18.21, reflecting a significant 90% growth compared to the corresponding period last year. This remarkable increase in EPS emphasises Meezan Bank's commitment to delivering enhanced value to its shareholders.

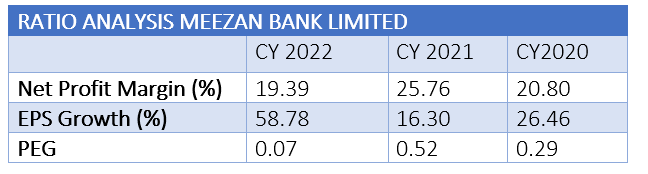

The net profit margin, a vital indicator of the bank's ability to convert revenue into profits, displayed a downward trend over the past three years. In CY22, the net profit margin settled at 19.39%, a decrease from the 25.76% reported in CY21 and closer to 20.80% in CY20. This decline may indicate increasing operational costs or evolving market dynamics that impacted the bank's profitability during this period. The EPS growth, a key measure of a company's profitability per outstanding share, experienced notable fluctuations. CY22 saw a significant surge in EPS growth by 58.78%, reflecting a remarkable uptick from the 16.30% growth in CY21, which was preceded by a 26.46% growth in CY20.

This suggests that Meezan Bank navigated certain challenges and opportunities in CY22, leading to a substantial increase in its earnings available to shareholders on a per-share basis. The price-to-earnings growth (PEG) ratio, which provides insights into the relationship between the company's stock price, earnings growth and valuation, also exhibited a varying pattern. With a PEG ratio of 0.07 in CY22, it significantly improved compared to the 0.52 in CY21 and was notably lower than the 0.29 in CY20. A lower PEG ratio suggests that the market may value the bank's growth potential more favourably than its stock price, implying an optimistic outlook for future earnings growth.

About the bank

Meezan Bank was incorporated in Pakistan on January 27, 1997, as a public limited company under the Companies Act, 2017 (previously Companies Ordinance, 1984). The bank was granted a Scheduled Islamic Commercial Bank licence on January 31, 2002, and formally commenced operations as a Scheduled Islamic Commercial Bank with effect from March 20, 2002. Currently, the bank is engaged in corporate, commercial, consumer, investment and retail banking activities.

Credit: INP-WealthPk