INP-WealthPk

Ayesha Mudassar

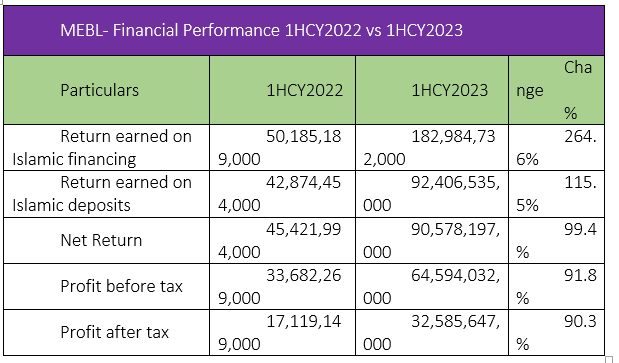

Meezan Bank Limited (MEBL), a leading Islamic bank of Pakistan, has declared a net return of Rs90.5 billion for the half-year period ended June 30, 2023, posting an impressive growth of 99.4% over the corresponding period of last year, reports WealthPK. This remarkable growth highlights the bank's proficiency in managing its Islamic financing and deposit operations, resulting in healthy returns for its stakeholders. As per the bank's half-yearly report, the return earned on Islamic financing surged to Rs182.9 billion, demonstrating a remarkable 264.6% year-on-year growth. Likewise, the return earned on Islamic deposits witnessed a substantial growth to Rs92.4 billion, a noteworthy 115.5% year-on-year increase.

Furthermore, the bank declared an unconsolidated profit-before-tax (PBT) of Rs64.5 billion for 1HCY23, with an impressive growth of 91.8% over the same period last year. The profit-after-tax (PAT) for the six months surged to Rs32.5 billion versus a PAT of Rs17.1 billion over the corresponding period of last year. The rise in profitability illustrates the bank’s resilient business model and its ability to seize growth opportunities. Earnings per share (EPS) for the half year stood at Rs18.21, reflecting a significant 90% growth compared to the corresponding period last year. This increase in EPS indicates that Meezan Bank’s earnings available to shareholders have substantially expanded on a per-share basis.

Three months analysis

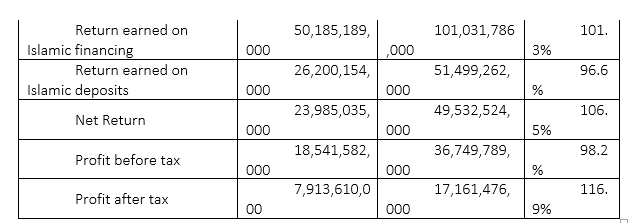

For the second quarter of the calendar year ending on June 30, 2023, Meezan Bank Limited's financial performance continued to grow as the net return reached Rs49.5 billion due to notable growth in return earned on Islamic financing and Islamic deposits. The return earned on Islamic financing reached a staggering Rs101 billion during the three months, illustrating 101% year-on-year growth. Moreover, the return earned on Islamic deposits also experienced 96.6% year-on-year growth in 2QCY23 compared to 2QCY22.

The PBT for the three months reached Rs36.7 billion, marking a noteworthy 98% year-on-year increase. Meanwhile, the PAT surged to Rs17.1 billion compared to Rs7.9 billion over the corresponding period of last year.

About the bank

Meezan Bank was incorporated in Pakistan on January 27, 1997, as a public limited company under the Companies Act, 2017. The bank was granted a “Scheduled Islamic Commercial Bank” licence on January 31, 2002, and it formally commenced operations on March 20, 2002. Currently, the bank is engaged in corporate, commercial, consumer, investment and retail banking activities.

Credit: INP-WealthPk