INP-WealthPk

Ayesha Mudassar

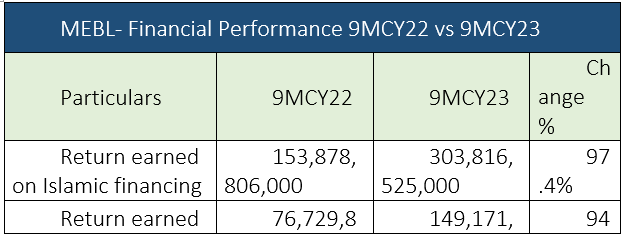

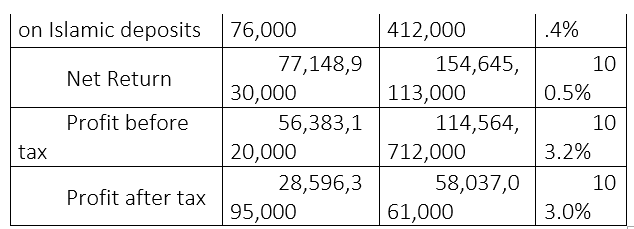

Meezan Bank Limited (MEBL), a leading Islamic bank of Pakistan, has declared a net return of Rs154.6 billion for the nine months ended September 30, 2023, with an impressive growth of 100.5 % over the corresponding period of last year, reports WealthPK. This remarkable growth highlights the bank's proficiency in managing its Islamic financing and deposit operations, resulting in healthy returns for its stakeholders. As per the bank's third quarterly report, the return earned on Islamic financing surged to Rs303.8 billion, demonstrating a remarkable 97.4% growth.

This is mainly driven by the higher underlying benchmark rate and higher average volume of earning assets. Likewise, the return earned on Islamic deposits witnessed substantial growth, reaching Rs149.1 billion, a noteworthy 94.4% increase. This rise is primarily attributable to higher average deposit and borrowing volume as well as an uptick in depositors' profit rates.

Furthermore, the bank announced an unconsolidated profit-before-tax of Rs114.5 billion for 9MCY23, with an impressive growth of 103.2% over last year. The profit-after-tax for the nine months surged to Rs58.03 billion versus Rs28.5 billion in the corresponding period of the last year. The rise in profitability illustrates the bank's resilient business model and ability to achieve volumetric expansion. Earnings per share (EPS) for the period stood at Rs32.4, reflecting a significant 104% growth compared to the corresponding period last year. This increase in EPS indicates that Meezan Bank's earnings available to shareholders have substantially expanded on a per-share basis.

Quarterly review

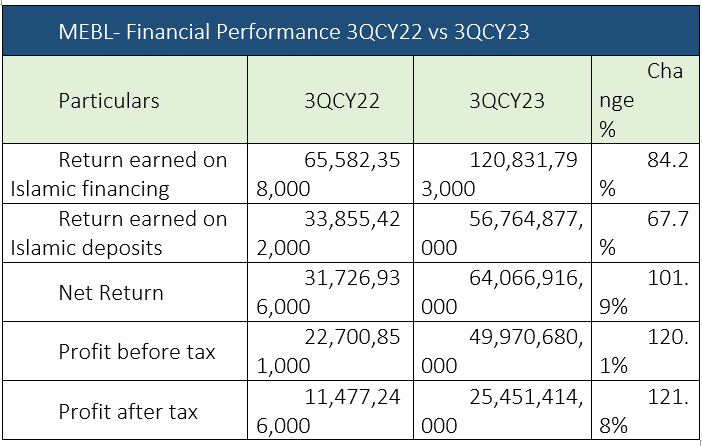

For the third quarter of the calendar year ending on September 30, 2023, Meezan Bank Limited's financial performance continued to be on a growth trajectory. The net return reached Rs64.06 billion due to prominent growth in return earned on Islamic financing and Islamic deposits. The return earned on Islamic financing reached a staggering Rs120.8 billion during the three months, illustrating 84.2% year-on-year growth. Moreover, the return earned on Islamic deposits also experienced 67.7% year-on-year growth in 3QCY23 compared to 3QCY22.

The profit-before-tax for the three months reached Rs49.9 billion, marking a noteworthy 120% year-on-year increase. Meanwhile, the profit-after-tax surged to Rs25.4 billion compared to Rs11.4 billion over the corresponding period of the last year.

About the bank

Meezan Bank was incorporated in Pakistan on January 27, 1997, as a public limited company under the Companies Act, 2017. The bank was granted a "Scheduled Islamic Commercial Bank" licence on January 31, 2002, and formally commenced operations as a Scheduled Islamic Commercial Bank with effect from March 20, 2002. Currently, the bank is engaged in corporate, commercial, consumer, investment and retail banking activities.

Credit: INP-WealthPk