INP-WealthPk

Qudsia Bano

MCB Bank Limited, a prominent player in Pakistan’s banking sector, has reported its financial performance for the three-month period ending on June 30, 2023, posting robust growth across various financial metrics and showing its resilience and adaptability within a dynamic market landscape. During this quarter, MCB Bank's markup interest earned amounted to Rs81.42 billion, exhibiting a substantial year-on-year growth of 78%. This growth is attributed to the bank's effective management of its lending portfolio, leveraging both traditional and innovative financial products. The net markup interest income for the quarter reached Rs36.94 billion, marking an impressive 77% year-on-year increase. This growth indicates the bank's proficiency in optimising its interest-related revenue streams. MCB Bank's non-markup interest income totaled Rs8.14 billion, representing a moderate 13% year-on-year increase.

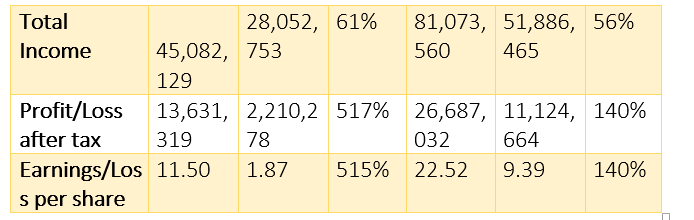

This growth highlights the bank's diverse revenue sources beyond traditional lending activities. Overall, the bank's total income for the quarter stood at Rs45.08 billion, showcasing a substantial 61% growth compared to the same period last year. This comprehensive income figure underscores MCB Bank's ability to effectively generate revenue from various avenues. The profit-after-tax for the three months amounted to Rs13.63 billion, demonstrating an exceptional year-on-year growth of 517%. This surge in profitability emphasises the bank's efficient risk management strategies and adeptness in navigating changing economic conditions. Earnings per share (EPS) for the quarter stood at Rs11.50, reflecting an impressive 515% growth compared to the corresponding period last year. This significant growth in EPS indicates that the bank's earnings available to shareholders have multiplied considerably on a per-share basis.

Six months analysis

In the first half of the ongoing calendar year 2023, MCB Bank Limited showcased commendable financial performance across various key metrics, reinforcing its position as a leading financial institution. The bank's markup interest earned during the six months reached Rs145.28 billion, reflecting a robust year-on-year growth of 70%. This growth signifies the bank's ability to effectively capture opportunities in the lending and investment landscape. The net markup interest income for the first half of the fiscal year amounted to Rs67.01 billion, showcasing an impressive 72% year-on-year increase. This growth underscores the bank's prudent management of interest-related income and expenses. MCB Bank's non-markup interest income for the six months stood at Rs14.06 billion, marking a 9% year-on-year increase.

This growth indicates the bank's diverse income streams beyond traditional lending activities. The bank's total income for the first half of the fiscal year reached Rs81.07 billion, reflecting a substantial 56% growth compared to the same period last year. This comprehensive income figure underscores MCB Bank's ability to generate robust revenue across various segments. The profit-after-tax for the six months amounted to Rs26.69 billion, demonstrating an exceptional year-on-year growth of 140%. This surge in profitability highlights the bank's effective financial management strategies and its ability to capitalise on market opportunities. EPS for the six months stood at Rs22.52, reflecting a significant 140% growth compared to the corresponding period last year. This remarkable growth in EPS emphasises the bank's consistent ability to generate higher earnings available to shareholders on a per-share basis.

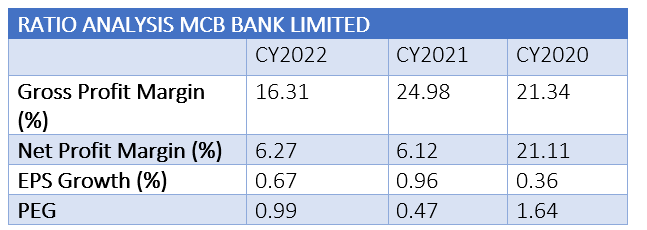

MCB Bank Limited's financial performance over the past three calendar years can be assessed through its key ratios, offering insights into its operational efficiency, profitability and growth trajectory. The gross profit margin, a vital indicator of how effectively a bank manages its cost of operations, has displayed variations over the years. In CY22, the gross profit margin stood at 16.31%, showing a decline from 24.98% in CY21, but still slightly above the 21.34% in CY20. This fluctuation may reflect changes in the bank's revenue mix, cost management or market dynamics. The net profit margin, indicating the proportion of revenue retained as net profit after all costs, has seen relatively minor fluctuations. In CY22, the net profit margin was 6.27%, slightly up from 6.12% in CY21, but notably lower than the 21.11% in CY20.

These fluctuations may reflect changes in the bank's cost structure, interest rate environment or provisioning requirements. The EPS growth, which gauges the percentage change in EPS from one year to another, has shown marginal variations. In CY22, the EPS growth was 0.67%, reflecting a modest increase from the previous year. In CY21, the EPS growth was 0.96%, indicating a slightly higher growth rate. Similarly, in CY20, the EPS growth was 0.36%, suggesting a more modest increase in earnings available to shareholders. The PEG (Price/Earnings to Growth) ratio, which assesses a bank's valuation relative to its EPS growth rate, has shown relatively stable values. In CY22, MCB Bank Limited's PEG ratio was 0.99, suggesting a balance between price, earnings and growth prospects. In CY21, the PEG ratio was 0.47, indicating an attractive valuation in relation to its EPS growth. Meanwhile, in CY20, the PEG ratio was 1.64, which may reflect a less favourable valuation relative to its EPS growth.

Credit: INP-WealthPk