INP-WealthPk

Ayesha Mudassar

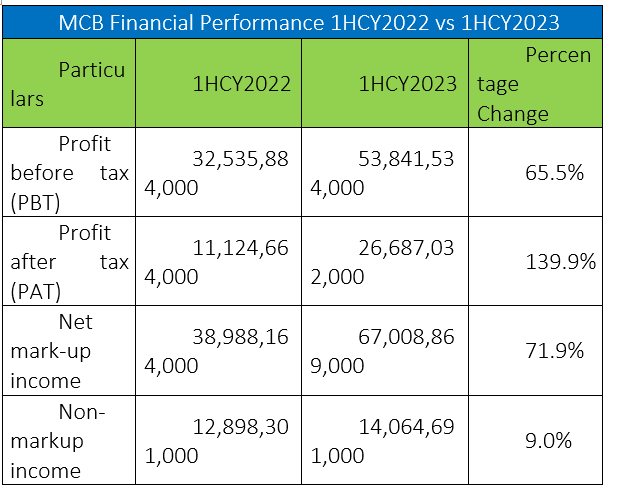

MCB Bank Limited (MCB), one of Pakistan’s largest private sector banks, achieved substantial growth in core earnings, resulting in an impressive 65% year-on-year increase in the profit-before-tax (PBT) for the half-year period ended June 30, 2023, reaching Rs53.84 billion. As per the unconsolidated interim statement, the profit-after-tax (PAT) posted a remarkable growth of 140% to reach Rs26.69 billion, translating into earnings per share (EPS) of Rs22.52 compared to an EPS of Rs9.39 reported in the corresponding period of last year.

![]()

Due to strong volumetric growth in the current account and timely repositioning of the asset book, the net markup income increased by 72% over the corresponding period last year. The bank’s non-markup income surged to Rs14.1 billion against Rs12.9 billion in the same period last year, with major contributions from fee commission income (Rs8.8 billion), income from trading in foreign currencies (Rs3.6 billion) and dividend income (Rs1.5 billion). Furthermore, the total asset base of the bank grew by 9% and was recorded at Rs2.28 trillion as of June 2023.

The analysis of the asset mix highlights that net investments increased by Rs169.6 billion. The bank continued its focus on building no-cost deposits, which resulted in a robust growth of Rs196 billion in average current deposits. The average current to total deposits ratio improved to 52.3% during the period under review from 41.1% in the corresponding period last year. The return on assets and equity both notably improved to 2.45% and 29.59%, respectively, whereas the book value per share was reported at Rs160.2.

Quarterly review

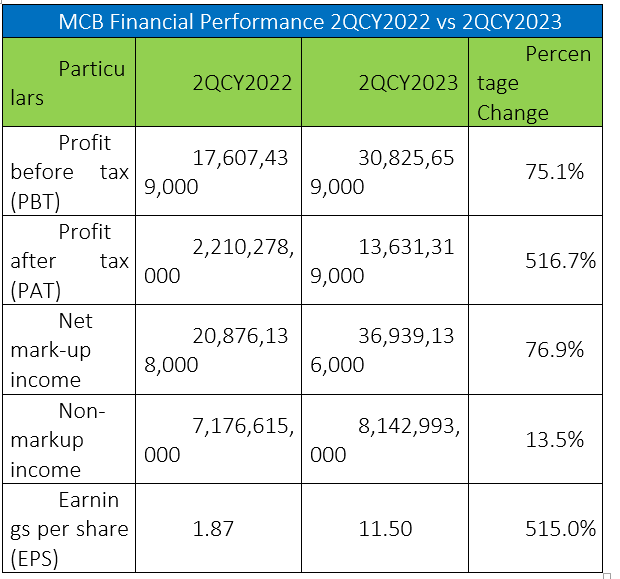

MCB witnessed an astonishing profit growth of 516.7% for the quarter ended June 30, 2023, as it declared a PAT of Rs13.6 billion for 2QCY23, compared to Rs2.2 billion in the same quarter of the previous year. The bank attained record profit mainly due to its focused efforts in building no-cost deposits.

During this quarter, the net markup income increased by 77% over the corresponding period last year, demonstrating the bank’s proficiency in optimising its interest-related revenue streams. In addition, the bank’s non-markup income totalled Rs8.14 billion, representing a moderate 13% year-on-year increase. EPS for the quarter stood at Rs11.5, reflecting an impressive 515% growth compared to the same period last year. This significant growth in EPS indicates that the bank’s earnings available to shareholders have multiplied considerably on a per-share basis.

Future outlook

MCB is committed to actively contributing to the development of the economy through strengthening financial inclusion and providing banking services across the country. Furthermore, the bank will target no-cost deposits to maximise the earnings potential and aggressively invest in the technological transformation to become a more agile and efficient organisation.

Credit: INP-WealthPk