INP-WealthPk

Jawad Ahmed

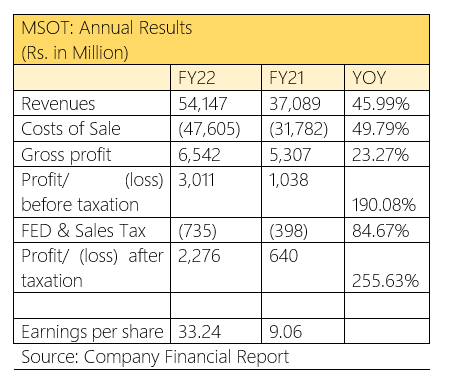

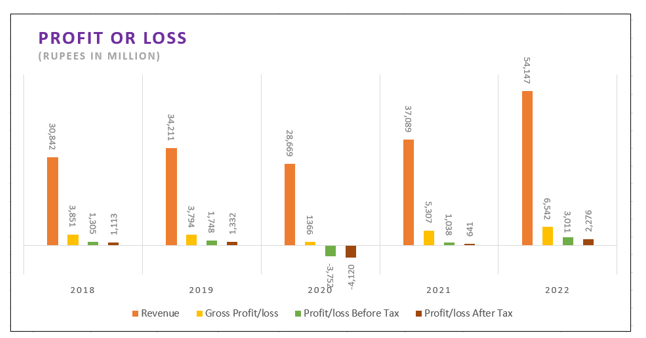

The revenues of Masood Textile Limited increased by 46% from Rs37 billion in FY21 to Rs54.14 billion during the fiscal year that ended on June 30, 2022, reports WealthPK.

During FY2021-22, the company’s revenue and profitability increased significantly.

Masood Textile was incorporated in Pakistan as a public limited company under the Companies Act, 1913. The main objects of the company are manufacture and sale of cotton/synthetic fiber yarn, knitted/dyed fabrics and garments.

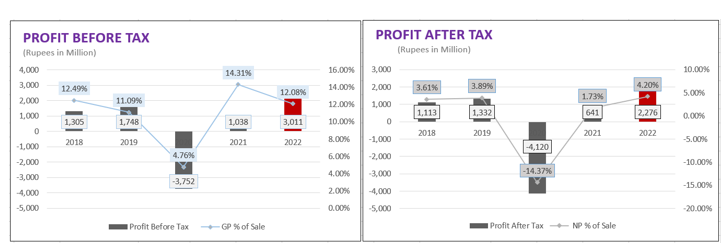

The company saw a substantial increase in topline, with the gross profit rising by 23.2% to Rs6.54 billion in FY22 from Rs5.30 billion the year before. Profit before taxation jumped from Rs1 billion in FY21 to Rs3 billion in FY22, with an increase of 190%.

In comparison to FY21, when the profit after tax was Rs640 million, this year's profit was Rs2.27 billion, with an increase of approximately 255%.

The Earnings Per Share (EPS) rose exponentially due to the considerable top-line growth, improving from Rs9.06 in FY21 to Rs33.24 in FY22.

Company’s performance over the years

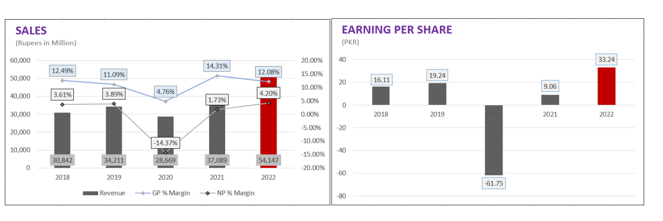

In 2019, the company’s sales revenue climbed to Rs34.2 billion from Rs30.8 billion in 2018.

The company's gross profit slightly dropped from Rs3.85 billion in the prior year to Rs3.79 billion this year, a 1.56% fall year over year.

However, the profit after taxes climbed by 20%, from Rs1.11 billion the year before to Rs1.33 billion this year. As a result, the EPS increased from Rs. 16.11 in 2018 to Rs. 19.24 in 2019.

In 2020, the company’s revenue declined to Rs28.6 billion as opposed to Rs34.2 billion in 2019. This was mostly caused by restrictions brought on by Covid-19, which blocked markets and had an impact on the supply chain. The company reported over 315% decrease in profit-before-tax during the year, bearing Rs3.75 billion loss which was Rs1.74 billion in the previous year. Additionally, the business reported a net loss of Rs4.12 billion, down from a net profit of Rs1.33 billion the year prior. As a result, the loss per share reached Rs61.75 in 2020 as against EPS of Rs19.24 in the previous year.

However, in 2021, the company experienced a spectacular increase in its turnover, which rose to Rs37 billion from Rs28.6 billion the year before.

Profit after tax increased from a loss of Rs4.1 billion the year before to a net profit of Rs641 million during the reviewed fiscal year.

The EPS increased somewhat from loss per share of Rs61.75 the previous year to Rs9.06 as a result of profit gains.

Recent results and future outlook

The company's sales increased by more than 46% in the fiscal year 2021–2022 as a result of rising demand driven by the economy's recovery after the Covid restrictions were lifted. Although the economy has grown since Covid-19, volatility, including the rise in global commodity prices, current account deficit, exchange rate volatility, and hyperinflationary situations, will continue to have an impact on its operations for the foreseeable future.

The company is optimistic that its management team, manufacturing employees, and the ongoing performance of client companies will allow it to achieve its sales targets for the following years.

Credit : Independent News Pakistan-WealthPk