INP-WealthPk

Ayesha Mudassar

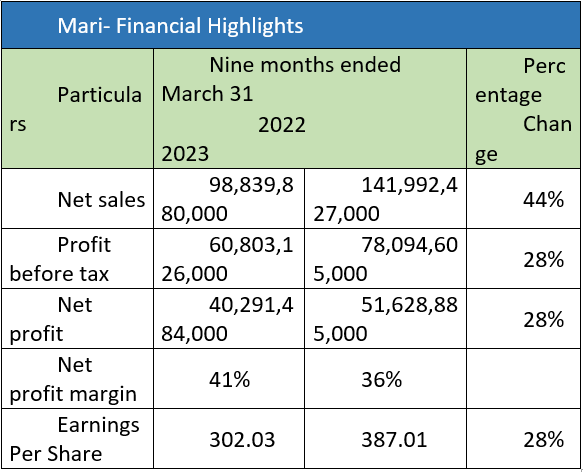

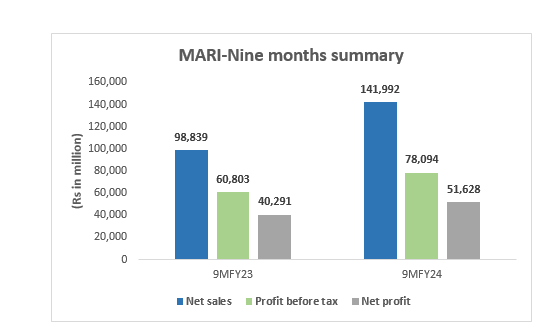

The net sales of Mari Petroleum Company Limited (Mari) grew by 44%, and both the before-and-after-tax profits by 28% each in the first nine months of the ongoing fiscal year (9MFY24) compared to the corresponding period of the earlier fiscal, reports WealthPK. The robust financial performance was largely boosted by enhanced hydrocarbon sales and higher sales prices during the period.

The oil exploration company's sales jumped from Rs98.8 billion in 9MFY23 to Rs141.9 billion in 9MFY24. Likewise, the net profit of Rs40.2 billion rose to Rs51.6 billion in 9MFY24. Mari's hydrocarbon sales rose 13% to 29.9 million barrels of oil equivalent (MMBOE) in 9MFY24, driven by full capacity operation of its Sachal Gas Processing Complex and additional gas sales from Ghazij appraisal wells under the Extended Well Test. Mari's performance reflects resilience and success. Despite a challenging environment, the company effectively implemented its plans and strategies, resulting in strong operational and financial outcomes. As per the latest financials, the company's earnings per share (EPS) stood at Rs387.01 against Rs302.03 in 9MFY23.

Last six years at a glance

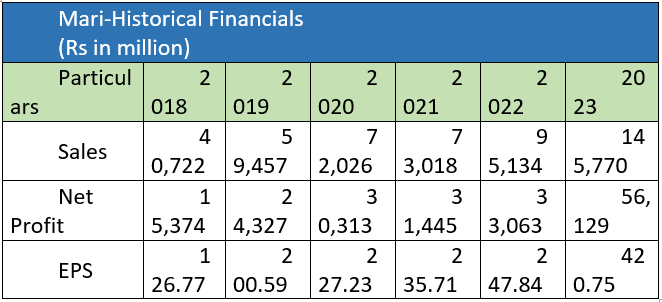

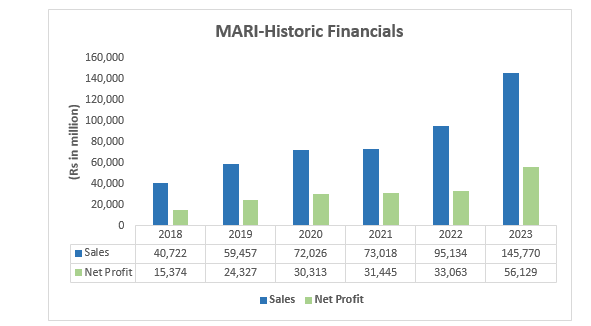

The sales and net profit of Mari have been growing over the past six years, beginning from 2018. However, the company performed remarkably well during FY23, and delivered exceptional results by achieving the highest-ever sales revenue of Rs145.7 billion compared to Rs95.1 billion during FY22.

In FY23, Mari announced impressive growth of around 53% year-on-year (YoY) in net sales and an increase of 70% in its bottom line. The revenue growth was primarily driven by higher prices and enormous local currency depreciation. The company's bottom line also benefitted from significant growth in financial income as well as colossal exchange gains.

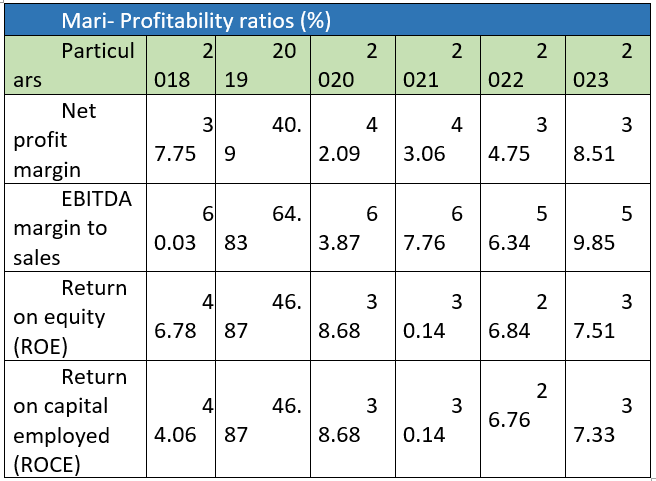

Profitability ratios

Profitability ratios provide insights into a company's ability to generate profits relative to its revenue, assets, equity or other financial metrics. The company witnessed fluctuations in its net profit margin over the six years. In FY23, the net profit margin was 38.51% compared to the previous year's margin of 34.75%, which indicates increasing revenue.

Similar to the net profit margin, the trend for EBITDA margin to sales shows fluctuations over the years, with a noticeable dip in 2022. During the years under review, both the return on equity and return on capital employed ratios increased in the first two years, followed by a decrease in 2020 and 2021, and then a slight increase in 2023.

About the company

Registered on the Pakistan Stock Exchange with the symbol "Mari", the company is the second-largest firm in the oil and gas exploration sector with a market capitalization of Rs374.1 billion. Its top competitors include Oil and Gas Development Company Limited, Pakistan Petroleum Limited and Pakistan Oilfields Limited. Mari's key customers include fertilizer manufacturers, power generation companies, gas distribution companies, and refineries. In addition to Mari Gas Field, it holds development and production leases as well as operatorship of exploration blocks and is also a non-operating joint venture partner with leading national and international E&P companies.

Future outlook

Despite the challenges, the company remains focused and determined to discover new hydrocarbon resources and enhance production to positively contribute towards the country's energy and food security.

Credit: INP-WealthPk