INP-WealthPk

Ayesha Mudassar

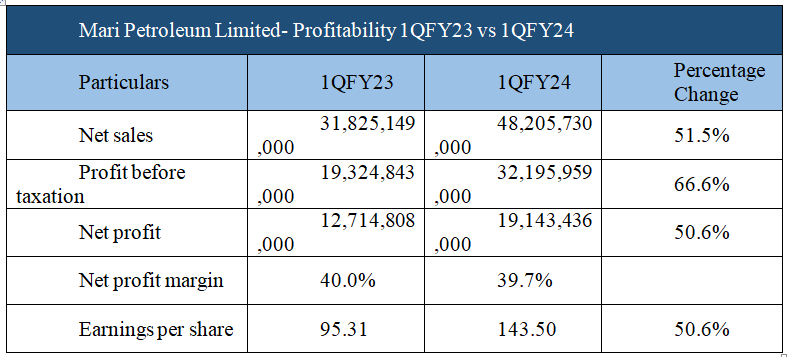

Mari Petroleum Limited (MARI) achieved impressive sales and profit growth in the first quarter of the fiscal year 2023-24 (1QFY24). The company's revenues, profit-before-taxation, and net profit increased by 51.5%, 66.6%, and 50.6%, respectively, compared to the corresponding period of the earlier fiscal year, reports WealthPK. In 1QFY24, MARI posted sales of Rs48.2 billion due to higher applicable oil and gas prices. The company posted a net profit of Rs19.1 billion, resulting in a net profit ratio of 39.7%.

In comparison to the corresponding period of FY23, the oil exploration company showed a 51.5% increase in revenues, pushing sales from Rs31.8 billion to Rs48.2 billion. Likewise, the net profit of Rs12.7 billion cranked up by 50.6% to Rs19.1 billion in 1QFY24. The earnings per share moved from Rs95.31 to Rs143.50 during the period under review.

Company description and contribution

Registered on Pakistan Stock Exchange (PSX) with the symbol 'MARI', the company is the second-largest firm in the oil and gas exploration sector with a market capitalisation of Rs280.1 billion. Its top competitors include Oil and Gas Development Company Limited, Pakistan Petroleum Limited, and Pakistan Oilfields Limited. During FY23, the company contributed Rs73.75 billion to the national exchequer in the form of royalties, taxes, levies, and duties. Indigenous production of natural gas, crude oil, and liquefied petroleum gas (LPG) by MARI helped curtail the country’s fuel import bill by over $3 billion.

Performance over four years

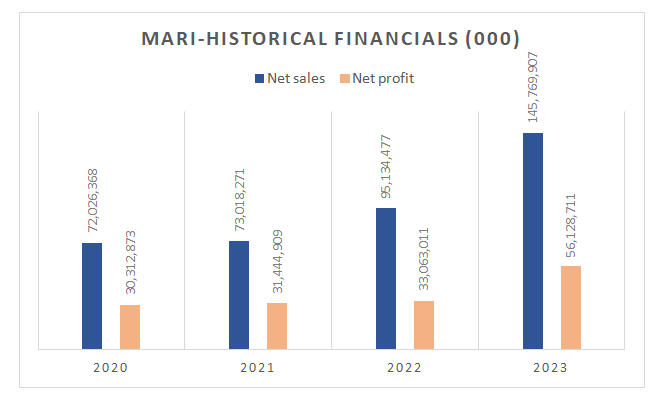

Analysis of MARI shows that its sales kept increasing in the last four years. The company posted its highest four-year sales in 2023 at Rs145.7 billion. Its sales increased from Rs72 billion in FY20 to Rs73 billion in FY21 and Rs95.1 billion in FY22.

In terms of net profit, MARI hit the highest four-year net profit in 2023 at Rs56.12 billion. The company posted a net profit of Rs30.31 billion in 2020, Rs31.44 billion in 2021, Rs33.06 billion in 2022, and Rs56.12 billion in 2023.

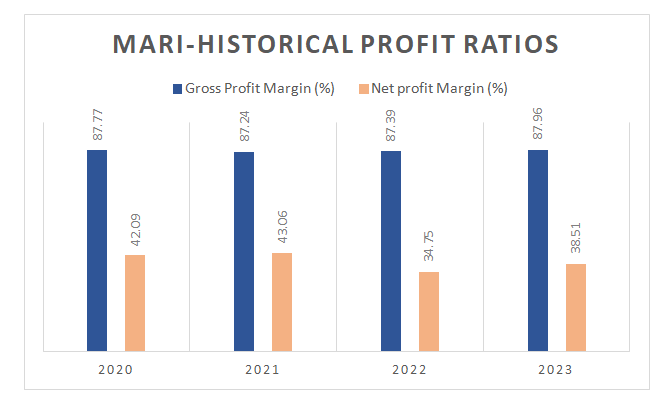

In the last four years, MARI posted the highest gross profit ratio of 87.9% in 2023. The company reported the highest net profit ratio of 43.1% in 2021 followed by 42.1% in 2020. The company’s profitability ratios have improved in the recently-ended fiscal year as compared to the previous year due to an increase in profit on account of enhanced net sales.

Credit: INP-WealthPk