INP-WealthPk

Fakiha Tariq

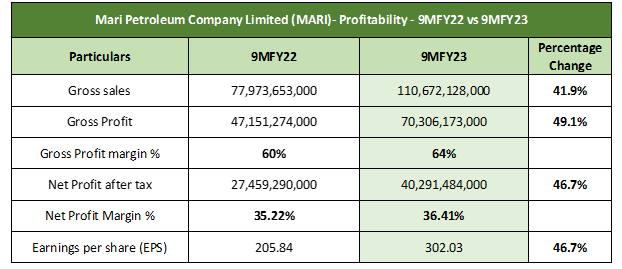

Mari Petroleum Limited (MARI) achieved impressive growth in the first three quarters of the current fiscal year 2022-23. The company’s revenues, gross profit and net profit increased by 41.9%, 49.1% and 46.7%, respectively, compared to the same period of the previous fiscal year, according to WealthPK. In 9MFY23, MARI made gross sales of Rs110 billion. The company posted a gross profit of Rs70.3 billion, resulting in a gross profit ratio of 64%. The company earned Rs40.2 billion in net profit, with a net profit ratio of 36.41% in 9MFY23. MARI posted earnings per share of Rs302.03 in the nine-month period of FY23.

In comparison to the corresponding period of FY22, the oil exploration company showed a 41.9% increase in revenues, pushing sales from Rs77.9 billion to Rs110 billion in 9MFY23. Likewise, the gross profit of Rs47 billion in 9MFY22 grew by 49.1% in 9MFY23. MARI’s net profit of Rs27.4 billion declared in 9MFY22 cranked up by 46.7% to Rs40.2 billion in 9MFY23. Nine-monthly earnings per share value moved from Rs205.84 to Rs302.03 in 9MFY23.

Registered on Pakistan Stock Exchange (PSX) with the symbol ‘MARI’, the company is the second-largest firm in the oil and gas exploration sector with a market capitalisation of Rs211.4 billion. MARI is the third-largest company listed on PSX as per its market capitalisation. Its top competitors include Oil and Gas Development Company Limited, Pakistan Petroleum Limited and Pakistan Oilfields Limited.

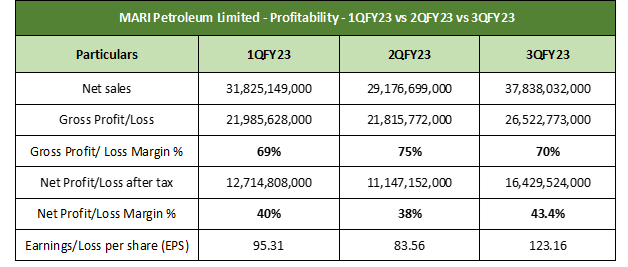

Quarterly review

Quarterly analysis reveals that the third quarter (January-March) of FY23 contributed the most to the consolidated nine-monthly financials of MARI. The company made the highest sales, gross and net profits in this quarter. MARI posted high profitability ratios and enjoyed profit-making both at the gross and net level in all the three quarters of the on-going fiscal year. In the first quarter (July-September) of FY23, MARI posted a gross revenue of Rs31 billion and a gross profit of Rs21 billion. The company posted a net profit of Rs12 billion. Therefore, the gross and net profit ratios were reported to be 69% and 40%, respectively. In 1QFY23, the oil company reported the earnings per share of Rs95.31.

In the second quarter (October-December), the company posted a gross revenue of Rs29 billion and a gross profit of Rs21 billion. The company posted a net profit of Rs11 billion. Therefore, the gross and net profit ratios were reported to be 75% and 38%, respectively. In 2QFY23, the company reported the earnings per share of Rs83.56. In the recently-ended third quarter (January-March), MARI hit the highest three-quarter gross revenue of Rs37 billion and gross and net profits of Rs26 billion and Rs16 billion, respectively. Thus, the gross and net profit margins for 3QFY23 were calculated at 70% and 43.4%, respectively. In 3QFY23, MARI posted the highest quarter-based earnings per share of Rs123.16.

Credit: Independent News Pakistan-WealthPk