INP-WealthPk

Qudsia Bano

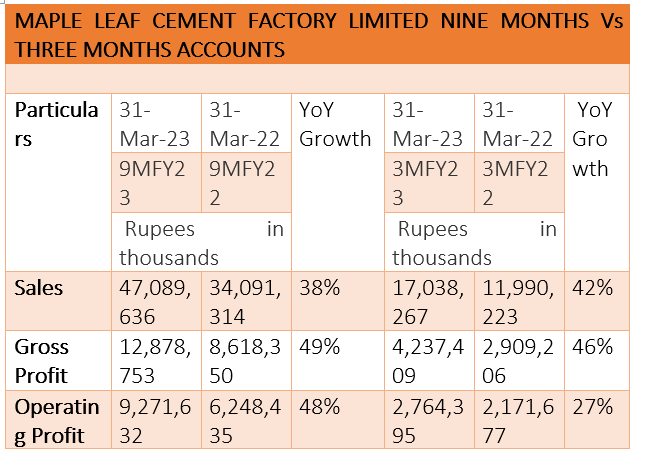

Maple Leaf Cement Factory Limited (MLCF) reported a net consolidated turnover of Rs47 billion during the first nine months of the previous fiscal year 2022-23 compared to Rs34 billion over the same period of FY22. Due to increasing selling prices in the local market, the company's top line climbed by 38%. The substantial inflationary impact on costs, especially fuel and power, was the main cause of the increase in selling prices. During that time, the country was reeling from the devastating effects of floods, which severely affected cement deliveries and the expansion of the construction industry. Along with this, other factors that hindered the expansion of the sector were the tardy implementation of large-scale projects, the limited use of PSDP funding, and weaker demand in the housing sector as a result of high borrowing rates and low disposable income.

Exports have not significantly grown since the American pullout from Afghanistan, despite a slight increase in export sales compared to the same period last year. Due to this, the economy has stagnated, and banking restrictions are another reason why export sales are low. Due to Pakistan's high production costs relative to international markets and increasing shipping costs that limited competitiveness in regional markets, cement exports to the rest of the globe were not feasible. The company produced a consolidated gross profit of Rs12.8 billion during the period under review, a 49% increase from Rs8.6 billion in the same period the year earlier due to the aforementioned variables affecting production costs.

In comparison to a profit of Rs5 billion in the comparable period, the company reported a consolidated pre-tax profit of Rs7.5 billion for the reporting period. In comparison to the prior period, when the consolidated tax component was Rs1.4 billion, it was Rs2.5 billion for the reporting period. The income tax-free profits of MLCF, which totalled Rs5 billion in the first nine months of the fiscal year 2022–23, led to a lower effective tax rate on a consolidated basis.

MLCF reported strong financial performance for the three months ended March 31, 2023. The company demonstrated robust growth across key financial metrics, reaffirming its position as a leading player in the cement industry. During the three-month period, MLCF’s sales reached Rs17 billion, exhibiting an impressive year-on-year growth of 42% compared to the corresponding period of the earlier fiscal. This substantial increase in sales can be attributed to increased demand for cement, robust construction activities, and the company's effective marketing strategies. The company's gross profit for the three months amounted to Rs4.2 billion, showcasing a remarkable growth rate of 46% compared to the same period last year.

This noteworthy increase in gross profit highlights the company's efficient cost management and optimisation of production processes. MLCF's operating profit for the three months stood at Rs2.76 billion, representing a solid growth rate of 27% compared to the corresponding period of FY22. This growth in operating profit indicates the company's ability to generate strong profits from its core operations, despite any potential challenges in the industry. The profit-before-tax for the three months reached Rs2.27 billion, demonstrating an impressive growth rate of 35% compared to the same period of FY22. The increase in the pre-tax profit reflects the company's successful operational efficiency and effective management of its financial affairs.

The profit-after-tax for the three months amounted to Rs1.50 billion, representing a significant growth of 26% compared to the corresponding period of FY22. The rise in the post-tax profit underscores the company's consistent profitability and sound financial performance. Earnings per share (EPS) for the three months stood at Rs1.40, showcasing a notable growth rate of 30% compared to the same period of FY22. The higher EPS reflects the company's ability to generate increased earnings on a per-share basis, thereby creating value for its shareholders.

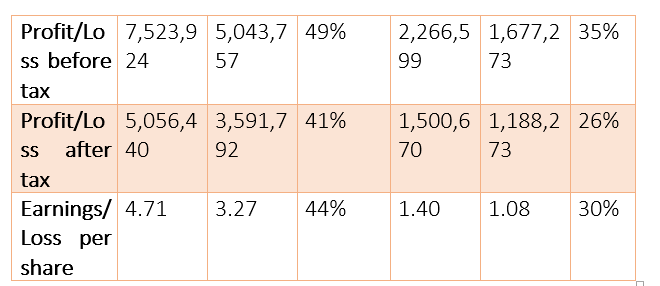

The company’s total sales volume of 3,276,503 tonnes during the July-March period of FY23 is an 8.17% decline from 3,568,126 tonnes sold during the same period in FY22. Domestic sales volume was 3,182,843 tonnes, representing an 8.51% reduction in demand due to the reasons indicated above. The company's export volume increased by 4.97% from 89,225 metric tonnes in the prior period to 93,660 metric tonnes in the same period of FY23.

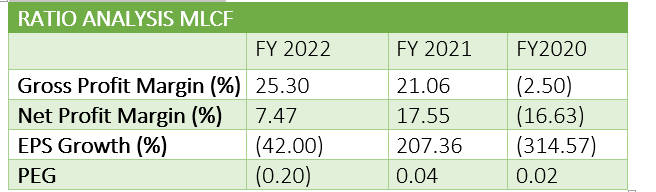

MLCF's ratio analysis reflects a mixed performance over the years. The gross profit margin has steadily improved, reaching 25.30% in FY22 from 21.06% in FY21, indicating better cost management. However, the net profit margin has been volatile, declining to 7.47% in FY22 from 17.55% in FY21. EPS growth also fluctuated significantly, with a decline of 42.00% in FY22 and a remarkable growth of 207.36% in FY21. In FY20, the company faced challenges, leading to negative EPS growth of 314.57%. The PEG ratio suggests potential undervaluation in FY22 and FY21 but overvaluation in FY20.

Credit: INP-WealthPk