INP-WealthPk

Qudsia Bano

BIPL Securities Limited was established in Pakistan on October 24, 2000. Being a subsidiary of BankIslami Pakistan Limited, the brokerage is primarily involved in stocks, money market, foreign exchange and commodity broking.

It is a TREC (Trading Right Entitlement Certificate) holder of the Pakistan Stock Exchange Limited (PSX) and a corporate member of the Pakistan Mercantile Exchange Limited (PMEX).

Investment in a variety of public and unlisted equities and debt instruments, economic research, and advisory services are the other activities of the firm.

Muhammad Ashfaq, the Equity Sales Officer of the company, sat with INP-WealthPK for an interview on the performance of the PSX over the past few quarters.

Q: Given the economic conditions in Pakistan, what do you think is the sentiment of the market?

A: The KSE-100 index lost 5% of its value in the first nine months of the fiscal year 2021-22, and was closed at 44,928 points on March 31 as opposed to 47,356 points at the start of the fiscal year. The index in the first quarter did not change much with a meager gain of just 0.75%. During this quarter, the average daily traded value was Rs10.98 billion, posting a decrease of almost 70% from the same period a year earlier. A surge in the commodities cycle and political uncertainty have made the past nine months challenging for Pakistan's economy. A healthy growth rate of 5.6% achieved in FY22 is projected to come down between 3% and 2% for FY23. Thanks to the government's favourable policies, large-scale manufacturing (LSM) grew by 7.6% from July 21 to January 22. Meanwhile, tax collection grew significantly as Rs4.38 trillion were collected in 9MFY22, up 29.1% year-on-year. Imports have been the main source of tax collection (52%), with income tax and sales tax being the other two important sources.

Q: What are the reasons behind fluctuations in the exchange rate and how it affects the industry?

A: The natural result of floating exchange rates, which are the norm for major economies, is currency volatility. Exchange rates are influenced by a variety of factors, such as a nation's economic performance, the likelihood of inflation, interest rate differences, capital movements, and so on. Even if we do not buy or sell goods or services internationally, changes in the exchange rate might have an indirect effect. Depreciation in local currency also raises the cost of imports.

Q: Most companies report decline in revenues in their half-yearly reports. What is the reason behind it?

A: The Covid-19 pandemic also affected Pakistan’s economy like other countries, slowing down economic growth. But the economy has rebounded somewhat. However, due to political uncertainty and fluctuation in currency, the revenues of some specific sectors are on the decline.

Q: How can foreign direct investment be attracted?

A: There is no doubt that an increase in FDI improves the GDP. However, of late FDI has been squeezed due to a balance of payments issue, mounting debt obligations, a shoddy tax structure, rising current account and budget deficits. These indicators do prevent foreign investors from investing in the country. Pakistan should make efforts to come out of the grey list of the Financial Action Task Force and improve its macroeconomic conditions to attract FDI. Pakistan must also make sure that there is a consistent tax policy, an effective tax system, and a stable political environment if it wants to increase investors’ trust. Particularly, tax policies ought to be more uniform. The wealthiest need to be brought into the tax net rather than putting greater pressure on the salaried class through higher income and sales taxes. In addition, Pakistan's agriculture sector, which is the one with the lowest tax burden despite making a sizable contribution to the nation's economy, needs to be taxed fairly.

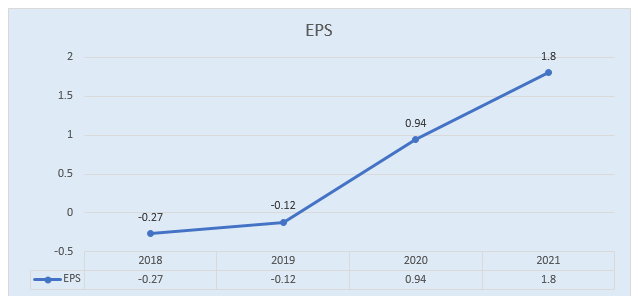

Q: What steps has your company taken to improve the earnings per share over the last two years?

A: To increase the EPS and profits of the company, we have adopted certain strategies, including the marketing strategy and management strategy. During 2019, our company’s EPS was negative due to the pandemic, but it now improved to Rs1.80 due to the effective management strategies.

Q: What measures can we take to improve the economic condition of the country?

A: A favourable economic climate gives Pakistan the chance to overcome structural bottlenecks that are preventing it from achieving its enormous potential leveraged by a sizable, young, and expanding population. Pakistan urgently needs to draw in foreign resources to meet its investment needs. At a time when many of Pakistan's neighbours are attracting sizable FDI inflows, FDI has been falling for a number of years for Pakistan and has remained dismally low.

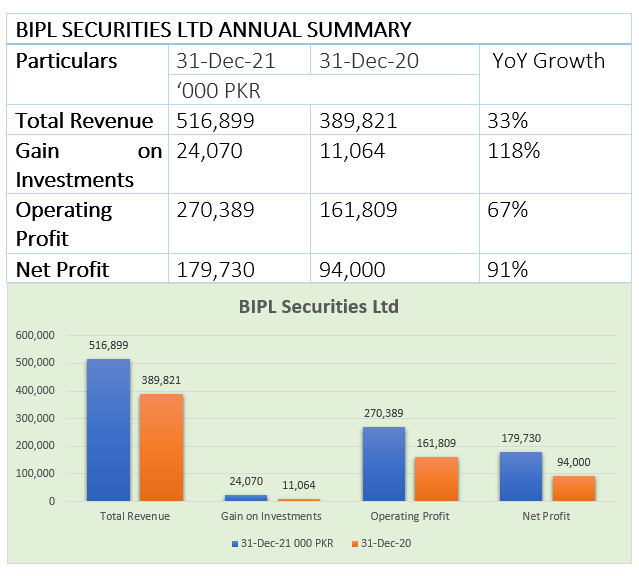

BIPL Securities performance

BIPL Securities Limited’s revenue surged 63% to Rs517 million in the calendar year 2021 from Rs389 million the year earlier. Similarly, gains on investment registered a growth of 118% and reached Rs24 million from just Rs11 million in 2020.

The net income increased 91% to Rs179 million compared with a profit of Rs94 million the preceding year, reports WealthPK.

Earnings Per Share

The earnings per share of the company have been growing since 2020. The EPS stood at Rs1.8 in 2021.

Credit : Independent News Pakistan-WealthPk