INP-WealthPk

Shams ul Nisa

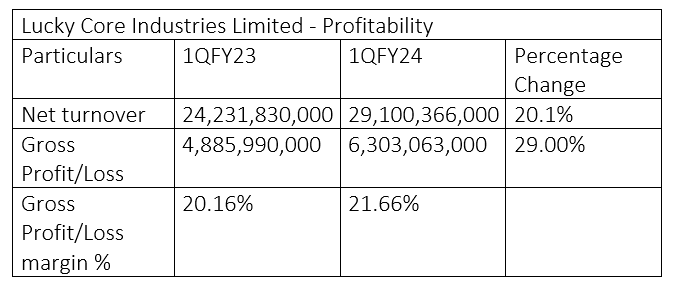

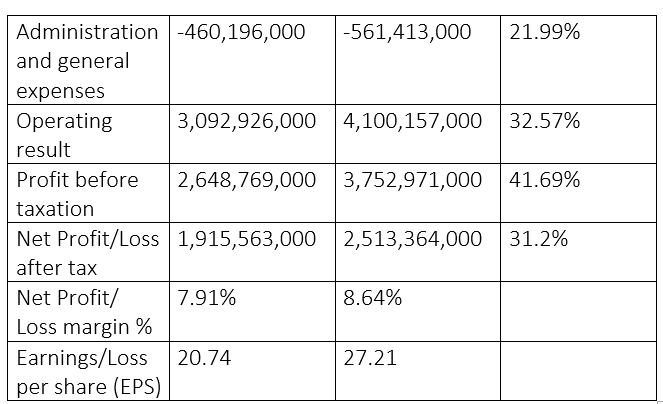

Lucky Core Industries Limited's financial results for the first quarter (July-September) of the current fiscal year 2023-24 showed the company posted growth in revenues and profits through efficient management despite economic challenges. The company's net turnover grew by 20.1% to Rs29.1 billion in 1QFY24 from Rs24.1 billion recorded in the corresponding period of last year. This rise was because of higher volumes and cost-push price changes made by the firm due to inflationary pressures brought on by the depreciation of the Pakistan rupee. The gross profit clocked in at Rs6.3 billion in 1QFY24, 29% higher than Rs4.88 billion in 1QFY23. Hence, the company's gross profit margin moved slightly up to 21.66% in 1QFY24 from 20.16% posted in the same period last year.

Administrative and general expenses rose 21.99% during 1QFY24 to Rs561.4 million from Rs460.19 million in 1QFY23. The company's chemicals and agri-sciences, pharmaceuticals, soda ash and animal health businesses delivered higher operating results, leading to a growth of 32.57% in operating results during 1QFY24. During 1QFY24, the company's profit-before-tax surged to Rs3.75 billion from Rs2.64 billion in 1QFY23, indicating a significant expansion of 41.69%. The net profit stood at Rs2.51 billion in 1QFY24 compared to Rs1.91 billion in the same period last year, posting a growth of 31.2%. The company attributed this increase to the higher operating results, foreign exchange gain, and higher gains from short-term investment during the period. The net profit margin stood at 8.64% in 1QFY24 compared to 7.91% in 1QFY23. Earnings per share increased to Rs27.21 in 1QFY24 from Rs20.74 in 1QFY23.

Historical trend

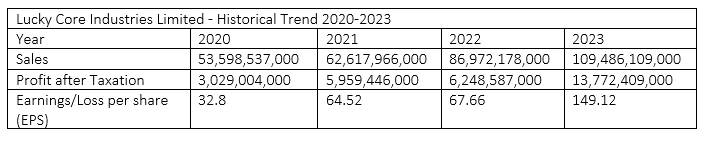

The company has followed an upward trajectory in sales over the years, reaching Rs109.48 billion in 2023 from Rs53.59 billion in 2020. In terms of net profit, the company posted the highest post-tax profit of Rs13.77 billion in 2023 compared to Rs3.029 billion in 2020. Similarly, earnings per share in the four years hit the highest of Rs149.12 in 2023.

Profitability ratios analysis

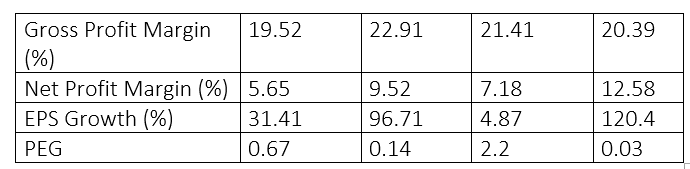

In 2020, the company's gross profit margin stood at 19.52%, which increased to the highest of 22.91% in 2021, but fell to 21.41% in 2022 and further to 20.39% in 2023. The net profit margin increased to 9.52% in 2021 from 5.65% in 2020. The company witnessed the highest net profit margin of 12.58% in 2023.

![]()

EPS growth in 2020 was around 32%, which rose to 97% in 2021 but fell significantly to 4.87% in 2022. Whereas, it showed a remarkable growth of 120.4% in 2023, indicating a high profit generation by the company during the year. The price/earnings-to-growth (PEG) remained below 1 in 2020, 2021 and 2023, indicating undervalued stocks. However, in 2022, the company registered a PEG of 2.2, showcasing overvalued stocks.

Company profile

Lucky Core Industries is a public limited company engaged in five diverse businesses, including polyester, soda ash, chemicals and agri-science, pharmaceuticals and animal health. The company manufactures products, including polyester staple fiber, soda ash, general and specialty chemicals, pharmaceuticals, nutraceuticals, animal health products and agricultural products.

Credit: INP-WealthPk