INP-WealthPk

Shams ul Nisa

Lucky Core Industries (LCI) posted a 10% increase in net turnover, but its after-tax profit dipped by 19.1% in the last financial year (FY24) compared to the earlier fiscal, reports WealthPK.

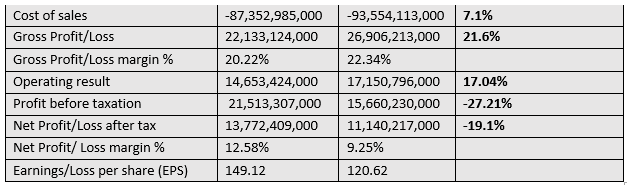

The company's revenue growth was driven by higher soda ash exports and a CPI-based pharmaceutical price adjustment in July 2023. Net turnover of the company's pharmaceutical segment rose by 33%, chemicals & agri sciences by 17%, and soda ash by 15%, while its animal health and polyester businesses remained stable during the period under review. However, rising costs caused a decline in the net profit. During the period, the company's cost of sales rose by 7.1%, mainly driven by higher production volumes and increased raw material prices. The company's gross profit grew by 21.6%, pushing the margin from 20.22% in FY23 to 22.34% in FY24

![]()

The operating result surged by 17.04% in FY24, benefiting from a broad range of business activities and products. However, profit-before-tax declined by 27.21%, highlighting difficulties in managing financial costs. As a result of the dip in the after-tax profit, the net margin fell to 9.25% in FY24 from 12.58% in the previous year. Additionally, earnings per share plunged from Rs149.12 to Rs120.62 in FY24.

Profitability ratios

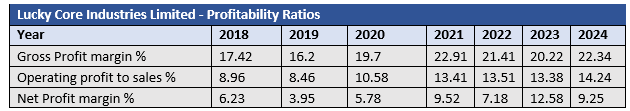

LCI's gross profit margin improved from 20.22% in 2023 to 22.34% in 2024, suggesting better profit retention after covering the cost of goods sold, due to enhanced pricing strategies and operational efficiencies. This margin, however, kept fluctuating from 2018 to 2022.

The operating profit-to-sales ratio followed an upward trend, growing from 8.96% in 2018 to 14.24% in 2024, reflecting the company's strong control over operating expenses relative to sales, allowing more revenue to be converted into operating profit. However, the net profit margin fluctuated, increasing from 6.23% in 2018 to 12.58% in 2023 before dropping to 9.25% in 2024, largely due to higher operational and financial costs.

Liquidity ratios

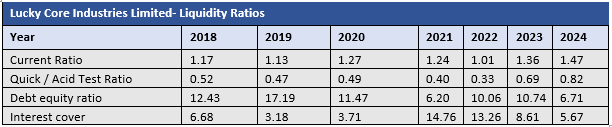

LCI's current ratio followed a positive trend, rising from 1.17 in 2018 to 1.47 in 2024, signalling the company's improved capacity to meet short-term liabilities with current assets despite a brief dip in 2022.

The quick ratio, which assesses the ability of a company to cover short-term obligations without relying on inventory sales, increased significantly from 0.33 in 2022 to 0.82 in 2024, highlighting stronger liquidity management. The debt-to-equity ratio fluctuated, decreasing from 12.43 in 2018 to 6.71 in 2024, indicating reduced financial leverage and a lower dependency on debt. However, the LCI's interest cover ratio, which measures a company's ability to pay interest on debt, fell sharply from 13.26 in 2022 to 5.67 in 2024.

Future outlook

Despite ongoing challenges, the company is well-positioned to navigate future uncertainties due to its strong balance sheet and diversified portfolio. Furthermore, strategic growth initiatives and optimal capital allocation are underway, and the company regularly conducts strategic reviews to mitigate potential adverse impacts. The company will continue to focus on additional revenue streams, optimising operating costs and maximising shareholder returns for a resilient future.

Company profile

LCI is a public limited company engaged in five diverse businesses, including polyester, soda ash, chemicals and agri sciences, pharmaceuticals and animal health.

Credit: INP-WealthPk