INP-WealthPk

Ayesha Mudassar

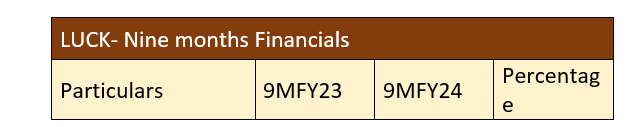

The net sales of Lucky Cement Limited (LUCK) grew by 24%, the gross profit by 57%, and the net profit by 67% during the nine months (July-March) of the ongoing fiscal year 2023-24, compared to the corresponding period of last year, according to WealthPK. In 9MFY24, the company made net sales of Rs87.4 billion and a gross profit of Rs29.7 billion. The net profit stood at Rs18.6 billion compared to Rs11.1 billion in the corresponding period last year, resulting in the earnings per share (EPS) of Rs62.43 versus Rs34.73 in the same period of the previous year. The improved performance was primarily due to the company’s strong focus on cost optimisation, risk management, and innovation to deliver sustainable value for the stakeholders.

(Amounts in thousands except for earnings per share)

Going by the income statement, the company’s cost of sales increased by 12% year-on-year (YoY) to Rs57.6 billion compared to Rs51.3 billion in 9MFY23. In addition, the gross margins improved to 34% as compared to 27% in 9MFY23.

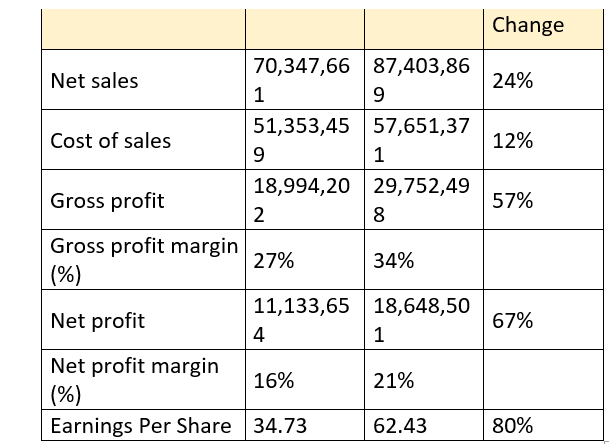

Quarterly financials

In comparison to the third quarter of FY23, Lucky Cement increased its revenues from Rs25.01 billion to Rs27.5 billion in 3QFY24, representing a growth of 10%. The gross profit of Rs6.4 billion in 3QFY23 increased by 23% in 3QFY24. Furthermore, the company reported a net profit of Rs4.9 billion in 3QFY24, which signifies improvement in profitability, with a percentage change of 23%.

Gross margins in 3QFY24 settled at 29% compared to 26%, indicating that the company’s cost of sales increased less relative to its sales. The net profit margin increased from 16% in 3QFY23 to 18% in 3QFY24, portraying that the company managed to control its expenses more effectively, leading to a higher margin of profit.

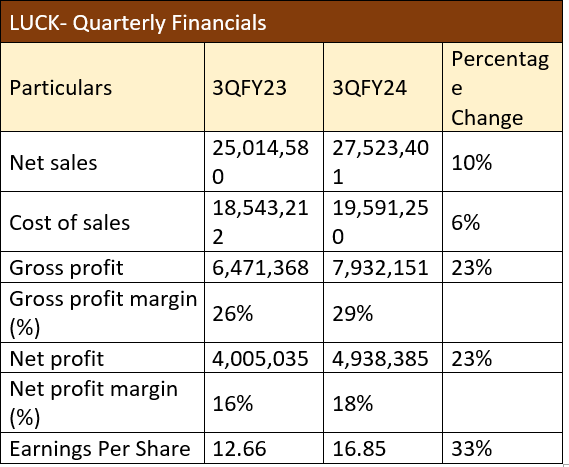

Sectoral financials- 9MFY23 vs 9MFY24

The cement sector recorded a 12% YoY growth in net profits, which clocked in at Rs85.9 billion against Rs76.9 billion in the same period of last fiscal year. Likewise, the sector's gross profit grew by 24% during the nine months of FY24. As per the results compiled by WealthPK from the income statements of the 11 PSX-listed cement companies, the sector saw an increase of 10% in its net sales, worth Rs383.7 billion as compared to Rs347.3 billion in 9MFY23.

The compiled sector includes Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL). According to the Monthly Economic Update and Outlook for April 2024, the total cement dispatches (domestic and exports) were 34.5 million tonnes (MT), which is 2.6% higher than the 33.6MT dispatched during the corresponding period of last year. The improved dispatches were mainly due to the sector's enhanced exports during the period under review. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. Moreover, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of last year, a rise of 44% YoY.

Company profile

Lucky Cement Limited was incorporated in Pakistan on September 18, 1993, under the Companies Ordinance, 1984 (now the Companies Act, 2017). The principal activity of the company is the manufacturing and marketing of cement.

Credit: INP-WealthPk