INP-WealthPk

Moaaz Manzoor

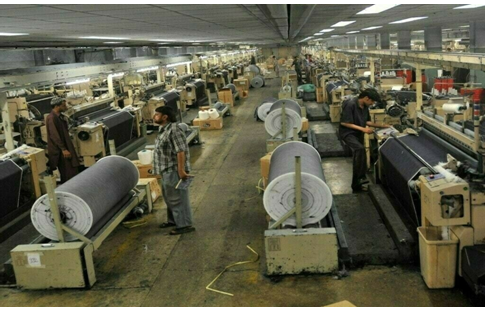

Prolonged contraction in large-scale manufacturing (LSM) highlights deep-rooted structural weaknesses in the economy, with the recovery remaining elusive despite macroeconomic stabilization, reports WealthPK. The sector recorded a decline of 1.8% in the first seven months of FY25, reflecting continued sluggishness. While inflation has eased and the current account position has improved, the industrial output remains constrained by high borrowing costs and a subdued demand.

Speaking with WealthPK, Rao Asad, economist and financial analyst at the Federation of Pakistan Chambers of Commerce & Industry (FPCCI), pointed out that LSM showed a negative trend, with December alone witnessing a contraction of 3.7%. He noted that a similar deceleration in agricultural growth — from 8.1% in Q1FY24 to just 1.2% in the same period this year — had further dampened the GDP growth, bringing it below 1% in Q1FY25.

“While indicators such as the current account, inflation, and exchange rate appear stable, they have not translated into a broader economic growth,” he observed. He said the monetary policy rate remains well above the equilibrium level, which might be necessary in the short term but continues to hinder industrial activity. Furthermore, 12 out of 22 sub-sectors have yet to recover to their base index values from nearly a decade ago, underscoring long-term stagnation in the industrial output. Without substantial policy interventions, some industries may never fully regain the lost ground, he added.

Ahmad Mobeen, Senior Economist at S&P Global Market Intelligence, emphasized that the broader economic trajectory remains fragile despite some signs of stabilization. “Large-scale manufacturing contracted 1.9% year-on-year in H1FY25, and the industrial production is expected to recover only gradually,” he said.

The projections suggest an expansion of 5.2% in 2025, though lingering uncertainties in global trade and domestic investment sentiment pose risks to sustained growth. While inflation hit a low of 1.5% in February, largely due to the base effects, it is expected to rise in the coming months, particularly in response to the seasonal factors.

The S&P Global Market Intelligence projects GDP growth at 2.9% for 2025, falling short of the National Economic Committee’s 3.6% target, with a gradual recovery to 3.7% in 2026 and 4.3% over the 2026-29 period. However, persistent industrial stagnation and weak investment remain significant challenges.

Despite some optimistic projections, the LSM sector’s continued contraction reflects a deeper structural malaise rather than a temporary slowdown. Policymakers face the challenge of balancing monetary prudence with growth imperatives, as maintaining excessively high interest rates may ultimately weigh down the industrial recovery. Addressing supply-side constraints and fostering an investment-friendly environment will ensure a sustainable economic expansion.

Credit: INP-WealthPk