INP-WealthPk

Naveed Ahmed

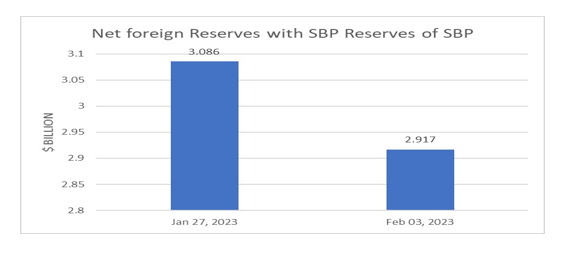

The State Bank of Pakistan (SBP) has rejected the notion that capping of the dollar price has resulted in a decline of $3 billion in remittances and exports, reports WealthPK. According to the SBP, most of Pakistan’s primary trading partners are experiencing monetary tightening, which resulted in lower export demand in the international market. Moreover, the net foreign reserves of the country decreased to $2.917 billion on February 3, 2022, from $3.086 billion on January 27, 2023. The fall in foreign currency reserves is also a result of the anticipated external repayment.

According to the Pakistan Bureau of Statistics, the current level of official reserves can cover imports of 18 days. The foreign currency reserves of a central bank should be adequate to cover imports for at least three months.

A document released by SBP explains that global monetary tightening is the main reason behind this scenario.

The US Federal Funds rate has grown from 0.25% to 4.5%, suggesting a perceptible tightening of monetary policy globally. The document, available with WealthPK, indicates that rising inflation in the industrialised world affected the purchasing power of consumers. As a result, remittances were progressively dropping after reaching a record level of $3.1 billion in April 2022 due to Eid-related flows.

However, greater inflation in developed countries led to a higher cost of living abroad and overseas Pakistanis were unable to send more remittances to strengthen the national economy. Moreover, internal factors such as the devastating floods and the subsequent supply outages have severely impacted Pakistan’s exports.

According to the SBP, foreign currency outflow has also been restarted due to increased travelling of Pakistanis abroad after the lifting of the Covid-19 restrictions. The easing of travel restrictions caused the outflow of foreign capital from Pakistan.

During the week ending on August 27, 2021, the central bank’s foreign currency reserves reached an all-time high of $20.146 billion. However, the reserves have now fallen by $17.229 billion.

By February 3, 2023, Pakistan’s total liquid fixed foreign currency reserves decreased to $8.54 billion, down $202 million from the previous week’s $8.742 billion.

Moreover, the foreign currency reserves of commercial banks also declined by $33 million, from $5.656 billion on January 27, 2023, to $5.62 billion in the week ending on February 3, 2023.

These circumstances prevail due to several external factors outside the control of SBP. The central bank rejected the notion that the relatively stable exchange rate caused the decline in exports. It would be inaccurate to blame the capping of the dollar price for the decline in Pakistan’s exports and remittances, according to the document available with WealthPK.

Credit: Independent News Pakistan-WealthPk