INP-WealthPk

Muneeb ur Rehman

The manufacturing sector is the mainstay of Pakistan’s economy, but the economic downturn has a bearing on its performance, resulting in sluggish growth due to lack of liquidity, high production costs and restrictions on import of raw material. The government’s excessive borrowing from banks to finance its budget and fiscal deficits has also crowded out the private sector with banks finding it safe to park their money in government treasuries. Commercial borrowers find it highly risky to extend credits to the private sector with record high interest rates, which might lead the private sector to default on loan repayments.

Speaking to WealthPK, Faizan Iftikhar, a research economist at Applied Economics Research Centre (AERC), Karachi, said the robust credit disbursements by financial institutions always helped the manufacturing sector achieve high levels of growth. “However, bank loans to private businesses, especially those in the manufacturing sector, are plummeting.”

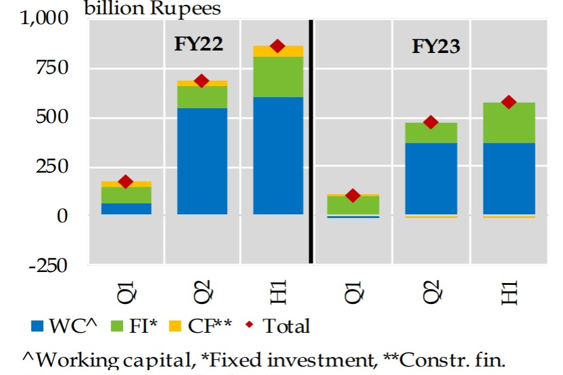

He said worsening macroeconomic conditions were affecting business confidence, which leads bank not to take any risk by extending loans to the private sector. “The slowdown of aggregate demand in the economy is also causing recessionary trends in the manufacturing sector.” According to the State Bank of Pakistan’s biannual report for the fiscal year 2022-23, credit to private businesses has reduced significantly.

![]()

During the first half of the previous fiscal year, the growth rate of credit to businesses was 15.1%, which has dwindled to 8.3% so far this fiscal.

Source: State Bank of Pakistan

Faizan Iftikhar also mentioned the impact of high interest rate on the demand for credit by the manufacturing sector. “The massive increase in the interest rate at the directions of the International Monetary Fund has acted as a discouraging factor. The interest rate at such levels leads to higher costs of production.”

He said the unprecedented inflation had also led to a reduction in the demand for goods. He said providing a support base to the manufacturing sector through credit facilities was imperative for growth and employment generation.

According to Pakistan Bureau of Statistics, the share of the manufacturing sector in the gross domestic product is almost 12%. The manufacturing sector has the potential to further increase exports base, create jobs, and contribute to tax revenue, if the government provides an enabling environment to it.

Credit: Independent News Pakistan-WealthPk