INP-WealthPk

Shams ul Nisa

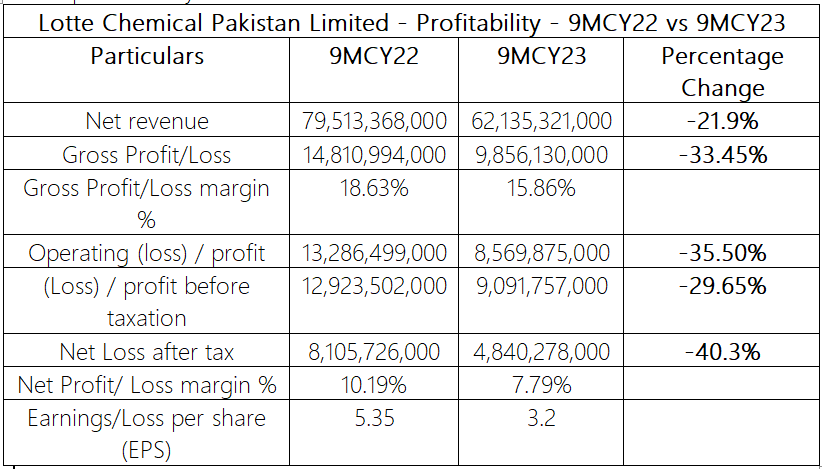

Lotte Chemical Pakistan Limited reported a decline of 21.9% in net revenue to Rs62.13 billion in the ninth month ending in September 2023 compared to Rs79.51 billion registered in the same period last year, reports WealthPK. According to the financial results, the gross profit fell 33.45% to Rs9.856 billion during 9MCY23 compared to Rs14.81 billion in 9MCY22. Consequently, the gross profit margin dropped to 15.86% in 9MCY23 from 18.63% in the same period last year.

The company also witnessed a major contraction of Rs8.569 billion in the operating profit during 9MCY23 compared to Rs13.28 billion in 9MCY22, posting a significant decline of 35.50%. At the end of 9MCY23, the profit before tax settled at Rs9.09 billion, a 29.65% reduction from Rs12.92 billion announced in 9MCY22. Similarly, the overall profitability plunged by 40.3% to Rs4.84 billion in 9MCY23 compared to Rs8.10 billion in the same period last year. During 9MCY23, the net profit margin decreased to 7.79% from 10.19% in the same period last year. The earnings per share fell to Rs3.2 in 9MCY23 from Rs5.35 in 9MCY22.

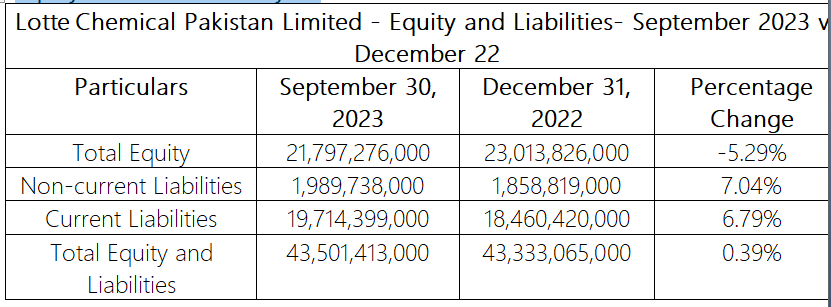

Equity and Liabilities Analysis

As of September 30, 2023, the company’s total equity stood at Rs21.79 billion compared to Rs23.01 billion on 31, December 2022, posting a contraction of 5.29%. Lotte Chemical Pakistan Limited’s current and non-current liabilities showed a significant growth of 6.79% and 7.04%, respectively. This indicates that the company has taken additional short and long-term liabilities to finance its expansion activities during the period under consideration. The total equity and liabilities magnified slightly by 0.39%, from Rs43.33 billion on 31st December 2022 to Rs43.5 billion on 30th September 2023.

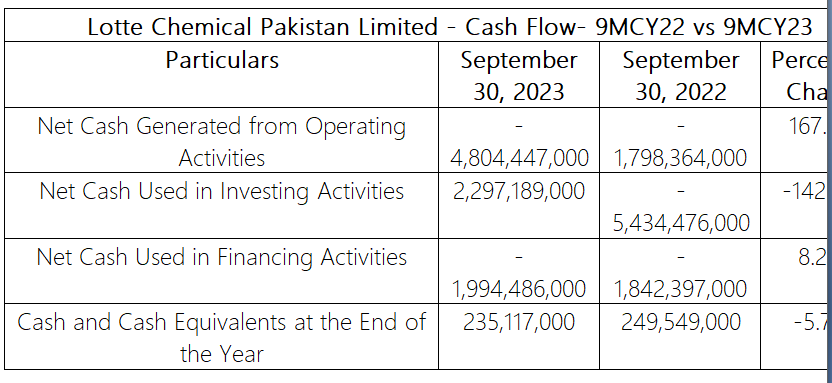

Cash Flow Analysis

During 9MCY23, the company focused on its core operational activities, as the net cash used in operating activities surged 167.16% to Rs4.8 billion from Rs1.798 billion used in the same period last year. As the company has invested in incorporating subsidiaries and other investment projects, the net cash generated from investing activities witnessed a positive hike to Rs2.297 billion in 9MCY23 compared to Rs5.43 billion net cash used in investing activities last year.

However, it is worth noting that Rs1.994billion cash was used for financing activities during September 2023, compared to Rs1.84 billion used in 1HCY22, a hike of 8.25%.The cash used indicates that the company has paid off more debt during this period, rather than investing. So, the cash at the end of the period dropped to Rs235.1 million on September 2023 from Rs249.54 million on September 2022.

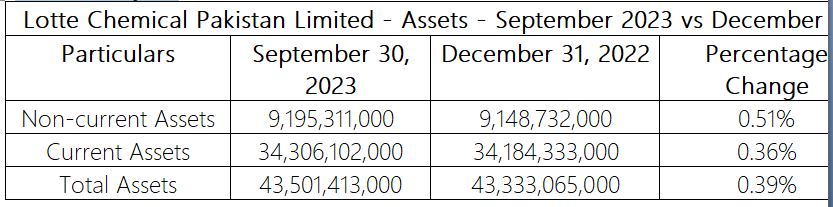

Assets Analysis

Lotte Chemical Pakistan Limited has invested in new subsidiaries and thus its non-current assets moved up to Rs9.195 billion on September 31, 2023, from Rs9.148 billion at the end of December 2022. Similarly, the company’s current assets grew slightly by 0.36% during the period under consideration. This increase in current and non-current assets leads to a marginal growth of 0.39% in total assets.

Credit: INP-WealthPk