INP-WealthPk

Shams ul Nisa

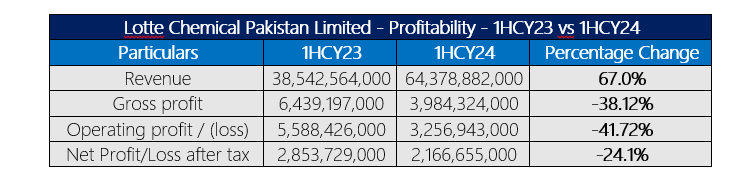

Lotte Chemical saw a 67.0% revenue hike in 1HCY24 to Rs64.3 billion, driven by the higher volume sold. However, the company reported a 38.12% decrease in gross profit from Rs6.44 billion to Rs3.98 billion in 1HCY24, mainly due to the higher cost of sales driven by a significant increase in gas prices, reports WealthPK.

The operating profit declined by 41.72% to Rs3.2 billion during the review period, caused by increased operating expenses that the company couldn't offset with higher revenues. Thus, the net profit after tax slipped by 24.1%, from Rs2.85 billion in 1HCY23 to Rs2.17 billion in 1HCY24.

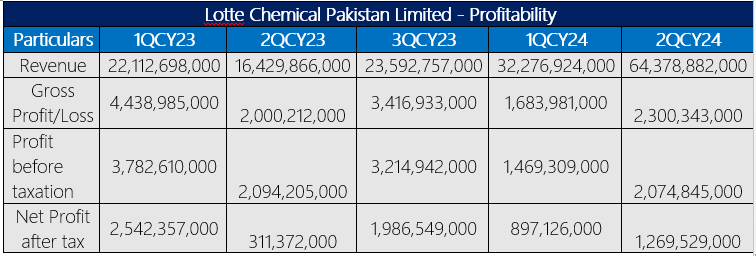

Quarterly Analysis

Lotte Chemical experienced a significant revenue growth from Rs22.11 billion in 1QCY23 to Rs64.38 billion by 2QCY24. However, the company's gross profit exhibited volatility, decreasing from Rs4.44 billion in 1QCY23 to Rs2.00 billion in 2QCY23, before recovering to Rs2.30 billion in 2QCY24. The company's profitability fluctuated due to the increased costs and competitive pricing pressures, resulting in a significant drop in gross profit during 2QCY23. The company's profit before taxation also reflected a downward trend, declining from Rs3.78 billion in 1QCY23 to Rs1.47 billion in 1QCY24. In 2QCY24, it stood at Rs2.07 billion. Similarly, the net profit shrank from Rs2.54 billion in 1QCY23 to Rs1.2 billion in 2QCY24.

Chemical sector

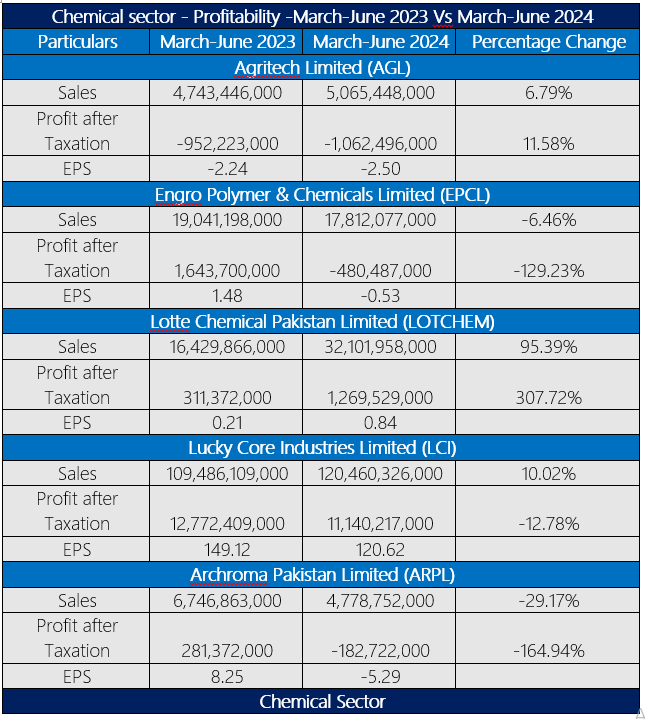

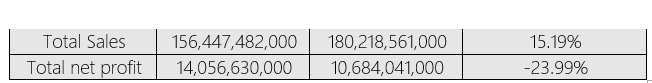

The chemical sector saw a 15.19% sales increase from Rs156.45 billion in March-June 2023 to Rs180.22 billion in March-June 2024, indicating that the companies in the sector are effectively capitalizing on the market opportunities. However, the sector's total net profit declined by 23.99%, indicating significant challenges in converting revenue into profit, mainly due to the high costs. Lotte Chemical Pakistan Limited emerged as the highest performer in the sector, with a growth of 95.39% in sales and a substantial increase in net profit by 307.72%. Likewise, Agritech Limited had a moderate growth in sales and net profit by 6.79% and 11.58%, respectively, whereas, Lucky Core Industries Limited sales widened by 10.02% but the net profit plunged by 12.78%. However, Engro Polymer & Chemicals Limited and Archroma Pakistan Limited suffered net losses of Rs480.4 million and Rs182.7 million, respectively. Thus, the EPCL and ARPL experienced a 6.46% and 29.17% decrease in sales.

Future Outlook

The Crude Oil (WTI) market is expected to rise due to the Middle East conflict threats, US interest rate cuts, and hurricane season supply disruptions. Paraxylene (PX) prices are expected to follow upstream energy prices in the next quarter, but may face pressure due to product diversion into the gasoline pool. The PTA market is expected to see a higher short-term demand ahead of holiday season demand from the West. The domestic polyester industry operations are expected to taper off, with manufacturers lamenting the rising energy prices and additional taxes. The government’s efforts to redefine the regulatory measures and lower the interest rates may help the domestic manufacturing industry.

Company profile

Lotte Chemical Pakistan Limited was established in Pakistan on 30 May, in 1998. The core activity of the chemical company is to manufacture and sell Pure Terephthalic Acid (PTA).

Credit: INP-WealthPk