INP-WealthPk

Muhammad Asad Tahir Bhawana

The household appliances sector is an organised segment in Pakistan, which has immense potential to grow if complete manufacturing of units is ensured. The local industry has still not developed to the level to manufacture complete units locally. Many components of electronic appliances are imported and then assembled domestically. Complete localisation of the sector will help the industry to boost its export earnings.

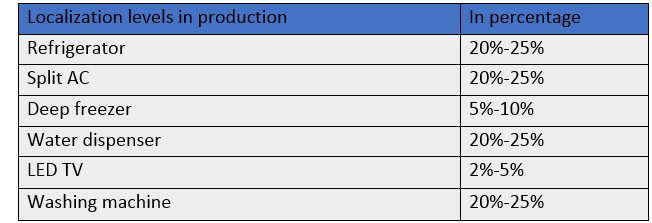

As shown in the adjacent table, localisation is very low in most major household appliance markets. Several major components such as the evaporator and condenser for refrigerators and freezers and the fan blade for split air conditioners are imported and then assembled locally. Additionally, the level of localisation is low in the small appliances market as well.

The small appliances market, specifically kitchen appliances, has a higher level of competition than the major appliances market due to the presence of several players in this market segment, including Geepas, Kenwood, Super Asia, and Homage. The household appliance sector’s estimated size was recorded at Rs688 billion in calendar year 2022 compared to Rs511 in CY21, showing an increase of 35% on a year-on-year (YoY) basis.

This positive growth can be attributed to an increase in prices, despite an obvious 16% decline in production and a corresponding decrease in sales volume. However, mounting inflationary pressures began to affect economic productivity and growth in the first half of FY23, indicated by a negative large-scale manufacturing (LSM) growth of 4%. Economic conditions and slower growth in gross domestic product (GDP) were reflected in per capita income growth of only 4% in 1HFY23. A slowdown in economic growth led to a steep drop in electrical equipment production by 22% compared to the corresponding period of last year, reflecting a reversal in demand pressures during FY21 and FY22.

Local and international companies dominate Pakistan's household appliance market, including PEL, Arcelik (Dawlance), Orient, Haier, and Waves Singer. A majority of these brands dominate the major appliance market, while other Chinese and local brands (Geepas, etc.) have a fair share of the small appliance market. In addition to focusing on just one or two products, certain players are also looking to expand their product lineups.

Some major players, such as Dawlance, Haier, and Samsung, have international associations and shareholdings, which help them to be more effective in the local market as well. PEL and Waves Singer are among the local players listed on the PSX (Pakistan Stock Exchange), reflecting the market's organised structure. Several of these companies have also entered into joint ventures with renowned international players.

Further, the household appliance market has been dominated by well-recognised brands and needs extensive capital investment, therefore, the barriers to entry into the market are high. The household appliances industry is set to have an optimistic future if complete localisation is realized.

Credit: Independent News Pakistan-WealthPk