INP-WealthPk

Muneeb ur Rehman

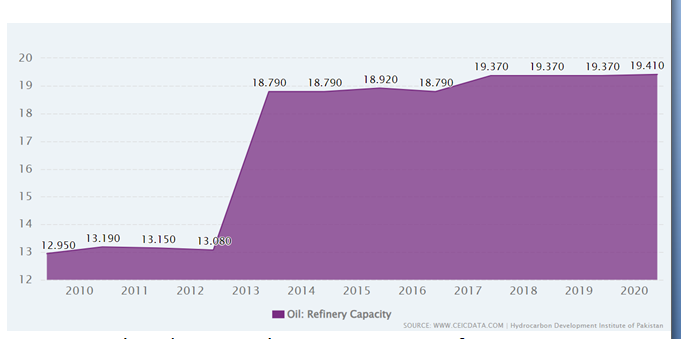

The limited capacity of companies to refine crude oil continues to hinder Pakistan’s quest for self-sufficiency in energy, necessitating import of a substantial quantity of refined oil that could otherwise be domestically refined, Muhammad Riaz Khan, former MD Oil and Gas Development Company Limited (OGDCL), told WealthPK. He said Pakistan remained net importer of refined oil due to low capacity of domestic refineries to process crude oil. Pakistan's refining capacity stands at 19.4 million tons annually. The full utilization is hindered by factors such as lack of upgradation, as well as technical and financial limitations.

Source: Hydrocarbon Development Institute of Pakistan

Riaz said with an annual production of 4.6 million metric tons of crude oil, Pakistan could only fulfil 20% of its total petroleum needs. “To cover the remaining 80%, the country relies on import of crude oil and refined petroleum products, incurring an annual expenditure of approximately $15 to $16 billion. “The refinery companies often struggle with outdated technology and limited access to modern, cost-effective refining methods. Many refineries in Pakistan have outdated equipment and technology, making them less efficient and environment- friendly,” he added.

He highlighted some of the bottlenecks discouraging foreign direct investment in the refining sector. “The refinery projects in Pakistan are subject to cumbersome processes of paperwork before approval. Simplifying the regulatory approval processes for refinery projects, including environmental clearances, land acquisition, and permits, is important. Reducing bureaucratic hurdles can make investment more attractive to potential investors”. The OGDCL ex-MD suggested the government provide tax incentives and grants for oil refinery projects focusing on capacity expansion, technological upgradation, and environmental compliance.

The success stories of East Asian countries, in his view, have takeaways for Pakistan. “Many East Asian countries have facilitated collaboration between the public and private sector. Government policies, tax incentives, and regulations are encouraging the private sector participation in refinery projects. This has attracted significant investment and expertise, leading to capacity upgradation in these countries”.

With the Pakistan-Saudi Arabia agreement to build another refinery in the Gwadar district of Balochistan, the prospects are high to invite more foreign investment in oil refineries, he hoped. In a nutshell, improvements in the refining capacity of the companies in Pakistan can cater to the domestic demand for refined oil besides easing the pressure on import bills.

Credit: INP-WealthPk