INP-WealthPk

Shams ul Nisa

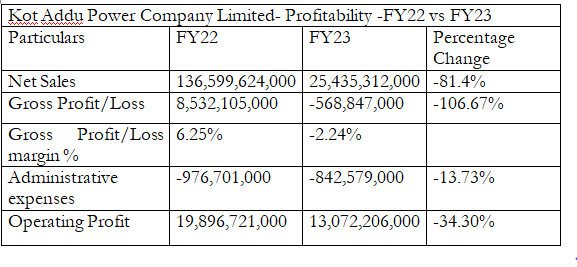

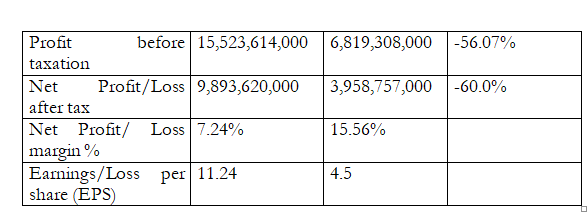

Kot Addu Power Company Limited (KAPCO) announced its financial results for the fiscal year ended June 30, 2023, posting a notable decline in net sales and profitability compared to FY22.According to the company’s results, it posted net sales of only Rs25.4 billion in FY23, which was 81.4% lower than Rs136.59 billion in FY22. The company limited its sales due to the Power Purchase Agreement (PPA) expiry on Oct 24, 2022. This resulted in a gross loss of Rs568.8 million in FY23 compared to a gross profit of Rs8.5 billion in FY22. The company attributed this loss to a rise in costs because of the addition of plant insurance and fixed expenses. The company also observed a hike in contributions to the Worker Participation Fund (WPF) and Workers Welfare Fund (WWF) and kept human resources despite the expiry of the PPA.

As a result, the company witnessed a gross loss margin of 2.24% in FY23 compared to gross profit margin of 6.25% in FY22. The administrative expenses were reduced to Rs842.5 million in FY23, which is 13.73% lower than Rs976.7 million in FY22. This resulted in a significant decline in operating profit by 34.30% from Rs19.89 billion in FY22 to Rs13.07 billion in FY23. The company’s profit-before-tax plunged to Rs6.8 billion in FY23 from Rs15.5 billion in FY22, resulting in a notable decline of 56.07%. During FY23, the effective tax rate stood at 42% because of the rise in super tax by the government. Hence, KAPCO reported profitability of Rs3.95 billion in FY23, which is 60% lower than Rs9.89 billion in FY22. Therefore, the earnings per share (EPS) stood at Rs4.5 in FY23 compared to Rs11.24 in FY22.

Historical analysis

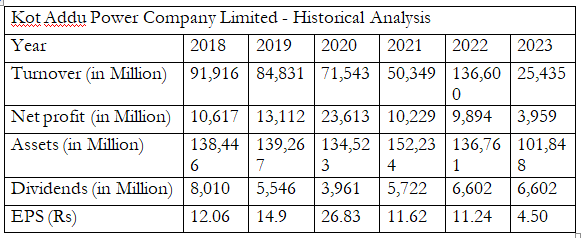

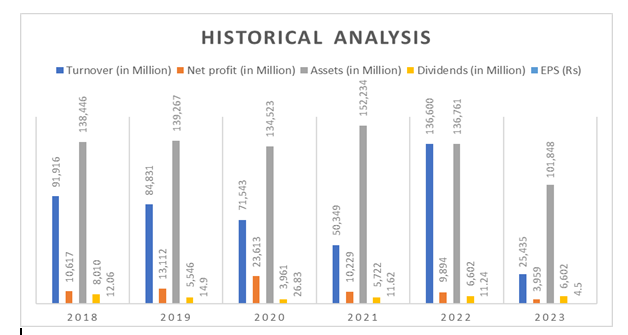

The company’s turnover decreased from Rs91.9 billion in 2018 to Rs50.3 billion in 2021. However, in 2022 the company achieved a remarkable turnover of Rs136.6 billion, which fell significantly to Rs25.4 billion in 2023.

The company’s net profit, however, exhibited an increasing trend from Rs10.6 billion in 2018 to the highest of Rs23.6 billion in 2020. In the subsequent years, the profit decreased gradually from Rs10.2 billion in 2021 to Rs9.89 billion in 2022, and to the lowest of Rs3.9 billion in 2023.

The company’s assets decreased from Rs138.4 billion in 2018 to the lowest of Rs101.8 billion in 2023. The highest assets of Rs152.2 billion were recorded in 2021. Similarly, the dividends fell overall from Rs8.01 billion in 2018 to Rs6.6 billion in 2023. KAPCO’s EPS varied over the period from Rs12.06 in 2018 to Rs4.50 in 2023. The highest EPS of Rs26.83 was recorded in 2020.

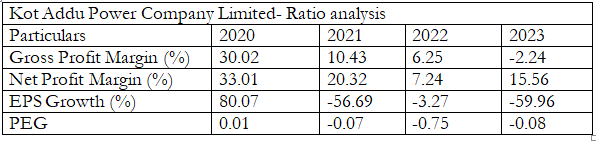

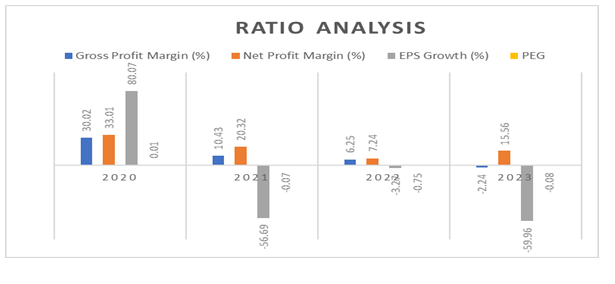

Ratio analysis

KAPCO observed a decreasing trend in gross profit margin from 2020 to 2023. The company recorded a gross profit margin of 30.02% in 2020, 10.43% in 2021 and 6.25% in 2022, but a gross loss margin of 2.24% in 2023. The net profit margin followed a fluctuating trend as it decreased from 33.01% in 2020 to 7.24% in 2022, but increased to 15.56% in 2023.

The company’s EPS growth remained negative in 2021, 2022 and 2023 with values of 56.69%, 3.27%, and 59.96%, respectively. However, the company observed positive EPS growth of 80.07% in 2020. A similar trend was followed by price/earnings-to-growth, with a positive value of 0.01 in 2020 and negative values of 0.07 in 2021, 0.75 in 2022, and 0.08 in 2023.

Company’s profile

KAPCO was established in Pakistan on April 25, 1996, by Pakistan Water and Power Development Authority (Wapda). The company’s core activities include the ownership, operation and maintenance of a power plant in Kot Addu, Punjab, which is the largest in Pakistan with 10 multi-fuel gas turbines and five steam turbines. The company sells its electricity to Central Power Purchasing Agency (Guarantee) Limited.