INP-WealthPk

Shams ul Nisa

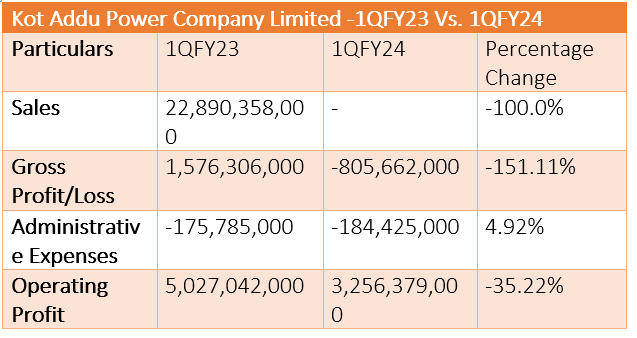

Kot Addu Power Company Limited's (KAPCO) net profit dropped to Rs1.18 billion in the first quarter of the ongoing fiscal year 2023-24 (1QFY24) from Rs2.109 billion in the same period of FY23, posting a 44% decline. According to the company's financials, the main reason behind this reduction is the firm made no sales during the period. The power generation and distribution company observed a gross loss of Rs805.6 million in 1QFY24 compared to a gross profit of Rs1.57 billion in 1QFY23. During the period under review, the company's administrative expenses widened by 4.92% to Rs184.4 million.

In 1QFY24, operating profit fell 35.22% to Rs3.25 billion from Rs5.027 billion in the same period last year. Profit-before-tax dropped to Rs1.93 billion from Rs3.14 billion in 1QFY23. The company paid a 27.28% lower tax (Rs755.6 million) in 1QFY24 compared to Rs1.03 billion in the same quarter of the previous year. The earnings per share stood at Rs1.34 in 1QFY24 compared to Rs2.4 in 1QFY23.

Historical trend analysis

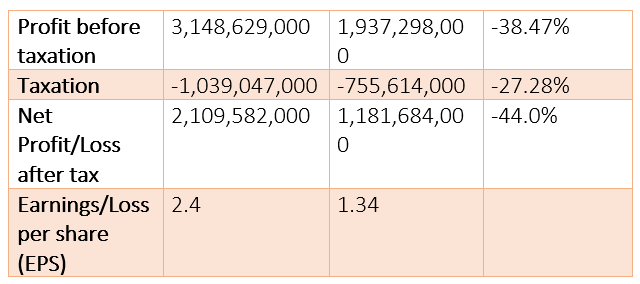

A significant decrease has been witnessed in the company's total turnover between 2018 and 2023. The turnover fell to Rs50.3 billion in 2021 from Rs91.9 billion in 2018. Nevertheless, the company posted an impressive turnover of Rs136.6 billion in 2022, but it plunged to Rs25.4 billion in 2023.

![]()

The net profit exhibited an increasing trend from Rs10.6 billion in 2018 to the highest of Rs23.6 billion in 2020. However, it decreased gradually from Rs10.2 billion in 2021 to Rs9.89 billion in 2022 and to the lowest of Rs3.9 billion in 2023. KAPCO's earnings per share varied from Rs12.06 in 2018 to Rs4.50 in 2023, reflecting a reduction in the company's profitability on each share. During six years, the company witnessed the highest EPS of Rs26.83 in 2020.

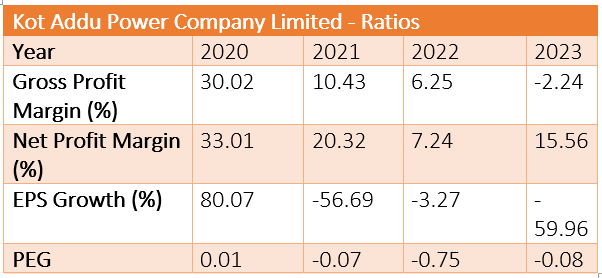

Ratios analysis

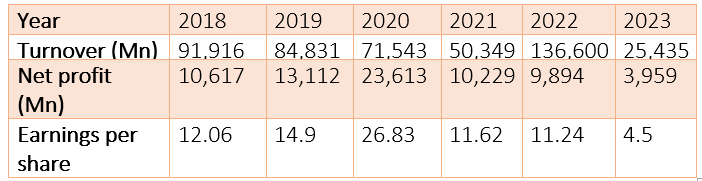

KAPCO observed a decreasing trend in gross profit margin from 2020 to 2023. The company recorded a gross profit margin of 30.02% in 2020, 10.43% in 2021, 6.25% in 2022, and -2.24% in 2023. This reflects the company's revenue generation continued to dip compared to the cost of production during this period. The net profit margin fluctuated as it decreased from 33.01% in 2020 to 7.24% in 2022, but improved to 15.56% in 2023.

The company's earnings per share growth remained negative in 2021, 2022 and 2023, with values of 56.69%, 3.27%, and 59.96%, respectively. However, only in 2020, the company observed positive earnings per share growth of 80.7%. A similar trend was followed by the price earnings-to-growth ratio, with a positive value of 0.01 in 2020 and negative values of 0.07 in 2021, 0.75 in 2022, and 0.08 in 2023.

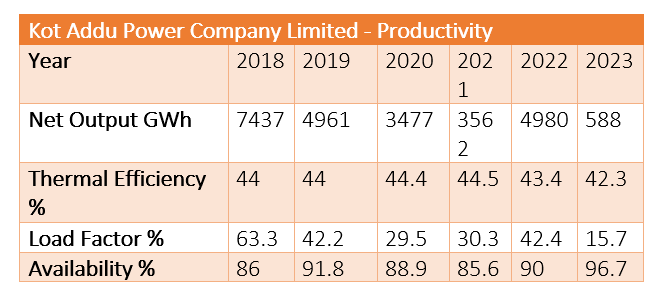

Productivity analysis

The productivity trend of the company showed that it generated a total of 7,437GWh of electricity in 2018 with a 44% thermal efficiency. During the period, the company observed a load factor of 63.3% and an overall availability of 86%.

In 2019 and 2020, the net output contracted to 4,961GWh and 3,477GWh. Similarly, the load factor declined to 42.2% in 2019 and 29.5% in 2020. However, thermal efficiency remained at 44% in 2019 but improved marginally to 44.4% in 2020 and gradually reduced to 42.3% in 2023. In the case of availability, it improved significantly to 91.8% in 2019 but decreased to 88.9% in 2020. In 2021 and 2022, the net output and load factor increased but reduced to the lowest of 588GWh and 15.7% in 2023. However, availability kept on improving from 85.6% in 2021 to 96.7% in 2023.

Company profile

KAPCO was established in Pakistan on April 25, 1996, by the Pakistan Water and Power Development Authority (Wapda). The company's core activities include the ownership, operation and maintenance of a power plant. The company's power plant is the largest in Pakistan, with 10 multi-fuel gas turbines and five steam turbines. The company sells its electricity to Central Power Purchasing Agency (Guarantee) Limited.

Credit: INP-WealthPk