INP-WealthPk

Shams ul Nisa

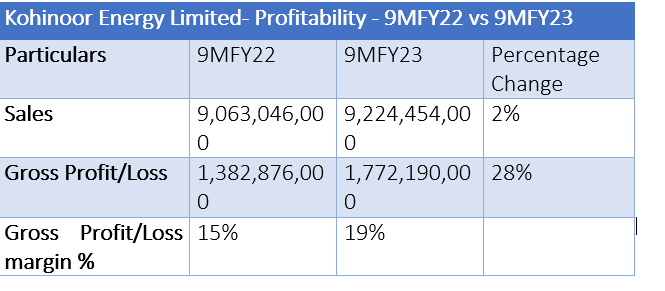

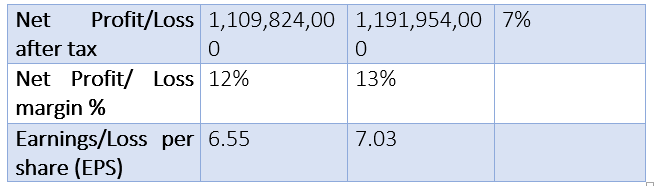

Kohinoor Energy Limited’s (KEL) sales, gross and net profits increased moderately in the first nine months of the previous fiscal year 2022-23 compared to the corresponding period of the earlier fiscal. The company’s sales inched up by 2%, net profit by 7% and gross profit by relatively 28% year-on-year, respectively, reports WealthPK. The sales increased to Rs9.22 billion in 9MFY23 from Rs9.06 billion in 9MFY22, showing that the company generated moderate revenue from its sales during this time.

The gross profit grew 28% to Rs1.7 billion in 9MFY23 from Rs1.3 billion in 9MFY22. The company showed improvement in managing its expenses and production process as it achieved a higher gross profit margin of 19% compared to a gross profit margin of 15% posted during the corresponding period of FY22.

The KEL’s net profit inched up to Rs1.19 billion in 9MFY23 from Rs1.10 billion in the corresponding period of year earlier. Therefore, the net profit margin slightly increased to 13% from 12% in 9MFY22. The company attributed the increase in the profits to the devaluation of rupee, improving fuel efficiency and increased capacity payments. The company’s earnings per share (EPS) stood at Rs7.03 in the nine months of FY23 compared to EPS of Rs6.55 during the corresponding period of FY22.

Assets Analysis

The non-current assets of Kohinoor Energy Limited witnessed a decline of 8.29% from June 2022 to March 2023. The company’s non-current assets pushed down to Rs2.4 billion in March 2023 from Rs2.6 billion in June 2022. This indicates the company reduced its long-term assets holdings during March 2023 as compared to June 2022. The current assets also dropped to Rs5.9 billion in March 2023 from Rs6.9 billion in June 2022, showcasing an overall fall of 13.58%. This shows a decrease in short-term asset holdings of the company. The reduction in both current and non-current assets led to fall in total assets. The total assets decreased by 12.10% as they shrank to Rs8.4 billion in March 2023 from Rs9.6 billion in June 2022.

Equity and liabilities analysis

Kohinoor Energy Limited posted a rise in capital and net profit as the capital and reserves of the company expanded by 8.74% between June 2022 and March 2023 as they extended to Rs5.3 billion in March 2023 from Rs4.9 billion in June 2022. This shows the company has increased its financial position by raising funds through external sources.

The company witnessed a reduction in its short-term obligations as the current liabilities dwindled 33.89% to Rs3.1 billion in March 2023 from Rs4.6 billion in June 2022, indicating that the KEL successfully paid off its debt obligations. The company’s total equity and liabilities also diminished by 12.10% as they dropped to Rs8.4 billion in March 2023 from Rs9.6 billion in June 2022.

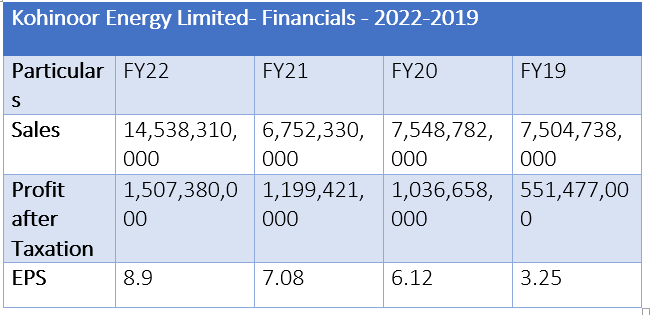

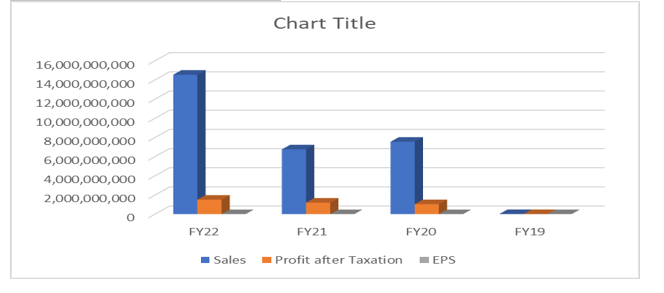

Analysis of financials over the years

Over the last four years, KEL recorded the highest sales of Rs14.5 billion in FY22 and the lowest sales of Rs6.7 billion in FY21. In between, the company’s sales stood at Rs7.54 billion in FY20 and at Rs7.50 billion in FY19. This indicates the company’s revenue more than doubled from FY19 to FY22, which can be attributed to the increase in production and well-managed sales strategies of the company.

Similarly, the highest after-tax profit was in FY22 at Rs1.5 billion, followed by Rs1.19 billion in FY21, Rs1.03 billion in FY20 and Rs551 million in FY19. This indicates the company is well organised in managing its costs and revenue. The maximum EPS was recorded at Rs8.9 in FY22, followed by Rs7.08 in FY21, Rs6.12 in FY20 and Rs3.25 in FY19.

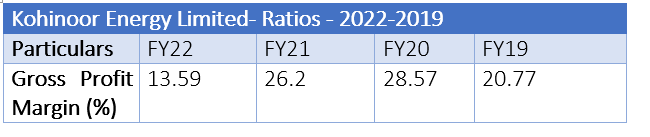

Analysis of ratios over the years

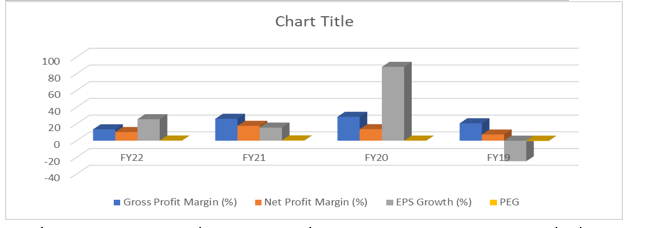

The company’s gross profit margin was the highest at 28.57% in FY20, whereas the lowest margin was 13.59% observed in FY22. In FY21, it was 26.2% and 20.77% in FY19. The lowest gross profit in FY22 indicates the higher costs of goods than the revenue it generated. The net profit margin showed fluctuations as it stood at 10.37%, 17.76%, 13.73% and 7.35% in FY22, FY21, FY20 and FY19, respectively, posting maximum net profit margin in FY21.

KEL’s earning per share growth percentage was recorded at -24.59% in FY19, the lowest among the four years, and 88.31% in FY20, the highest among the four years. The price/earnings to growth ratio (PEG) was observed negative 0.45 in FY19, while it remained positive at 0.17, 0.32 and 0.06 in FY22, FY21 and FY20, respectively.

Company profile

Kohinoor Energy was founded on April 26, 1994 as a public limited company under the now repealed Companies Ordinance, 1984. The company generates, distributes, sells and supplies electric power. Its sole customer is Water and Power Development Authority. It is located in Lahore and is jointly run by Saigols Group of Companies and Toyota Tsusho Corporation.

Credit: INP-WealthPk