INP-WealthPk

Jawad Ahmed

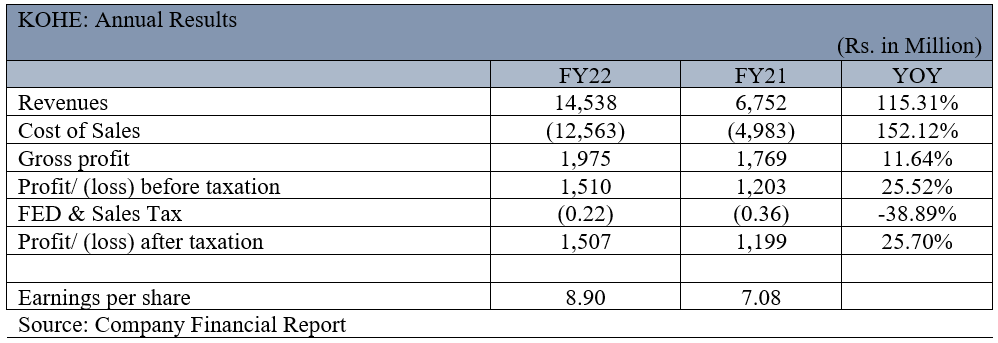

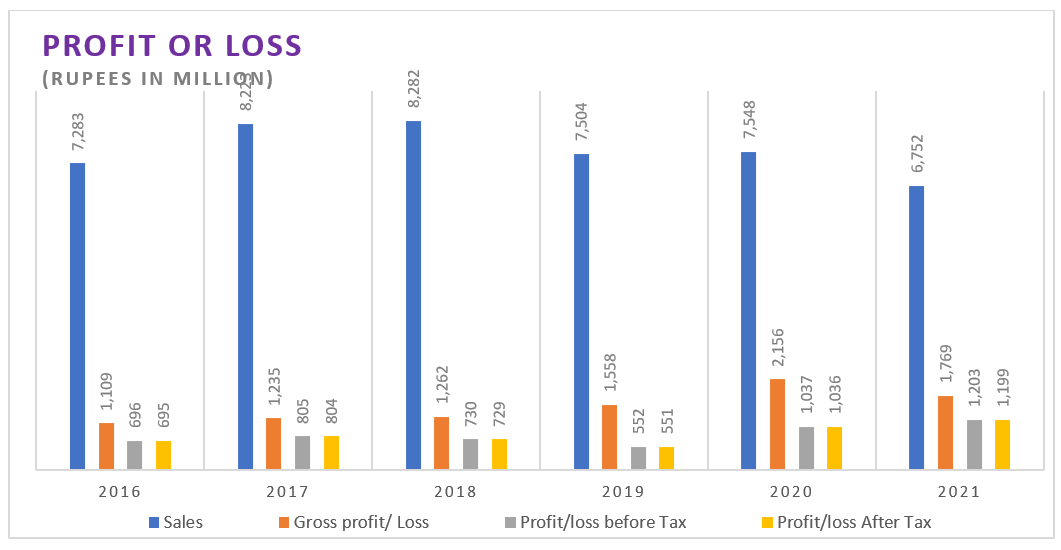

Kohinoor Energy Limited’s revenues increased over 115% to PKR14.538 billion in the financial year ended June 30, 2022 compared with Rs6.752 billion in the year 2021. The sales revenue during the fiscal year 21-22 increased both quantitatively and monetarily, reports WealthPK quoting the company’s financial stats.

The gross profit climbed 11.6% to Rs1.975 billion in 2022 from Rs1.769 billion in the previous year as a result of increase in revenue. The profit before tax for the year was Rs1.51 billion, up 25.5% from Rs1.20 billion in 2021.

The company’s net profitability rose 25.7% from Rs1.199 billion in FY21 to Rs1.507 billion in FY22. As a result of significant topline growth, the earnings per share (EPS) soared to Rs8.90 from Rs7.08 in the previous year.

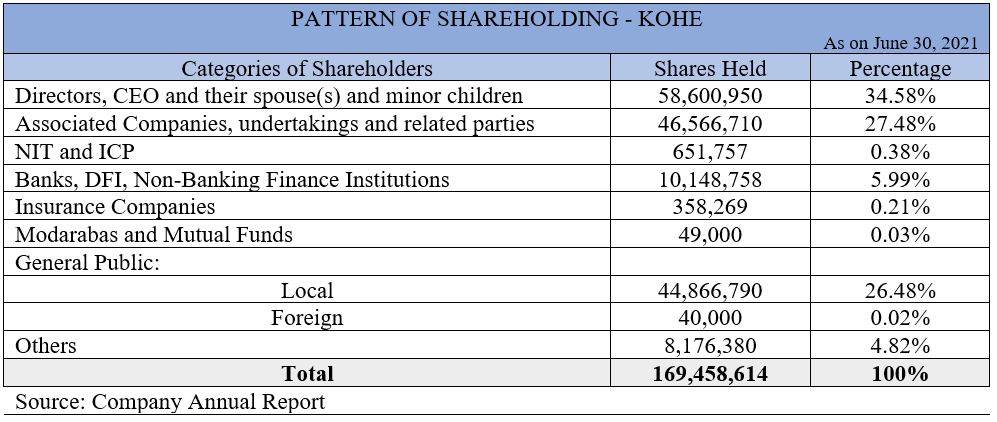

Shareholding pattern

As of June 30, 2021, the company’s directors, CEO and their spouse(s) and children owned 34.58% of the shares; associated companies, undertakings and related parties about 27.48%; general public (local) investors 26.48%; banks, DFI, and non-banking financial institutions 5.99%; others 4.82%; and insurance companies, modarabas and mutual funds collectively less than 1%.

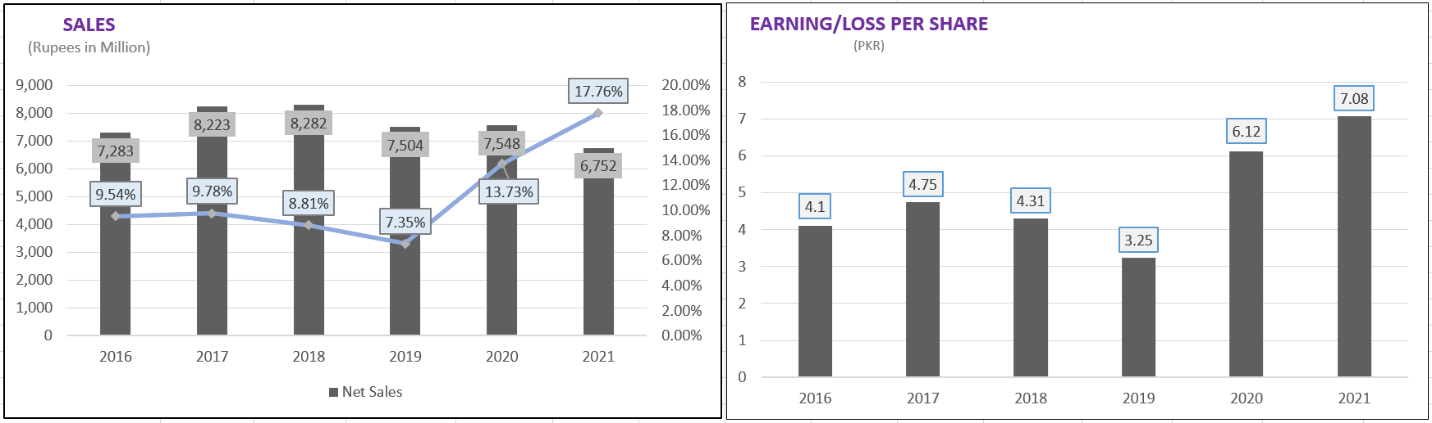

Historical performance

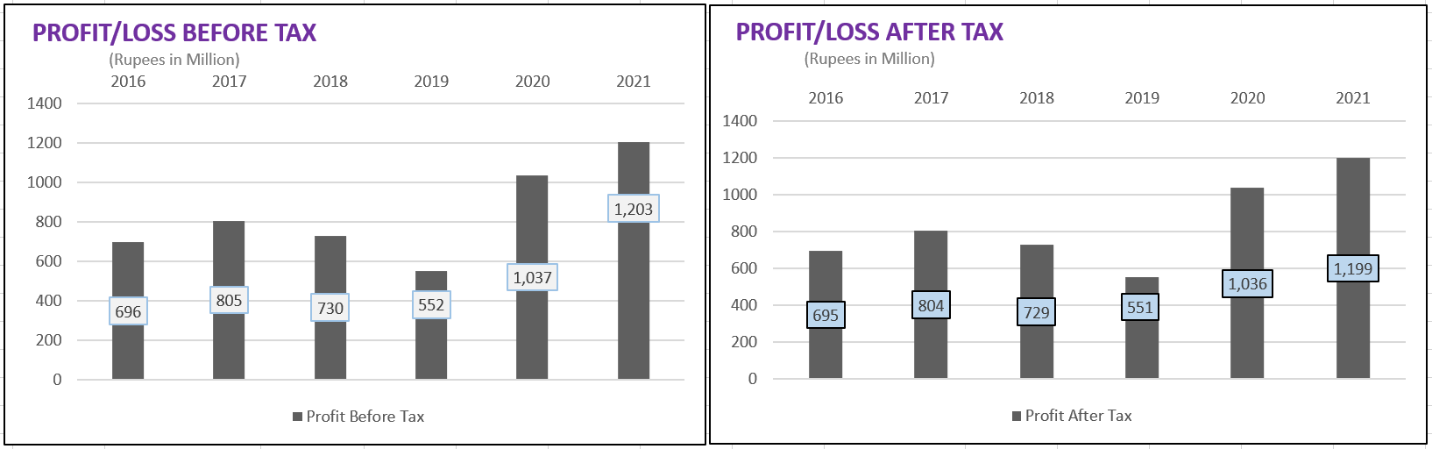

In 2018, sales for the company totaled Rs8.282 billion, a small increase from Rs8.223 billion in 2017. The gross profit also saw a very slight gain, rising to Rs1.262 billion from Rs1.235 billion in a year before. While the profit-after-tax decreased by 9.33% to Rs729 million from Rs804 million in 2017.

In 2019, the sales decreased by 9.39% to Rs7.504 billion from Rs8.282 billion the year before. The company's gross profit margin increased from Rs1.262 billion in the previous year to Rs1.558 billion in 2019.

The net profit fell by 24.42% to Rs551 million in 2019 from Rs729 million in 2018. As a result of decreased profit, the EPS decreased from Rs4.31 in the previous year to Rs3.25.

The yearly revenue climbed less than 1 percent from Rs7.504 billion in 2019 to Rs7.548 billion in 2020. The gross profit increased by 38.4% from Rs1.558 billion in 2019 to Rs2.156 billion in 2020. As a result, the company's earnings after taxes improved as well, going from Rs551 million in 2019 to Rs1.036 billion in 2018.

As a result, the EPS climbed to Rs6.12 in 2020 from Rs3.25 the previous year.

In 2021, the sales revenue dropped by 11% to Rs6.752 billion. Despite a drop in top-line revenue, the profitability ratio showed a spectacular improvement made possible by persistent and diligent efforts.

The business had a pre-tax profit of Rs1.203 billion as opposed to Rs1.037 billion the year before.

In comparison to the previous year's net profit of Rs1.036 billion, the net profit climbed by 16% to Rs1.199 billion. As a result, the EPS increased to Rs7.08 from Rs6.12 in 2020.

Kohinoor was incorporated as a publicly listed company in Pakistan on April 26, 1994 under the repealed Companies Ordinance, 1984.

The principal activities of the company are to own, operate and maintain a power plant in Lahore and to sell power to the Water and Power Development Authority (WAPDA) under a power purchase agreement (PPA).

Credit : Independent News Pakistan-WealthPk