INP-WealthPk

Shams ul Nisa

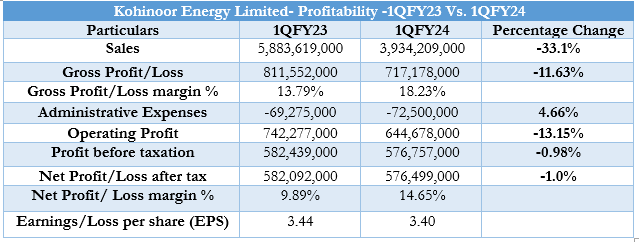

The Kohinoor Energy Limited sales contracted by 33.1% to Rs3.93 billion at the end of the first quarter of the ongoing fiscal year 2023-24, compared to Rs5.88 billion in the same period last year. According to the company’s results for 1QFY24, it posted a gross profit of Rs717.17 million, which is 11.63% lower than Rs811.55 million in 1QFY23. In contrast to the decline in sales and gross profit, the company’s gross profit margin improved to 18.23% during the period under review as opposed to 13.79% in the corresponding quarter of the previous year.

On the expenses side, the company’s administrative expenses increased 4.66% to Rs72.5 million from Rs69.27 million in the previous term. However, the operating profit went down by 13.15% to Rs644.67 million in 1QFY24, against Rs742.27 million in 1QFY23. Therefore, the profit before and after tax dropped by 0.98% and 1% in 1QFY24, respectively. The company registered a profit before tax of Rs576.7 million against Rs582.4 million in 1QFY23. However, its net profit stood at Rs576.49 million at the end of this quarter quarter, compared to Rs582.09 million in 1QFY23. The earnings per share showed a slight decline to Rs3.40 in 1QFY24, as opposed to Rs3.44 in the 1QFY23.

Historical Trend

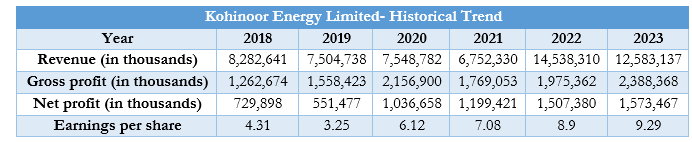

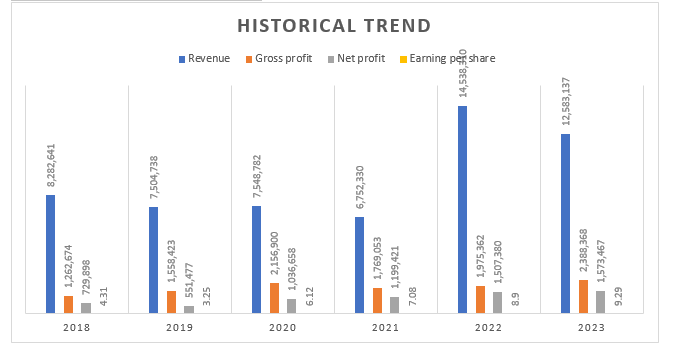

Kohinoor Energy Limited's historical trend reveals erratic performance from 2018 to 2023. Its revenue was Rs8.28 billion in 2018, Rs6.75 billion in 2021, and Rs14.5 billion in 2022, the highest revenue, which fell steadily over the following years. In 2023, it dropped to Rs12.58 billion. On the other hand, from Rs1.26 billion in 2017 to Rs2.15 billion in 2020, the gross profit increased. It dropped to Rs1.76 billion in 2021, but over the next six years it rose to Rs1.97 billion in 2022 and a peak of Rs2.38 billion in 2023.

The company’s net profit was Rs729.89 million in 2017 but it dropped to Rs551.47 million in 2019. However, from Rs1.036 billion in 2020 to Rs1.57 billion in 2023, it keeps improving. Over the six years, a similar pattern in the company's earnings per share was noted, with the highest of Rs9.29 in 2023 and the lowest of Rs3.25 in 2019.

Valuation and Liquidity Position

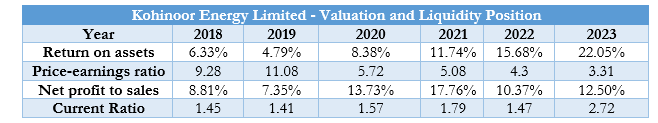

The company's return on assets decreased from 6.33% in 2018 to 4.79% in 2019. But after dropping to 8.38% in 2020, it picked up steam, kept growing, and experienced the biggest growth, yielding a 22.05% return on assets. This increase in asset return is a sign of the company's effective asset utilization management. After declining from 5.72 in 2020 to 3.31 in 2023, the price-to-earnings ratio increased from 9.28 in 2017 to 11.08 in 2019. This falling price-earnings ratio suggests that investors' future earnings growth will be slower. Over the six years, the net profit to sales fluctuated, falling between 7.35% in 2018 and 17.76% in 2021. There were two significant declines in the company, 7.35% in 2018 and 10.37% in 2022. The company reported a 12.50% net profit on sales in 2023.

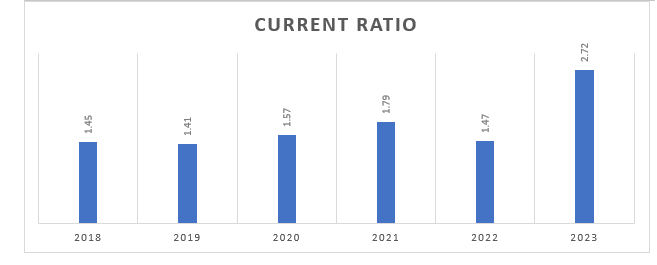

A company's current ratio, also known as its liquidity ratio, indicates how well it can use its current assets to pay down its short-term liabilities. A current ratio below 1.2 signifies a higher risk of not being able to meet short-term obligations, while a ratio between 1.2 and 2 or higher is considered safe. The company's liquidity ratio increased from 1.45 in 2018 to 2.72 in 2023, indicating an improvement.

Company profile

Kohinoor Energy Limited was founded as a public limited company in 1994. Under a Power Purchase Agreement (PPA), the Company's main business is to own, run, and maintain a power plant in Lahore and sell the electricity generated by it to the Pakistan Water and Power Development Authority (WAPDA), its only client. With a 124 MW net capacity, the company generates electricity using an oil-fired furnace power plant.

inpCredit: INP-WealthPk