INP-WealthPk

Hifsa Raja

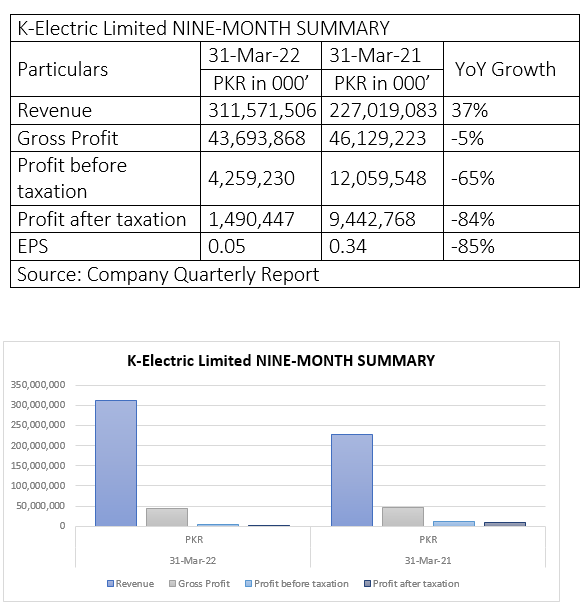

Karachi Electric Limited’s revenue stood at Rs311 billion in the first nine months ending March 31, 2022, compared with Rs277 billion in the corresponding period of the previous year.

However, the gross profit declined 5% year-on-year to Rs43 billion in 9MFY22 from Rs46 billion in 9MFY21.

Similarly, the profit-before-taxation registered a 65% decline during the nine-month period of FY22 and stood at Rs4.2 billion compared to Rs12 billion in the corresponding period of FY21.

The profit-after-taxation declined 84% to Rs1.49 billion in 9MFY22 from Rs9.44 billion over the corresponding period of FY21, reports WealthPK.

Performance in fiscal 2020-21

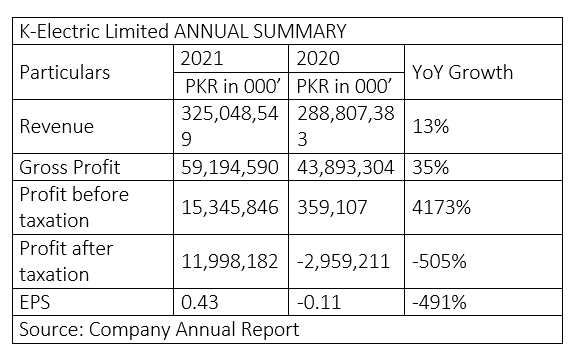

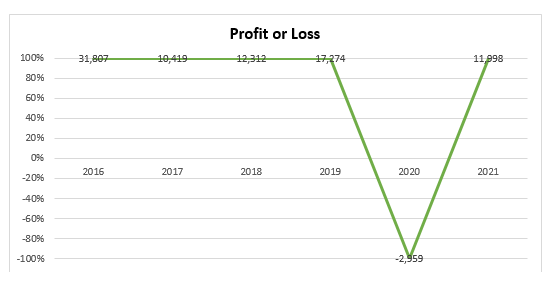

During the fiscal year 2020-21, the company’s revenue increased 13% to Rs325 billion from Rs288 billion in 2019-20.

The company’s gross profit stood at Rs59.19 billion in FY21 over Rs43.89 billion in FY20, posting an increase of 35%.

The profit-before-taxation ballooned to Rs15.34 billion in FY21 from a paltry Rs359 million in FY20, registering a phenomenal increase of 4173%.

The profit-after-taxation for FY21 also jumped to Rs11.99 billion from a loss of Rs2.95 billion in FY20, showing a massive 505% decrease in loss.

Earnings Per Share

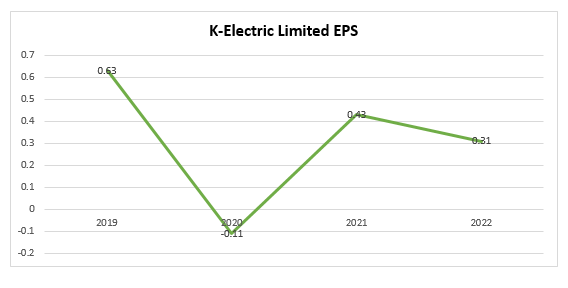

The earnings per share (EPS) of K-Electric stood at Rs0.63 in 2019, but turned in minus in 2020 at Rs0.11. However, in 2021, the EPS improved and jumped to Rs0.43. It slightly decreased to Rs0.31 in 2022.

Ratio Analysis

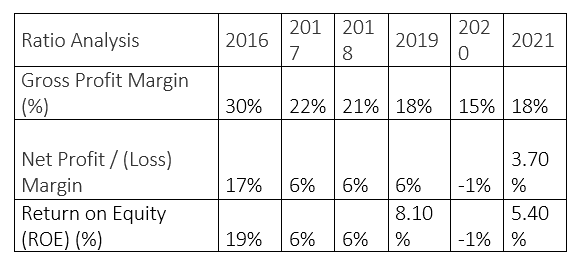

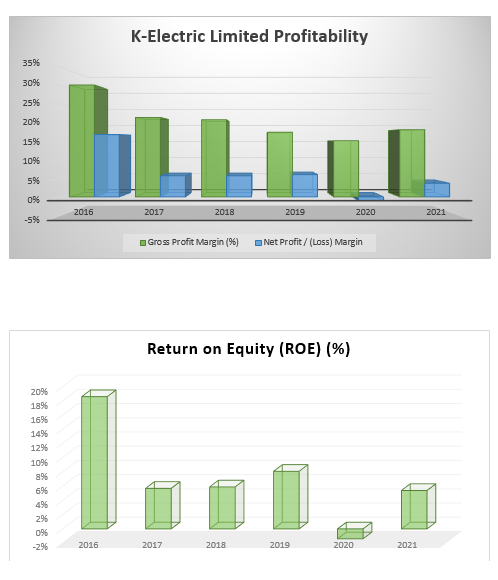

The company’s gross profit margin was 30% in 2016, 22% in 2017, 21% in 2018 and 18% in 2019. The gross profit margin decreased to 15% in 2020, but improved to 18% in 2021.

The net profit margin in 2016 stood at 17%. Then it dropped to 6% in 2017 and remained unchanged for the next two years.

In 2020, the net profit margin fell to minus 1% in 2020, but it recovered to 3.70% the next year, indicating the company was bit efficient in its performance.

In 2016, the total return on equity was 19%. The return on invested equity declined to 6% in 2017 and 2018. It grew to 8.10% in 2019. The return was negative in 2020, but improved to 5.40% in 2021.

Profit or loss over the years

The company’s gross profit remained consistently positive over the last four years from 2016 to 2019. But the company suffered a loss in 2020. However, it rebounded in 2021.

K-Electric Limited is principally engaged in the generation, transmission and distribution of electric energy to industrial and other consumers.

Credit : Independent News Pakistan-WealthPk